Baltic Dry Index suggests weakness ahead for government bonds

The Baltic Dry Index is a measure of the price of shipping dry goods such as coal, iron ore or grain, and is commonly used as an indicator of global demand. The beauty of this index is that unlike financial markets, it’s not subject to speculation. We’ve mentioned the Baltic Dry Index once before on this blog, when Jim highlighted at the beginning of September 2008 that continued new lows in the index were good news for government bonds.

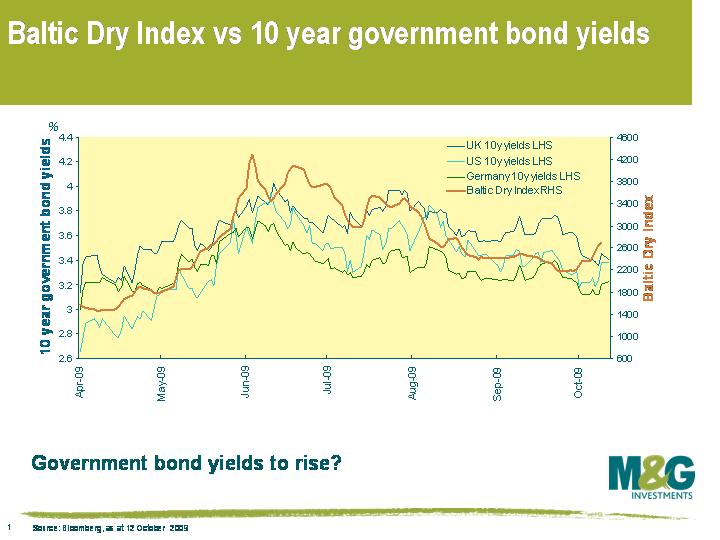

Now, the index is beginning to suggest the opposite. This chart (data as at today) illustrates the index level versus 10 year government bond yields in the US, Germany and the UK since the beginning of April 2009, and government bond yields haven’t followed the Baltic Dry Index higher in the past couple of weeks (at least they hadn’t when I started messing around with the chart on Thursday, although unfortunately for the purpose of this blog comment there was a pretty hefty sell off on Friday).

Now, the index is beginning to suggest the opposite. This chart (data as at today) illustrates the index level versus 10 year government bond yields in the US, Germany and the UK since the beginning of April 2009, and government bond yields haven’t followed the Baltic Dry Index higher in the past couple of weeks (at least they hadn’t when I started messing around with the chart on Thursday, although unfortunately for the purpose of this blog comment there was a pretty hefty sell off on Friday).

A rise in the Baltic Dry Index is all the more important because it tends to exhibit strong momentum. For example, since the beginning of April, a daily increase has been followed by another daily increase (or a daily decrease followed by another decrease) more than 80% of the time.

Before people get too excited though, it’s worth remembering that shipping rates are influenced by their own set of demand and supply factors (eg the supply of ships) so the correlation can and does change over time. But given the Baltic Dry Index’s strong track record, it’s definitely something worth keeping a close eye on.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox