European High Yield vs. Eurozone Tail Risk High Yield

As Eurozone concerns have dominated risk appetite within the market this year, a key question that faces many market participants is how to capture some of the attractive risk premiums that this weakness creates without exposing themselves unduly to the significant “tail risks” of a full blown Euro death spiral.

In this vein, a popular trade in recent months has been to add exposure to the US high yield market. The rationale is fairly simple (and one that we agree with): The US high yield market is trading at reasonably cheap levels, yielding 8.6% with a spread over treasuries of 754bps*. Yet at the same time the US economy is performing much better than Europe, its government can borrow cheaply and you don’t suffer from all the inherent tail risks of the European markets.

There is no doubt that issuers within the European high yield market are exposed to the economic headwinds that the Eurozone has created. However, is it fair to label the market as one that is riven with tail risks? We’d argue it isn’t.

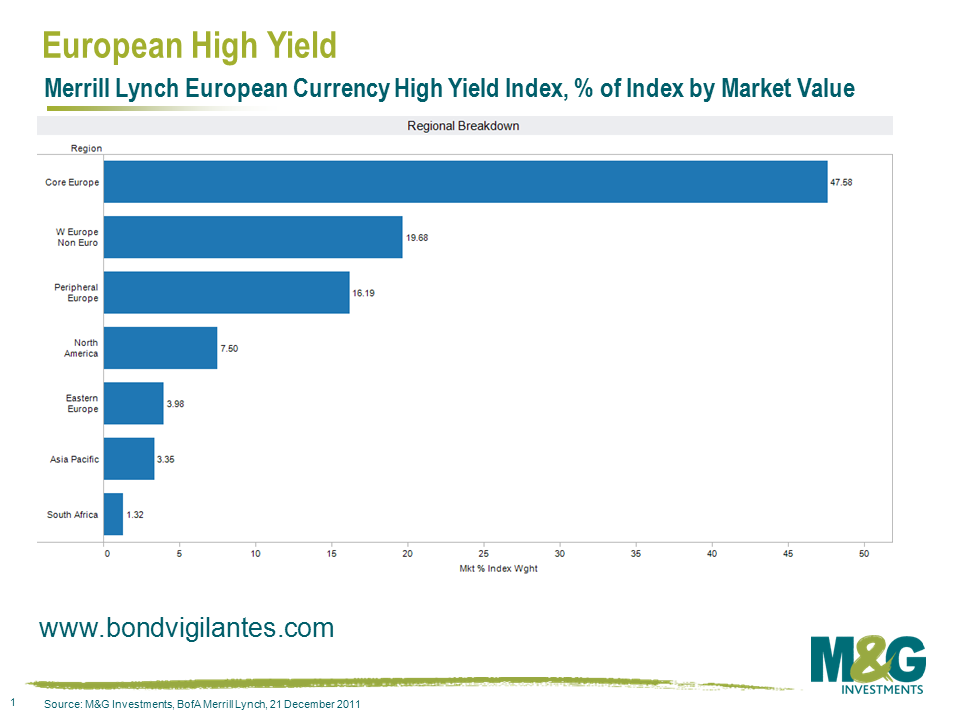

The chart below splits the high yield market into different regions according to the geographic centre of gravity for each issuer. “Core Europe” encompasses German, French, Dutch, Austrian and any other current Eurozone country that has avoided the “Peripheral” tag. This area, arguably less exposed to true tail risk events (i.e. a Spanish and/or Italian exit from the Euro) accounts for just under half of the market at 47.58%. The “Peripheral Europe” issuers, or the real “tail risk” within the market, accounts for around 16% at current trading levels. Let’s put this another way: 84% of the market is not directly exposed to a major tail risk event.

Probably more surprising is the proportion of the market that operates entirely outside of the Eurozone. Taken together, Western European Non Euro (i.e. UK, Swiss, Swedish, Norwegian issuers), Eastern European, North American, South African and Asia Pacific issuers account for a little over 36% of the market.

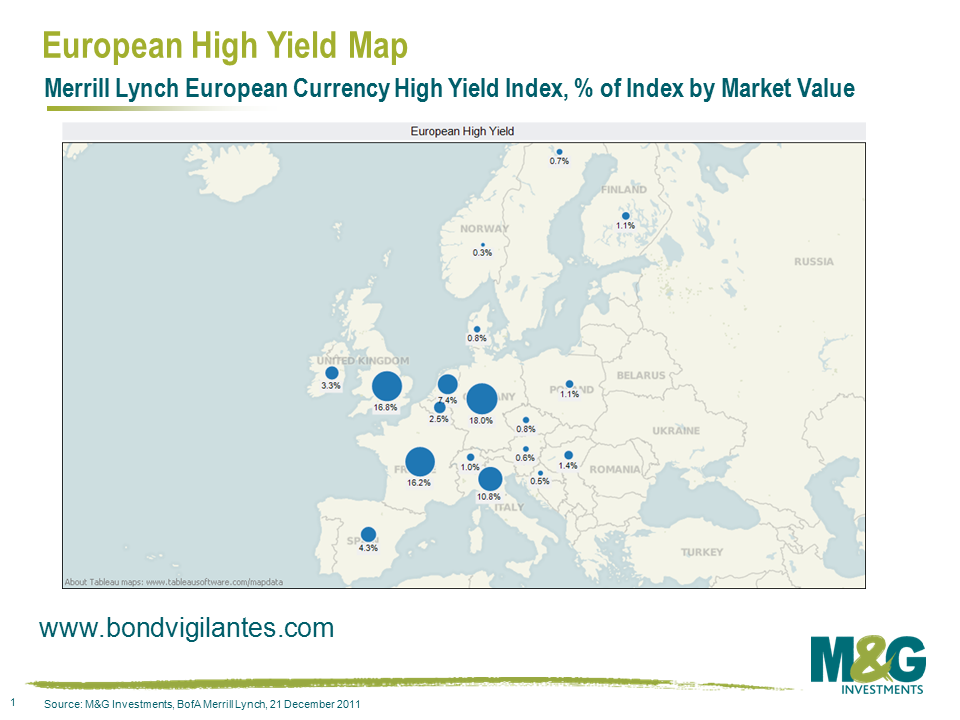

Also, when we focus on the European map of issuance below, the country by country specifics of the market are easier to determine. Taken together German, French and British issuers account for 51% of the market.

The point is this – there is no doubt that there are many risks within the European high yield market (volatility, economic headwinds, the likelihood of rising default rates), but we believe there are still many pockets of opportunity where investors can capture some attractive risk premia without directly exposing themselves to catastrophic European “tail risks”.

*Source: Bloomberg, Merrill Lynch US High Yield Master II Index, 20th December 2011

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox