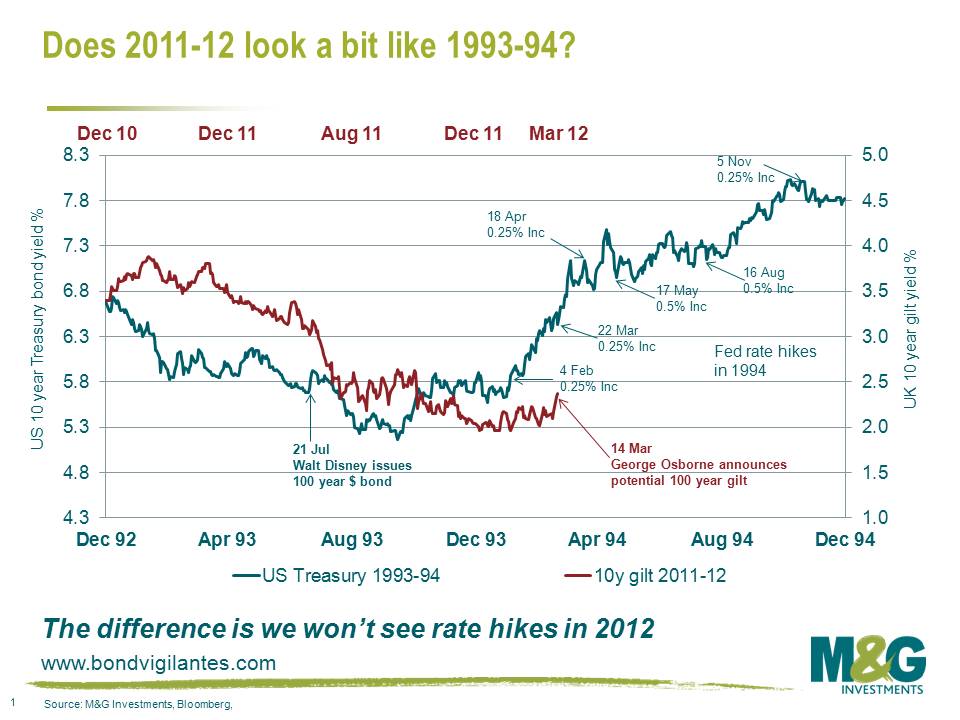

Is bond market price action looking a bit like 1993-94? And the timing of fairytale 100 year bond issues.

1993 was a golden year for US Treasury investors, with 10 year yields falling from 6.7% at the start of the year to 5.3% by its end. It felt like nothing could go wrong – and inflation had even fallen throughout the year from 3.3% to 2.7%. Yet on 4th February 1994, the Fed hiked rates by 0.25%. And they hiked again in March, by 0.5% in May and August, and a further 0.25% in November. The annual inflation rate was still actually falling until May 1994, when it hit 2.3%, and on a monthly basis in January, just before the shock hike, inflation was 0%! Yet the Fed was right – there were some price pressures in the economy and these became visible in the third quarter of 1994. Their trigger was a significant improvement in economic growth. At the start of 1993 the economy was growing at under 1% on an annualised rate, but this had dramatically improved to over 5% by year end. By early 1995 though it was back below 1% after the series of aggressive rate hikes – a result that perhaps led the Fed to be much more gradualist in future expansions?

The reason we are interested in 1993-94 is that the price action in Treasuries back then looks very similar in scale and direction to what we saw in gilts and other markets in 2011. The 10 year gilt yield fell from nearly 3.5% to below 2% in a year. Since the start of this year yields have started to rise again, with big moves in the last 3 days. It’s a similar pattern to 1994 but with one big difference – there’s no way that Central Banks are going to hike rates this year is there? And that alone makes a sell off on 1994’s scale unlikely.

A couple of last points though – firstly the US Fed has said that economic conditions “are likely to warrant exceptionally low levels for the federal funds rate at least through late 2014”. But note that this is not an explicit promise, but is totally contingent on the economic activity. And also note that the market no longer believes that “late 2014” is when rates will rise – the market is now pricing in a Fed rate hike in 2013, and for rates to be around 75 bps higher by the late 2014 Fed expected first hike.

And secondly, I have also marked on the chart the date when Walt Disney famously issued a 100 year $ bond, just months before the massive bear market began. I’ve also marked George Osborne’s announcement of the potential 100 year gilt in the UK this week. The Circle of Life? When You Wish Upon a Star?

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox