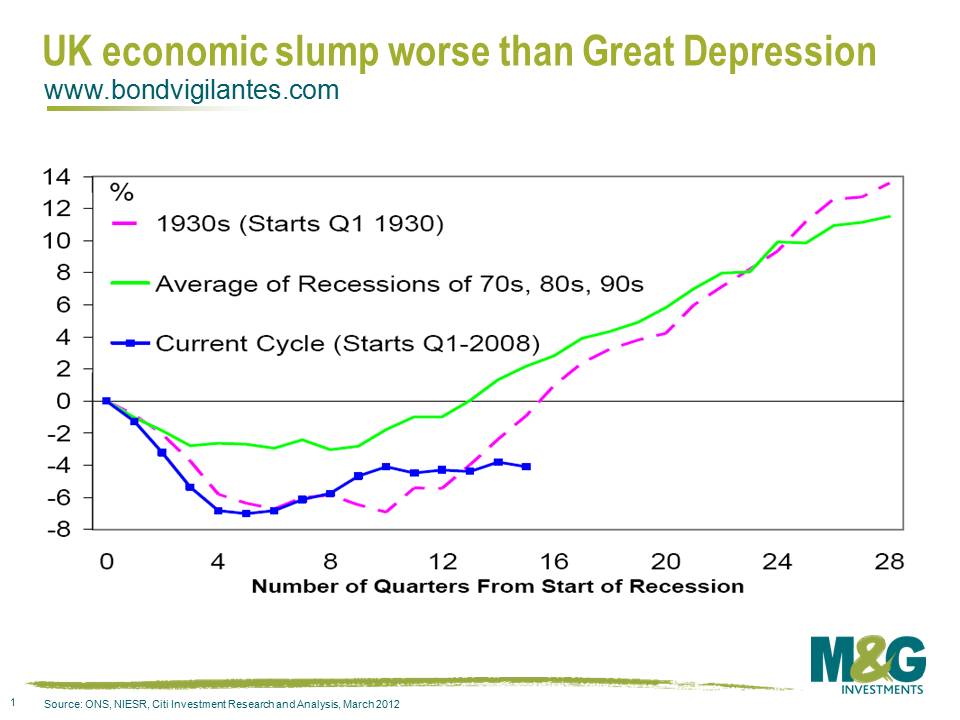

UK economic recovery worse than Great Depression, and no sign of improving

It was announced this morning that the UK economy grew just +0.5% in 2011, a downward revision from +0.7% previously announced. As the chart below from Citi illustrates, the UK economy has stalled. UK real GDP is 4.1% below its pre recession peak, which makes this ‘recovery’ worse than the Great Depression.

The UK’s experience of the past few years is also considerably worse than Japan’s experience in the aftermath of its bubble. Looking back, Japan’s decade doesn’t look all that ‘lost’ in comparison – Japan’s real GDP in 1991 was +2.6%, -0.1% in 1993, +0.9% in 1994 and +2.5% in 1995, and Japan’s average annual real growth rate through the 1990s was +1.2%. It’s also worth pointing out that for all the talk of austerity in the UK, the reality is that government expenditure actually increased by 0.1% in real terms last year. Austerity hasn’t really started yet.

Sterling is the fourth worst performing currency in the world so far today, down 0.5% versus the euro and down 0.3% versus the US dollar. A continuation of abysmal UK growth should result in sterling appearing more regularly towards the bottom end of the currency tables than the top.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox