UK inflation: the Bank of England would have to generate significant disinflation in the majority of goods we consume to hit the 2% inflation target, killing any recovery. Food and administered price rises are the problems.

With the UK’s 2% CPI inflation target having now been exceeded for 39 consecutive months, last week’s budget formally acknowledged the on-going situation and changed the Bank of England’s remit.

Although chancellor George Osborne maintains that medium-term price stability represents “an essential pre-requisite for economic prosperity”, the updated remit simultaneously introduces the concept of flexible inflation targeting in the short term, asserting that the Bank of England committee “may wish to allow inflation to deviate from the target temporarily” in exceptional circumstances, i.e. as the result of shocks and other disturbances. In short, inflation targeting looks like it will continue to take a back-seat to the pursuit of growth and employment with the chancellor accepting that inflation is likely to rise further and may remain above the 2% target for the next two years. It is also interesting to note that there is no restriction on how far inflation is permitted to deviate from its target, nor has any time limit been set for any such deviations.

Allowing more flexibility simply reflects the reality, and it can therefore be argued that this is probably based on the theory that whilst current inflation rates are hurting consumers, hiking rates to bring inflation down – by raising mortgage and loan rates – would hurt even more. Wage growth is only just above 1% per year, so the authorities perhaps feel that overshooting the inflation target is unlikely to create an inflationary spiral based on rocketing pay settlements.

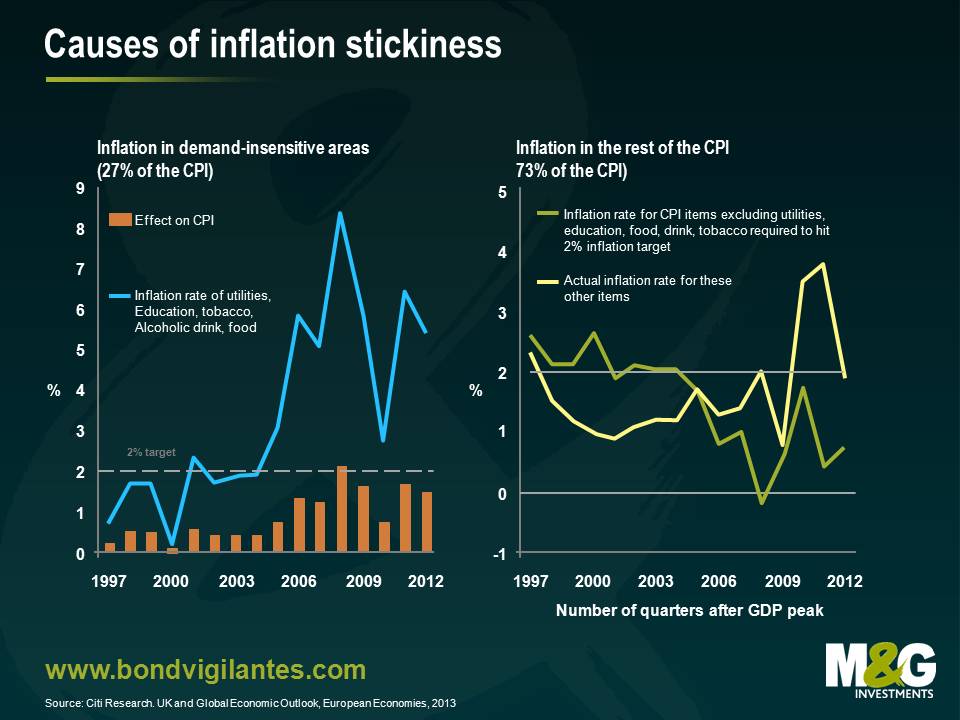

Citigroup’s Michael Saunders has presented an interesting piece of research which he believes breaks down the root causes of inflation stickiness. The research shows that for most of the inflation basket, there isn’t a problem and for the 27% where there is a problem, it is not clear that hiking rates would be a solution.

The first graph demonstrates the inflation generated from demand-insensitive areas (e.g. goods that have relatively static demand curves, regardless of changes in the price) such as utilities, education, tobacco, food and alcoholic beverages. This part of the basket contributes to 27% of the overall CPI figure. In recent years, this proportion has persistently exceeded the Bank of England’s 2% target thanks to formulae on these prices which allow “inflation plus” rises, and in the case of food, volatile weather. The Bank of England explains this away by treating it as a one off shock; Michael Saunders argues that this portion of the CPI basket is seeing a consistent series of small shocks, and is therefore predictable. Therefore in order to compensate for the above-target growth in price level of these prices, the inflation rate of the remaining portion of the basket of goods would have to see much lower inflation to offset this and to meet the 2% target. The required adjustment is demonstrated by the green line in the second graph, while the actual inflation rate for this portion of the CPI basket is shown in yellow.

As you can see, Citigroup’s research shows that the actual inflation rate for the remaining portion of the CPI basket of goods must fall considerably ( from around 2% per year to around 0.7% per year) if the formal 2% inflation target is to be met. Indeed, in the aforementioned Bank of England remit, George Osborne himself concedes that the impact from both regulated and administered prices have together contributed to the persistent inflationary environment.

It is subsequently made clear that in the current environment of deliberately loose monetary policy and the ensuing departure from the inflation target, UK above-target inflation is baked into the cake unless the Bank of England tries to depress demand for the remaining demand-sensitive proportion of the basket. If this inflation overshoot is not curbed over time, this could potentially affect expectations of future inflation, calling the Bank of England’s ability to deliver medium term price stability into question. Therefore, despite champagne being removed from the CPI’s 2013 basket of goods, let’s hope that over time the Bank of England’s credibility is still something the UK can celebrate.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox