Time gentlemen please: the Fed prepares its exit from QE

The punch bowl of easy money that the US Federal Reserve has offered the market has been significant over the last 5 years: from low rates, to quantitative easing and benign regulation. The purpose of the party was to keep animal spirits high and prevent the gloomy cycle of recession from turning into depression. This generosity has been mirrored around the world in different guises, and so far the policy has worked with varying degrees of success. The net effect has been to avoid economic depression.

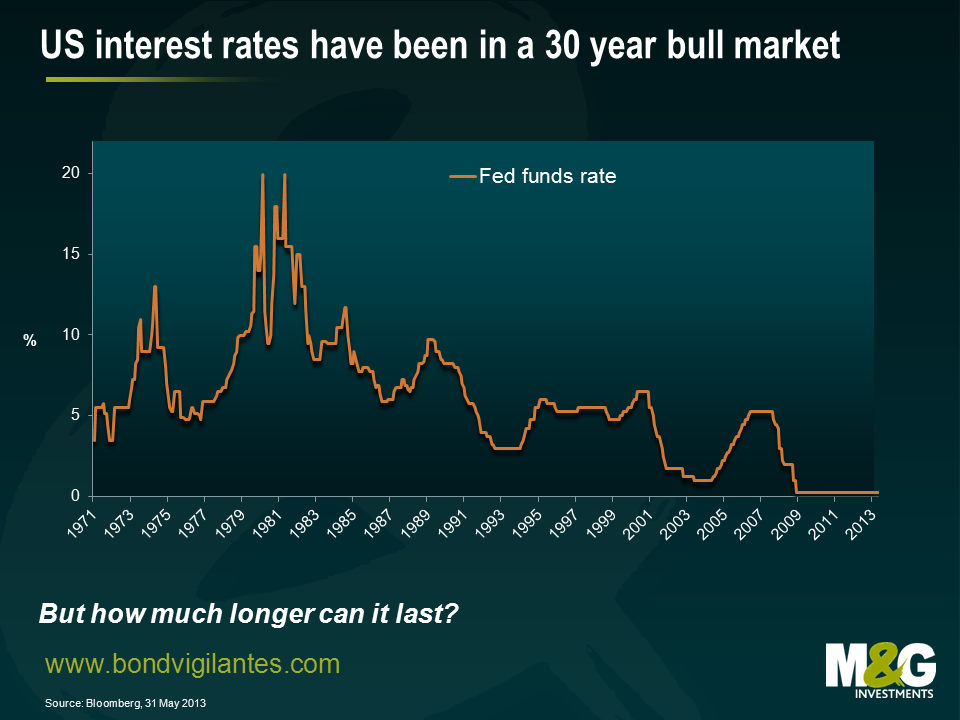

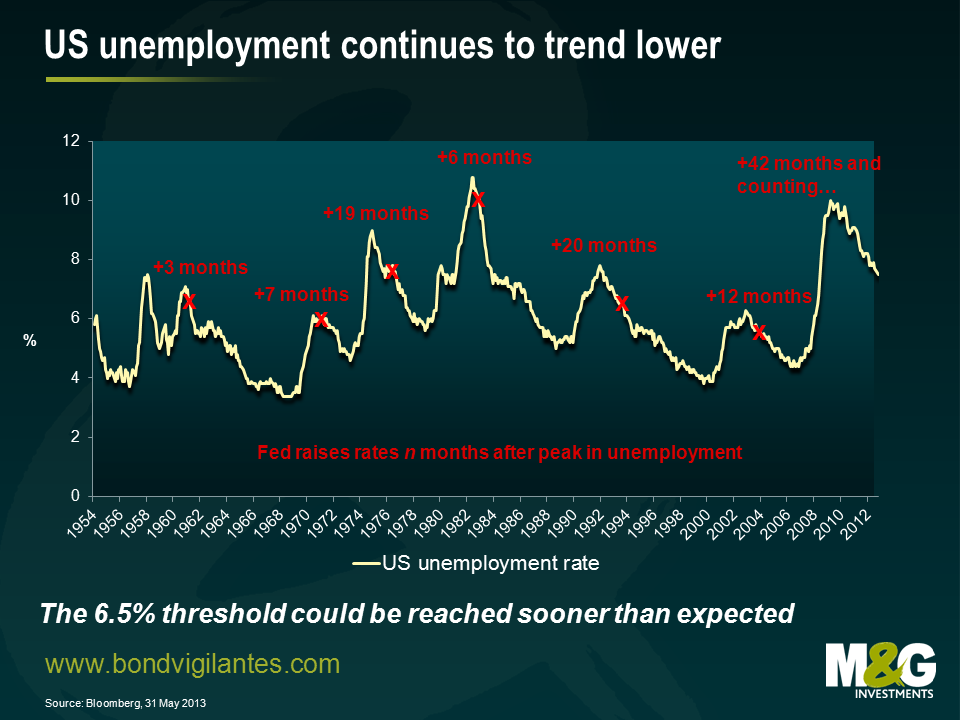

Low interest rates and deficit spending have worked in the USA. The two charts below show the long term trend in US interest rates (wow what a party!) and the trend in unemployment, with the annotations showing how long after the peak in unemployment the Fed waited before hiking rates. This time around, not only has the volume of liquidity that has been served been record breaking, but the extent of the party, in terms of how long we have been sitting at the bar enjoying ourselves, has been remarkable compared to other cycles. Unwinding this is obviously going to pose some challenges.

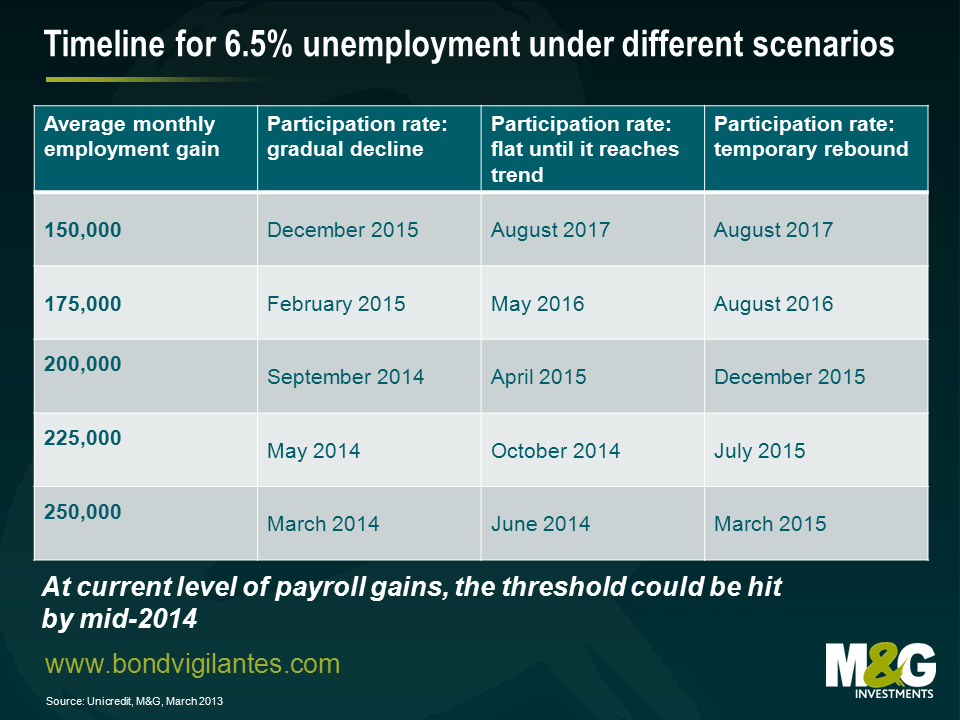

Barman Ben Bernanke realises he is faced with this problem, as depression is now highly unlikely in his neighbourhood. The financial system is functioning, the housing market is in a new bull market, and unemployment is on a firm downtrend. The futures market is currently discounting the first rate hike from the Fed in early 2016, but growth could easily come in stronger than expected given the rebound in the housing market, which could also reduce unemployment faster than people anticipate (see Jim’s blog here for a discussion of how powerful the housing effect could be). So there’s a real risk that the Fed will have to move before the market expects. The attached chart shows that according to Unicredit, given the average pace of payroll gains over the past 6 months, the unemployment threshold could be reached as early as mid 2014, and possibly sooner if the housing market continues to strengthen.

Given the jittery moves in the markets over the past couple of weeks on talk of tapering QE, Bernanke needs to decide how to wind down the party he has generously hosted, with the minimum of damage.

He does not want to upset his customers (the markets) too much, as the chaos that can ensue when a crowd of drunks is thrown out onto the street is never pleasant. He needs to gently guide his customers genially to the door.

This in effect is what Fed speak is currently doing. The Fed knows the economy is on a sound footing and that it needs to take some of the financial stimulus away. It is basically saying thanks for your custom, please finish up your drinks and leave the bar. And like any fine host, the Fed pats its drunk customers on the back and promises they will reopen tomorrow so the customer leaves smiling and hopeful.

Time gentleman, please.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox