Stand up for your rights! Covenant erosion in high yield bond documentation

2013 saw a record year for new issue volumes in the European high yield market. A total of $106bn equivalent was raised by non-investment grade companies according to data from Moodys. Whilst this is beneficial for the long term diversification and growth of the market, there have been some negative trends. Given the intense demand for new issues, companies and their advisors have been able to perpetuate the erosion various bondholder rights to their own advantage. What form has this erosion taken and why are they potentially so costly for bondholders? Here we highlight some of the specific changes that have crept into bond documentation over the past 2 years and some examples that demonstrate the potential economic impact for investors.

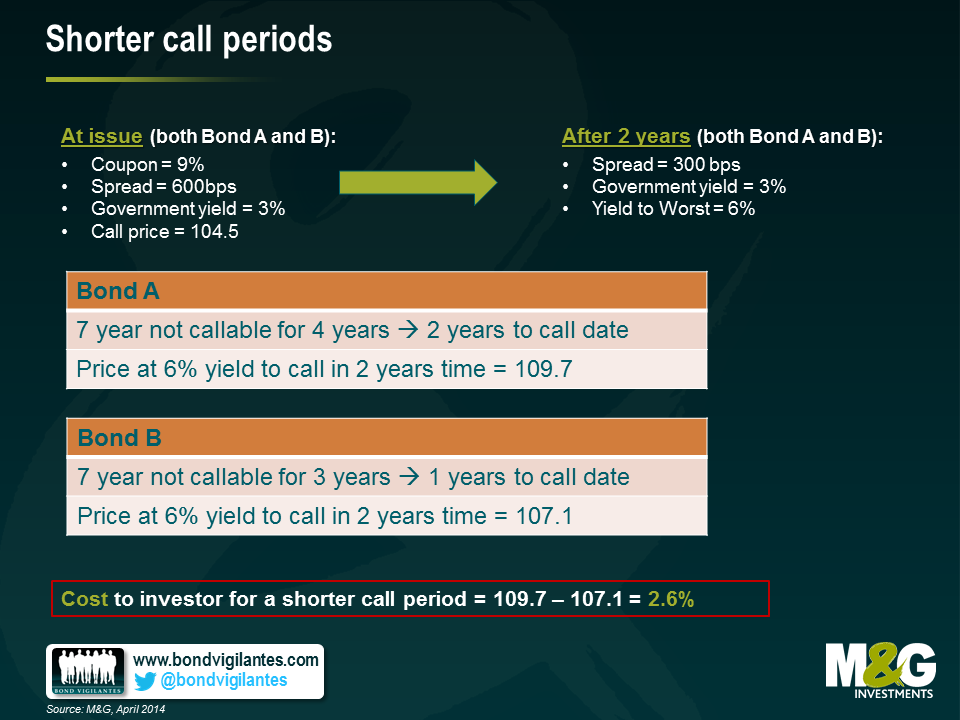

1) Shorter call periods – high yield bonds often contain embedded call options which enable the issuer to repay the bonds at a certain price at a certain point in the future. The benefit for the issuer is that if their business performs well and becomes less financially risky, they can call their bonds early and re-finance at a cheaper rate. The quid pro quo for bond holders is that the call price is typically several percentage points above par, hence they share in some of the upside. However, the length of time until the next call is important too. The longer the period, the higher the potential capital return for any bond holder as the risk premium (credit spread falls). The shorter the call period, the less likely the issuer will be locked into paying a high coupon. Take for example the situation below: reducing the call period has an associated cost to the investor of 2.6% of capital appreciation.

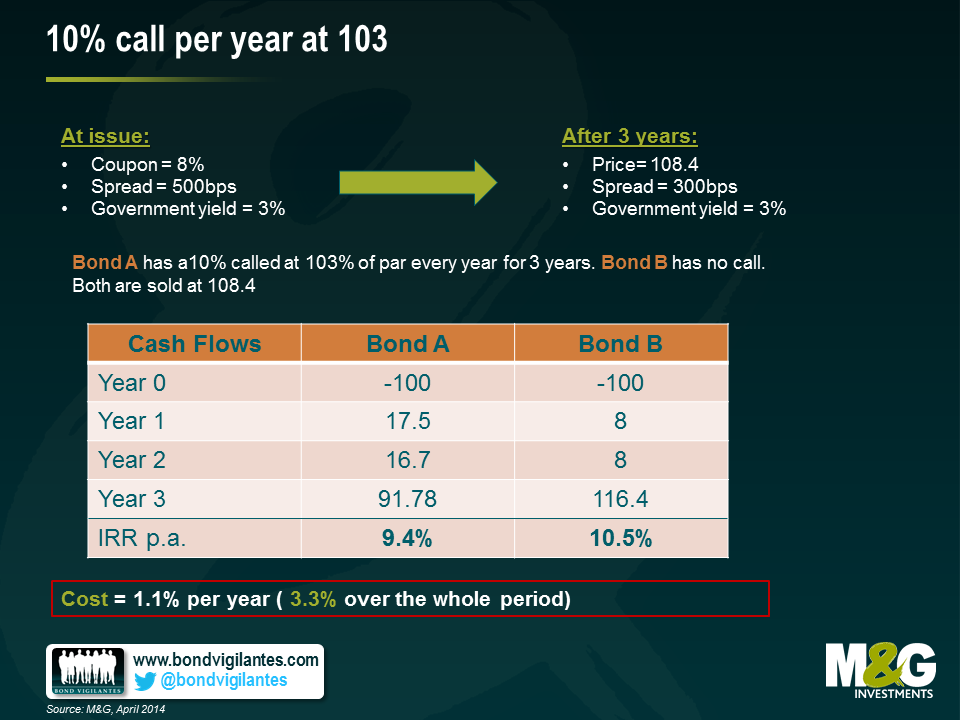

2) 10% call per year at 103 – Similar to the example above, the ability to call a bond prior to maturity has the impact of reducing potential upside to investors. One innovation that favours issuers has been the introduction of a call of 10% of the issue size every year within the so called “non call” period, usually at a preset price of 103% of par. So assuming a 3 year “non call” period, almost 1/3rd of an issuers bond can be retired at a relatively limited premium to par. Take for example the counterfactual scenario below. Here we see the inclusion of this extra call provision has reduced the potential return to bondholders by 3.3% over the holding period.

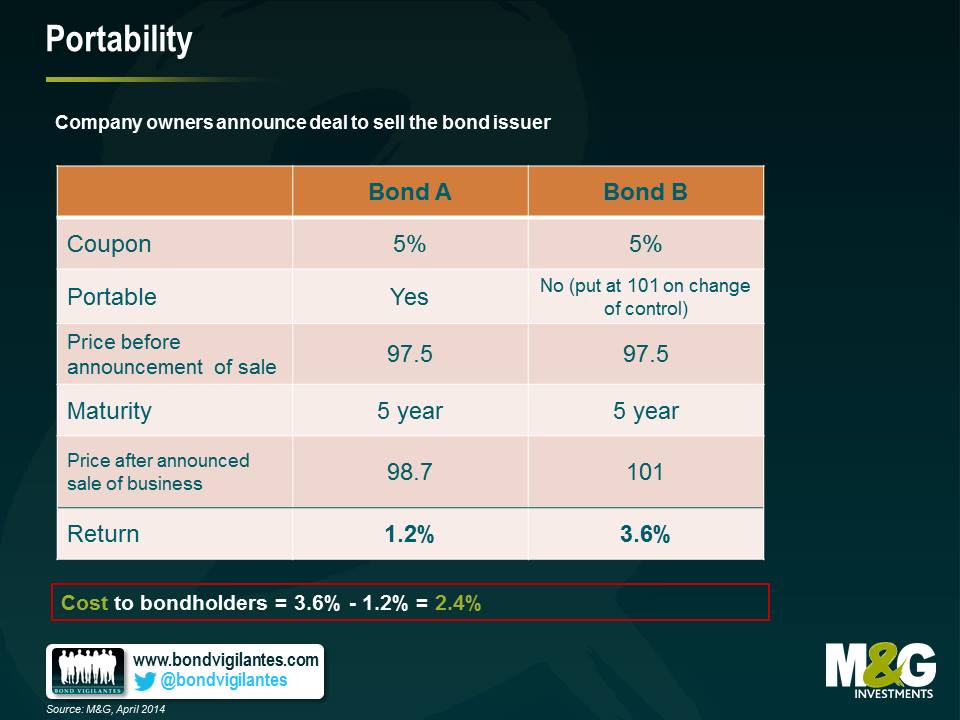

3) Portability – One of the most powerful bondholder protections is the so called “put on change of control”. This gives the bondholder the right but not the obligation to sell their bonds back to the issuer at 101% of face value in the event the company changes ownership. Crucially, this protects investors from the potential re-pricing downside of the issuer being purchased by a more leveraged or riskier entity. For the owners of companies, this has been a troublesome restriction as the need to refinance a complete capital structure can be a major impediment to any M&A transaction. However, a recent innovation has been to introduce a “portability” clause into the change of control language. This typically states that subject to a leverage test and time restriction, the put on change of control does not apply (and hence the bonds in issue become “portable”, travelling with the company to any new owner removing the need to potentially re-finance the debt). With much of the market trading well above 101% of par, the value of the put on change of control is somewhat diminished so some investors have not seen this as an egregious erosion of rights. The owners of the issuers on the other hand enjoy a much higher degree of flexibility when it comes to buying and selling companies. There are costs to bondholders, however. In particular, as and when bonds trade below face value, this option can have significant value. In the example below we see that the inclusion of portability has an associated cost of 2.4%

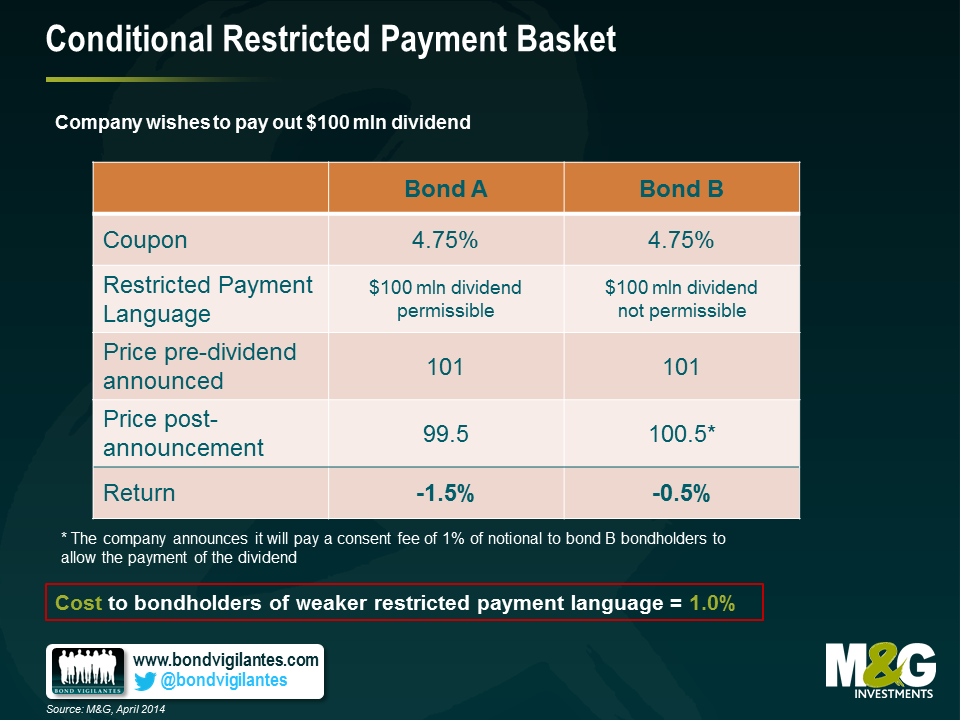

4) Conditional Restricted Payment Basket – Another protection for high yield bondholders has been the restrictions on dividends. This prevents owners of businesses from stripping out large amounts of cash leaving behind a more leveraged and riskier balance sheet. If a company was performing very well and the owners wished to take out a large dividend, they would usually be forced to re-finance the debt or come to a consensual agreement with bondholders to allow them to do so. Consequently, the call protections would apply and the bondholders would be able to share in some of the success of the issuer’s business. However, another recent innovation has been the loosening of this “restricted payments” provision to allow a limitless upstreaming of dividend cash out of the business subject to a leverage test. This limits the ability of owners to load up the balance sheet with debt at will, but without the need to re-finance the bonds bondholders loose some of their bargaining power and once more are likely to lose out in certain situations. In this example, we see an impact of 1.0%

What can investors do to cope with these unwelcome changes? Some sort of collective resistance would probably be the most effective tool – bondholders need to be prepared to stand up for their rights – but this is difficult to maintain in the face of inflows into the asset class and the need to invest cash. Until the market becomes weaker and negotiating power swings back toward the buyers of debt rather than the issuers, the most pragmatic course of action is for investors to asses any change on a case by case basis, then factor these in to their return requirements. This way investors can at least demand the appropriate risk premium for these changes and if they deem the risk premium insufficient they can simply elect to abstain. In the meantime, the old adage holds as true as ever – caveat emptor.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox