EM corporate bonds: spreads are attractive compared to developed markets

Emerging market (“EM”) corporate bonds are a fast-growing segment of the fixed income market. The hard-currency (USD, EUR, GBP and CHF) EM bond market has doubled in size since 2010 and is now worth over $1.3 trillion – which makes it as big as the US high-yield market. Including local-currency bonds, the Bank of International Settlements estimated that the EM corporate bond market was worth nearly $4 trillion at year-end 2013.

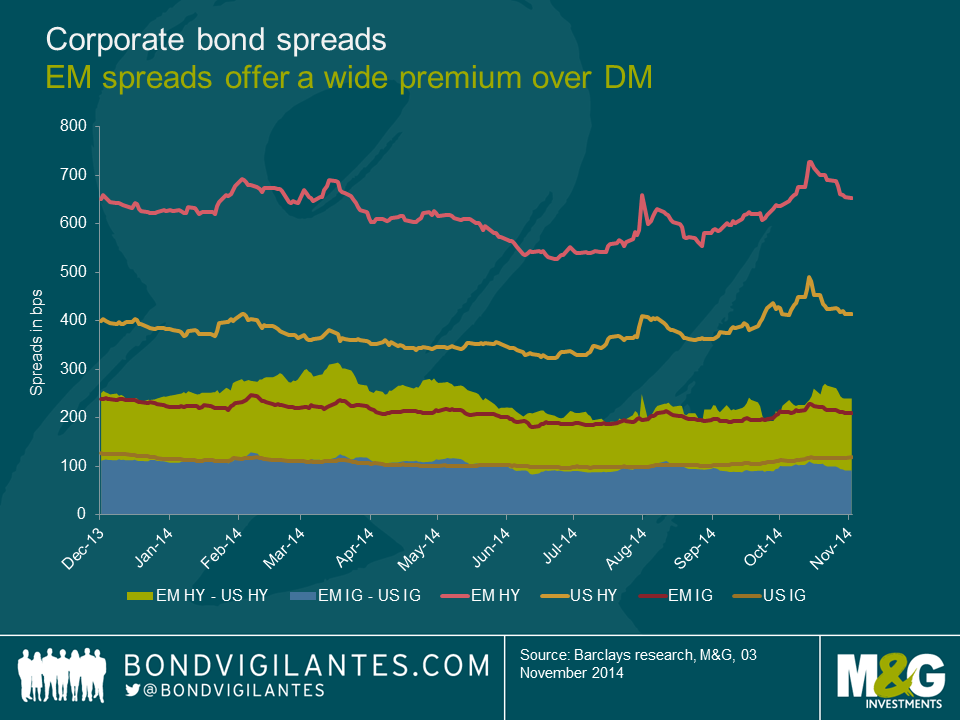

The following chart shows the recent evolution of hard-currency EM and US corporate spreads. Arguably, while the EM spread premium over the US currently looks slightly more expensive than last March or April, it nevertheless remains compelling and since December 2013 has averaged a premium of just over +100bps in investment grade credits and about +215bps in high yield corporate bonds.

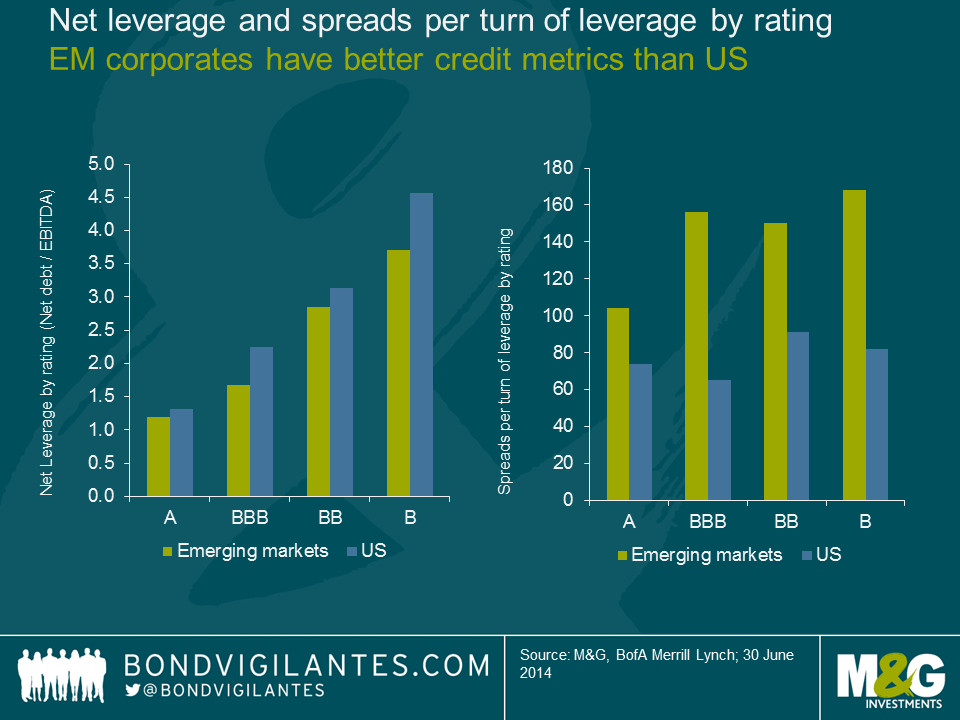

There is no doubt that higher spreads in EM comes with higher risks compared to developed markets (“DM”). However, as can be seen in the graph below, EM corporates tend to have better credit metrics than their US counterparts for a similar credit rating class, while offering much wider spreads than DM. This is because EM corporates have additional risks compared to DM issuers, such as political or country specific risks.

Bottom-up research is paramount in the EM stock selection process and investors should look to assess not only financial statements but also industry risk, corporate governance, financial disclosure, covenant package or recovery value estimates. However, a top-down approach is also critical as currency, inflation and political risks, among others, can have a significant impact on the fundamentals of a corporate bond. All of these risks, whether they are company-specific or related to the country, are in theory included in credit ratings and this is the reason why EM issuers will likely be assigned a lower credit rating by rating agencies than their US peers with similar credit metrics.

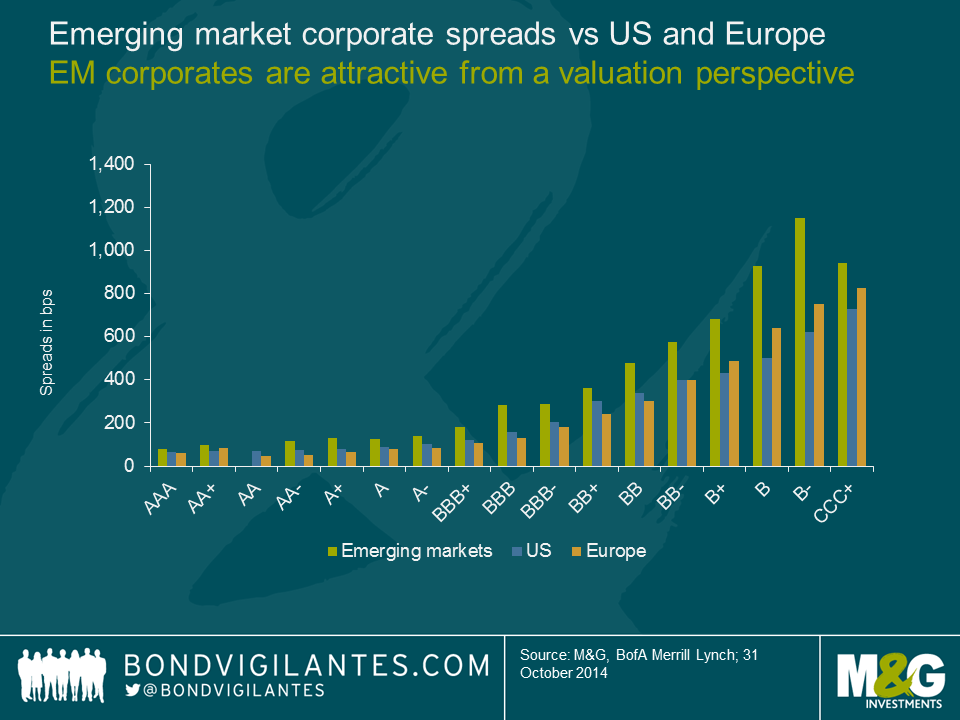

The true question therefore is to assess whether the EM spread premium over DM corporates is attractive once accounting for the additional risks involved with these instruments. The following graph shows that for a similar bond rating class EM bonds consistently offer higher spreads than US and European counterparts, implying investors get compensated for the credit risk plus get a premium for investing in EM. Why is this?

One may argue that EM bond ratings are not reliable as credit rating agencies may underestimate macro risks, in particular the issuers’ vulnerability to currency risk, or adverse bankruptcy laws for offshore bondholders in some jurisdictions where very few historical default cases have occurred. Indeed, “rating mistakes” do exist across the EM rated universe – as in DM ratings – and investors should not be looking blindly at bond ratings. However, credit rating agencies have been historically very conservative in assessing EM credit ratings and tend to be more credible when looking at the entire rated EM corporate universe.

A more relevant answer, in my view, to the question of why EM spreads offer a significant risk-adjusted premium over DM is market liquidity risk because (i) it is not captured by rating agencies, and (ii) EM corporate bonds are less liquid than DM. All markets are exposed to illiquidity but emerging markets are more sensitive to liquidity risk due to the smaller average size of issues and the fact that foreign investors – a less sticky investor base than domestic investors – tend to reduce risk in times of market volatility. Liquidity in emerging markets was one of the hot topics of the Oct-2014 IMF Annual Meetings in Washington D.C. as financial regulatory reforms have led to reduced liquidity in the market, in turn becoming a source of instability for emerging market bonds. The following charts are good evidence of reduced liquidity in the EM corporate bond market, showing EM corporate bonds trading volumes increasing at a much slower pace compared to the outstanding issuance of EM corporate bonds. Last year’s taper tantrum was also symptomatic of reduced liquidity in the EM corporate bond market, although it was also the result of stretched valuations and significant unhealthy inflows by foreign investors in the twelve months ended May 2013.

While it is therefore critical to be mindful about the deteriorated liquidity in EM markets, liquidity risk nevertheless does not fully explain the compelling credit risk-adjusted spread premium of EM corporates over DM. Another component of the spread premium, I argue, comes from the fact that investors are reluctant to invest in markets they are not familiar with. People fear what they don’t know and in bond investing the unknown translates into risk, hence higher spreads. Evidence of such behaviour from investors may be seen in the fact that whenever new bonds are issued in the EM hard-currency bond market, overseas investors tend to be more demanding in terms of pricing than local investors who arguably have higher FX exposure and better knowledge of both the operating environment and the sovereign risks. Although EM liquidity has deteriorated -you are still getting generously paid compared to developed markets.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox