Goodbye to War Loan: 1917 to 2015.

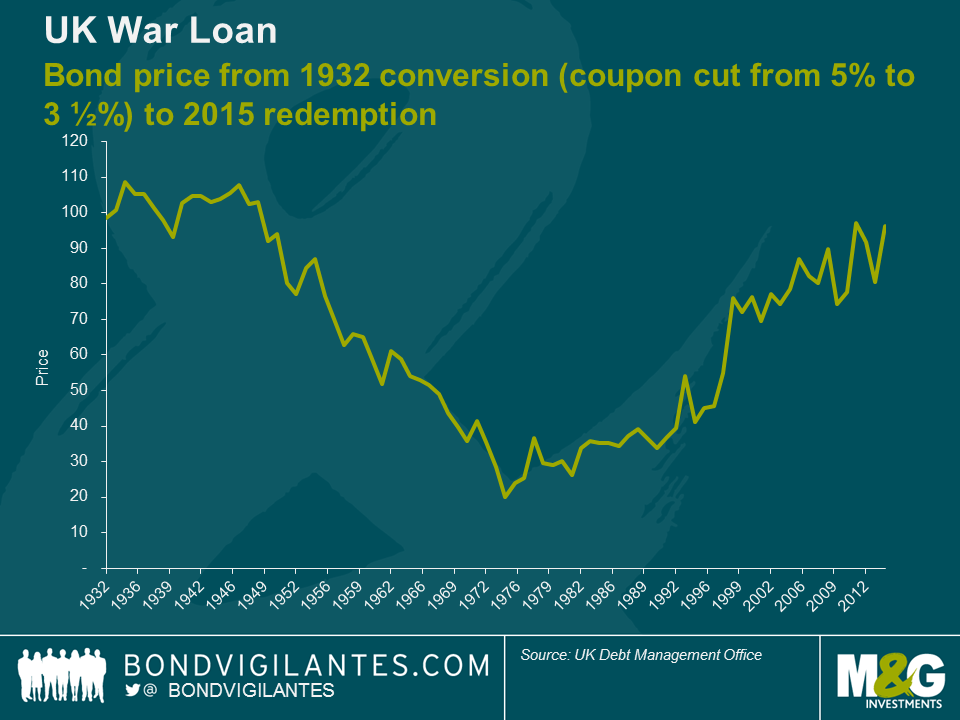

Today, the War Loan issued in 1917 to help finance Britain in World War 1 is finally redeemed. We’ve written about it repeatedly over the years as it has always fascinated us. Was its coupon cut in 1932 a form of default from the UK government? Does George Osborne’s claim that it is being redeemed this year as a result of a tight grip on the public finances ring true?

To commemorate this most interesting of gilts we have made a film about War Loan – one that tells the economic history of the UK through wars, default, the re-joining and leaving of the gold standard, the inflationary 1970s, the loss of the UK’s AAA credit rating, and finally the deflation that has followed the Great Financial Crisis.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox