Is there still slack in the US labour market?

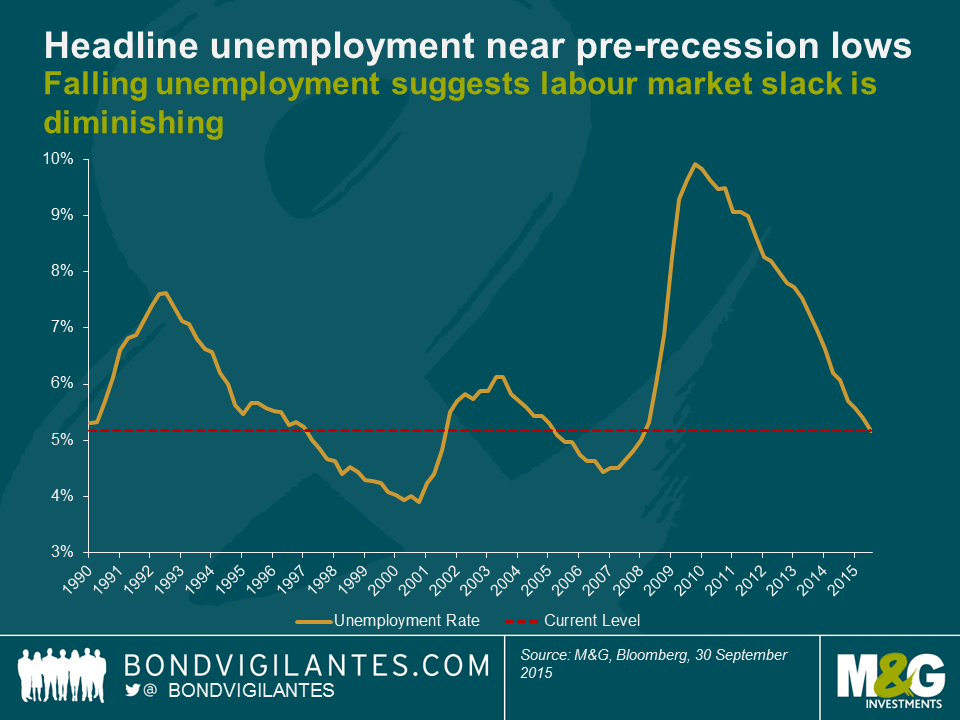

We have often blogged about the current tightness in the US labour market; in particular the initial jobless claims number as a percentage of the working age population being at all-time lows. The Fed too has recently produced indicators to tell a similar tale; looking at unconventional unemployment proxies – such as the insured unemployment rate in this recent post – suggests that labour market slack has diminished to multi-decade lows. However it’s well known that whilst the unemployment rate has fallen to levels that might be expected to cause wage inflation, we’ve also seen a significant fall in the participation rate. There remains a debate about the reasons for this fall (from more than 67% at the start of this millennium to just over 62% now), although most believe it is not just cyclical (reflecting the damage done by the 2008 Global Financial Crisis) but also structural (demographics etc.). An enduring criticism of the improving labour market story is therefore that it has been a low-quality recovery with discouraged workers ceasing their job search or retiring early due to their skills mismatch. These searchers fall out of the unemployment rate, which paints an improving, yet distorted, picture. Indeed, the chart below shows that the headline unemployment rate is approaching its pre-recession lows.

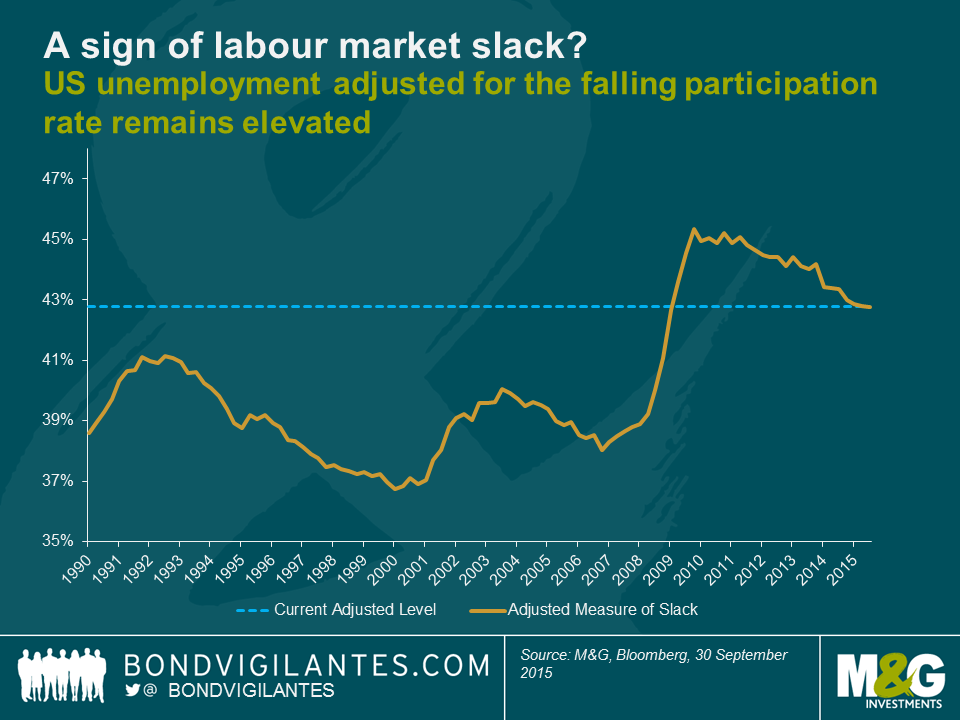

Adjusting the headline unemployment for the falling participation rate and assuming that the actual unemployment rate is the sum of the headline number of unemployed and the percentage of non-participants over time, gives an alternate proxy for the US labour market. In other words, this shows what the US labour market would look like if we adjusted the unemployment rate to effectively add back in those who have left the labour force.

As you can see, the graph above indicates that the adjusted measure of available labour is 43%, compared to the 40% average over the period. You would need a large further fall in the headline unemployment number (or a similar rise in participation rates) to return US labour market tightness to its pre-recession levels, on this adjusted measure. The US Employment Cost Index has been stuck around 2% since the end of the recession – a period where we have had this huge “reserve army of labour” available for capital to utilise. The falling participation rate has overwhelmed the impact of falling headline unemployment and could make significant wage growth difficult to achieve.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox