Beware of the pitfalls in US high yield retailers

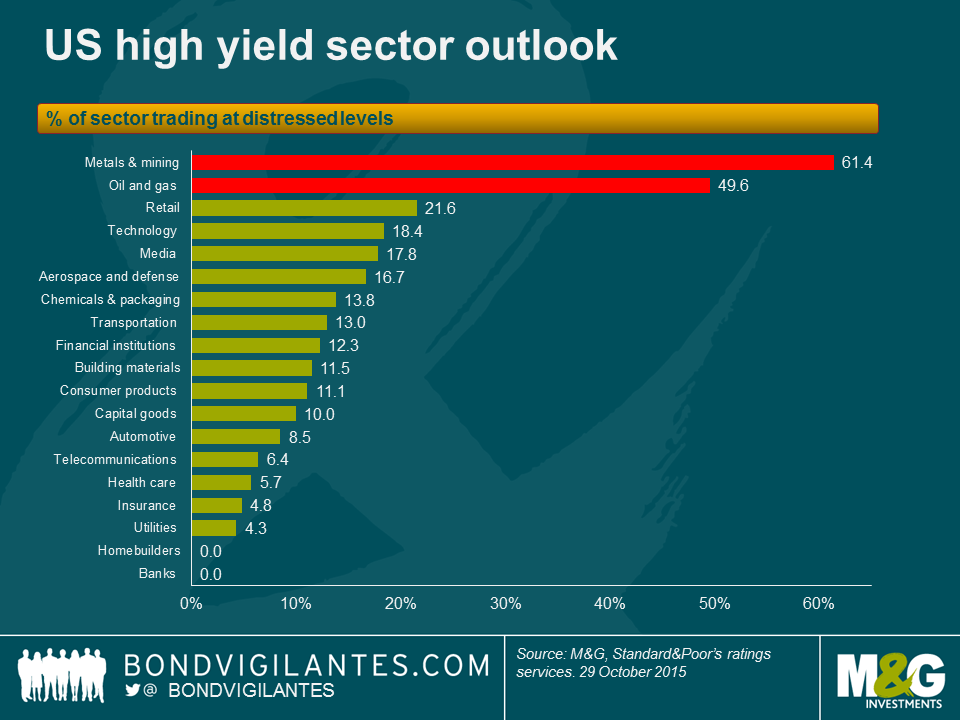

The fact that commodity-related sectors, like metals & mining and energy, are the highest-yielding and worst performing sub-sectors this year in the broader high yield Index is no surprise. There is a high degree of distressed credits in these sectors suffering on the back of the current low commodity price environment. S&P recently released its summary of sectors with the highest distressed ratios (or the percent of each sectors’ issuers whose bonds have option-adjusted spreads (OAS) greater than 1,000) and, unsurprisingly, metals & mining and energy are on top of the list with distressed ratios of 61.4% and 49.6% respectively.

What might surprise some is that the retail sector comes in third place, with a 21.6% distress ratio, despite the US economy being in decent shape with job creation and lower gas prices freeing up more disposable income.

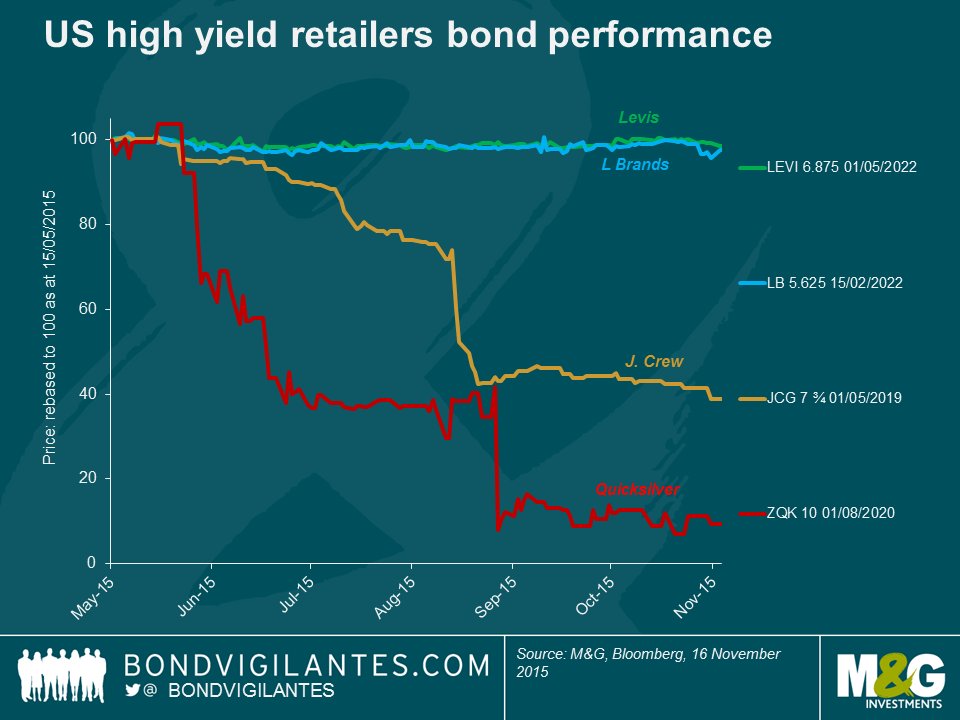

This is mostly due to a number of highly distressed individual names skewing the picture, because the balance of the sector trades at levels closer to, or even within, the broader high yield index. The table below provides a snapshot of a few of the “haves” and “have nots” within the sector and illustrates the importance of avoiding potential pitfalls.

It’s true that the move to e-commerce has played a role in hampering retail traffic and sales through the traditional venues, which most of these retailers operate (shopping malls, big box stores etc.), but many of these wounds have been self-inflicted. Some management teams got promotions and/or fashion seasons wrong and others changed their business model in a way that alienated their customers.

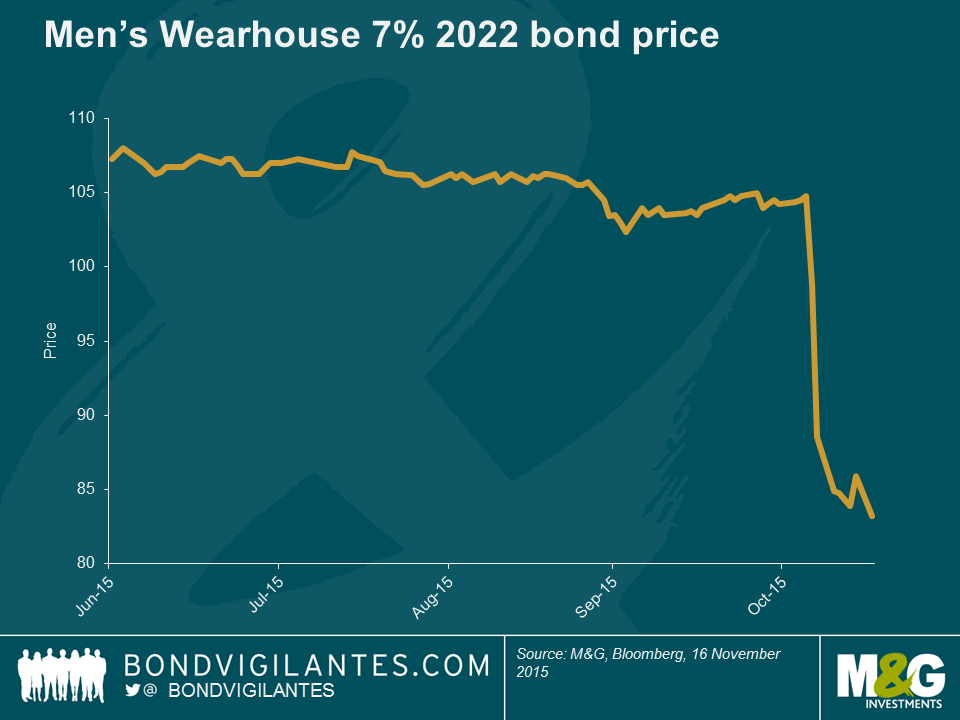

Men’s Wearhouse, a specialty retailer focused on men’s suits and accessories, is the latest example of the latter. The company’s stock has plummeted nearly 50% since October and its 7%, 2022 bond dropped approximately 20 points following the company pre-announcing disappointing Q3 results, which took the market by surprise.

The culprit was lower-than-expected sales of its Jos A. Bank (JAB) label, which Men’s Wearhouse acquired last year for around $1.5bn. JAB was famous for a promotion where customers could buy one suit and get three free. Upon acquiring JAB, Men’s Wearhouse pledged to do away with the promotion. The size of the resulting drop in sales caught management, by its own admission, by surprise. In a classic example of a company getting away from what its core customer demands: the three-for-one promotion was more vital to JAB’s prospects than management recognized.

More examples include J Crew Group (JCG), which suffered by making changes to its core style, leaving its existing customer base alienated; or in retail parlance, it committed a “fashion miss”.

In the case of Quiksilver (ZQK), management lost control of its wholesale channel, leading to deep price discounting and brand damage. Plus, ZQK had an unsustainable capital structure (i.e. too much debt) and despite new management efforts, the company filed for U.S. Chapter 11 protection in September.

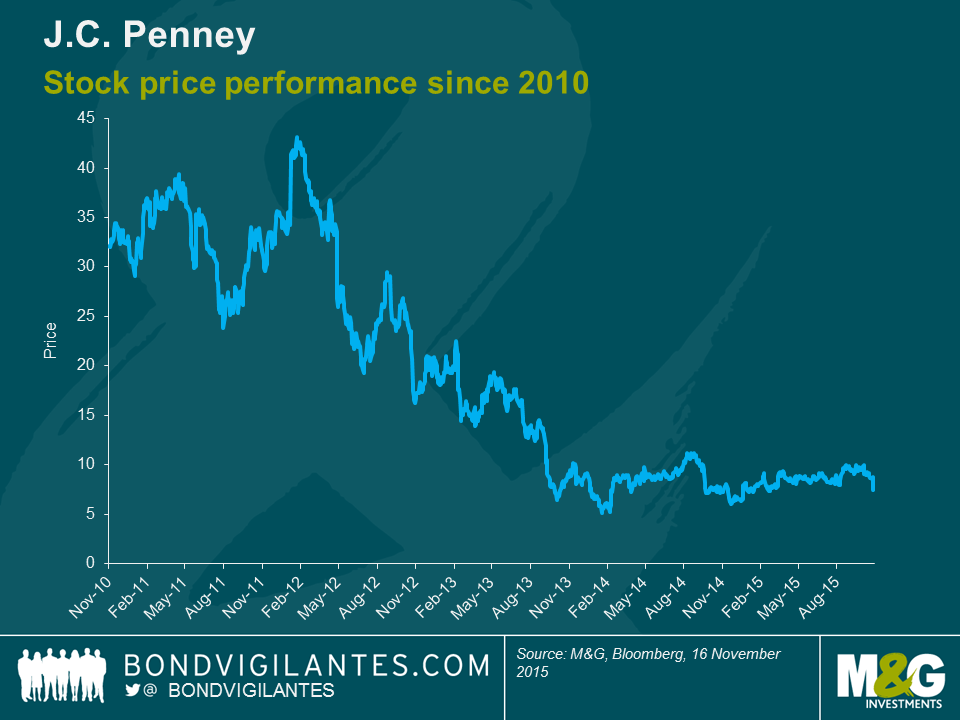

JC Penney (JCP), a big box department store, was already suffering from structural shifts such as e-commerce when it started altering its core business model by introducing a “store-in-a-store” concept. This meant that individual brands (Martha Stewart is one famous example) were given virtual stores within JCP’s existing stores. Although this concept wasn’t entirely ground-breaking, JCP has been around since 1902, and this concept didn’t strike a chord with its longstanding conservative customer base, who viewed JCP as an old-school, traditional, discount retailer. Opinions remain mixed on the long-term prospects of JCP, but this demonstrates that recovering from strategic mistakes, especially when coupled with structural changes, can take many years.

NB we are highlighting JCP’s equity rather than the company’s bonds as the company has re-financed and restructured its capital structure over this time period. Subsequently, the equity performance gives a cleaner illustration of how JCP’s attempts to recover have lingered for years as it tries to repair its brand and regain customers.

And the list goes on. Other distressed retail names with more than $400m in bonds outstanding include BI-LO Holdings, Claire’s Stores, Jo-Ann Stores, The Bon-Ton Department Stores, The Gymboree Corp and Toys R Us.

Men’s Wearhouse’s 2022 bond is now yielding 10.6%, or +872 bps on an OAS basis, as the market is trying to determine/gauge whether the company can recover. So not truly distressed as per S&P’s definition, but not a million miles away.

Now, Men’s Wearhouse may rebound quickly, which means this sell-off could represent a buying opportunity if one believes in the company’s prospects and its ability to regain customers. Or its troubles may linger as sales and customers erode further, in which case investors need to be prepared for the long haul and assess if they are being adequately compensated for the elevated risk of the business going forward and how likely they consider the possibility of a debt restructuring.

In either case, this example highlights the peril of strategic mistakes damaging what was otherwise a well-performing business. It also highlights a theme we have commented on frequently – the importance of credit research and stock selection, as investors need to be cognizant of not just credit risk profiles and credit ratios, but also idiosyncratic and business model risk profiles.

Disclosure: M&G funds hold L Brands 5.625 2022 and Levis 6.875 2022 bonds and JC Penney equity

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox