Why doesn’t the ECB just buy oil?

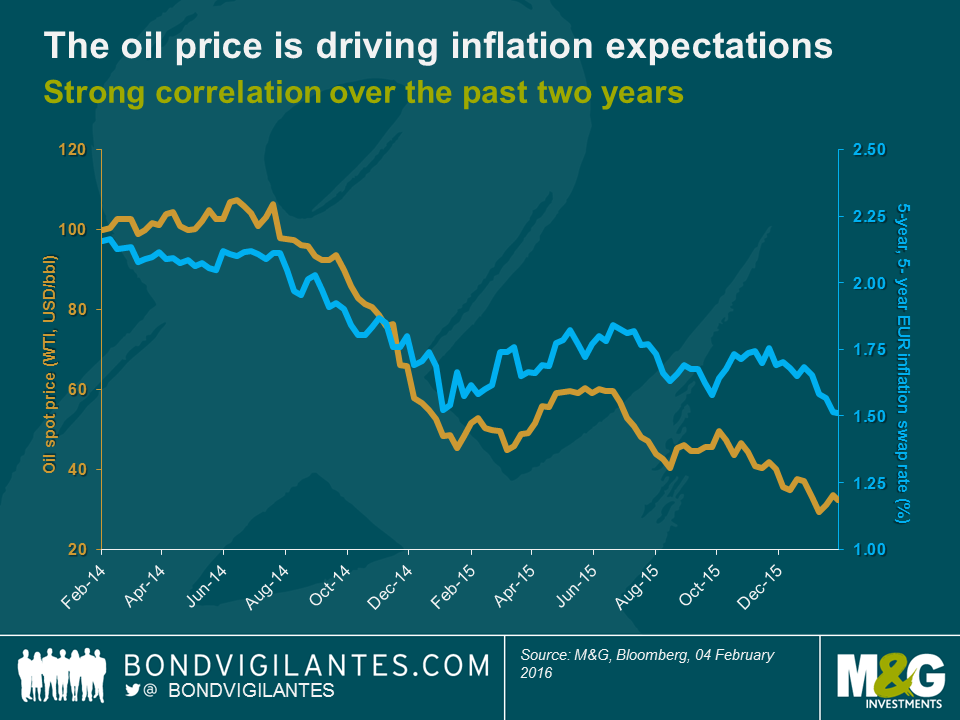

It’s pretty clear that the pressure is on the European Central Bank (ECB) to come up with some form of policy response at their next Governing Council meeting in March. Take, for example, the 5-year, 5-year EUR inflation swap rate (i.e., the swap market’s estimate of where 5-year inflation rates might be in five years’ time), which has taken a nose dive to 1.5% (see chart below). This is remarkable as the current number implies that the market expects the ECB to still be failing quite miserably to bring medium-term inflation close to 2% even in five years, despite negative interest rates and quantitative easing (QE). Not exactly a strong vote of confidence in the ECB’s policy tools, I’d say.

It seems that monetary policy is taking a backseat, whereas the oil price is driving market expectations of the future path of inflation rates. This follows some logic, of course, as a drop in oil price has direct deflationary effects on the energy component (and indirectly via lower transportation costs on other components) of the price index. One could argue however that a nearly perfect correlation (+0.9 over the past two years) between the oil spot price and expectations of 5-year inflation rates in five years’ time seems excessive. We have, for example, written about base effects (see Jim’s panoramic) and the diminishing downward pressure on petrol prices of any further oil price declines going forward (see Richard’s blog). In the past, the correlation between both data series also used to be a lot weaker (+0.3 over the prior two years). Still, market sentiment is pretty unambiguous these days: moves in the oil spot price by and large dictate future inflation expectations.

Adding to the ECB’s inflation woes are turbulences in financial markets. “Risk-off” has been the prevailing sentiment in 2016 so far. The Euro Stoxx 50 equity index has lost more than 13% year-to-date and EUR investment grade credit spreads have widened by c. 20 bps. Again, the oil price appears to be the dominating metric driving risk asset valuations. At this point it doesn’t seem to matter much anymore whether oil plunges due to sluggish demand (which would indeed be a legitimate concern) or because of growing supply. Remember how markets reacted to the Iran sanctions being lifted surprisingly early. The positive effects for the world economy of opening a country with nearly as many citizens as Germany to international trade and investment flows – the planned purchase of more than 100 airplanes from Airbus to modernise Iranair’s fleet is just the tip of the iceberg – were easily outweighed by market expectations of additional crude oil supply.

Markets do not seem to care much either whether a country or an industry is “long” or “short” oil. Germany, for instance, is one of the world’s biggest net oil importers (i.e., short oil) to the tune of around 110 million tonnes of oil equivalents per year, according to the Energy Atlas of the International Energy Agency. Cheaper crude oil lowers expenses for German companies and consumers alike, so that money can be invested or consumed elsewhere. All else being equal, the German economy should benefit from low oil prices. Still, on a day when the oil spot price falls for whatever reason, you can be almost certain that Bund yields rally and the DAX equity index finishes in the red. A similar case can be made for many other countries, too (see Charles’ blog).

The market’s obsession with the oil price is bad news for the ECB which is judged by its ability to deliver inflation close to 2% and promote market stability. So in order to remain credible, the ECB would need to control the oil price. But that’s beyond the capabilities of a central bank, or is it? Maybe the ECB should announce at its March meeting that asset purchases will from now on include crude oil. The ECB currently buys assets worth EUR 60 billion per month, so that’s around EUR 2 billion every day. If only 1% of this amount, a cheeky EUR 20 million, were invested in oil at a spot price of – optimistically – USD 35 per barrel (bbl), this would translate at an exchange rate of 1.1 USD per EUR into just shy of 630k bbl of sweet, sweet crude per day. The ECB would thus more than offset the proposed 500k bbl per day of additional supply with which Iran is spooking the market.

It wouldn’t be the first time either that a European institution props up goods prices by buying up excess supply. Just think about the infamous “butter mountains” and “wine lakes” of the 1980s under the framework of the European Union’s Common Agricultural Policy programme. Still, storage of large quantities of crude oil might prove challenging. Let’s assume the ECB kindly agrees to convert its shiny new Frankfurt headquarters into a giant strategic oil reserve. We all have to make sacrifices, eh? Applying some basic geometry to the numbers from the ECB’s factsheet we can approximate the storage volume: 350k cubic meters for both towers combined, give or take. This reservoir could hold around 2.2 million bbl of oil – not bad. But sadly not good enough as the ECB would run out of storage space after only 3.5 days of oil purchases. Fortunately, there is still the derivatives market. Instead of physically buying crude oil at spot, the ECB might want to consider buying oil futures to intervene in the oil market.

Of course, none of this will happen in reality. But all proponents of the “low oil is always bad” mantra should exactly push for such a, shall we say, unorthodox solution. If you truly believe that falling oil prices will forever squeeze inflation prospects and destroy asset valuations, you should urge Mr Draghi to fill his boots with the unloved commodity.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox