The US economy is not slowing down, it’s getting close to full employment

We are a little bemused following the latest US Employment report. The headline figure of +38,000 jobs for May (expected: +160,000) disappointed the market, with Treasuries rallying and a June/July rate hike off the table in most economists’ views. A decline in the participation rate to 62.6% helped the unemployment rate fall to 4.7%, the lowest level since 2007, while average hourly earnings rose to 2.5% year on year.

It is well known that US Employment reports (especially the headline payrolls number) should be taken with a large pinch of salt, as the report is often subject to large revisions and has a margin of error of almost 100,000 jobs. Additionally, the Bureau of Labor Statistics estimates that the seven-week long Verizon strike had an effect of weighing on payrolls by around 35,000 jobs. These jobs may well be added back to the employment numbers next month.

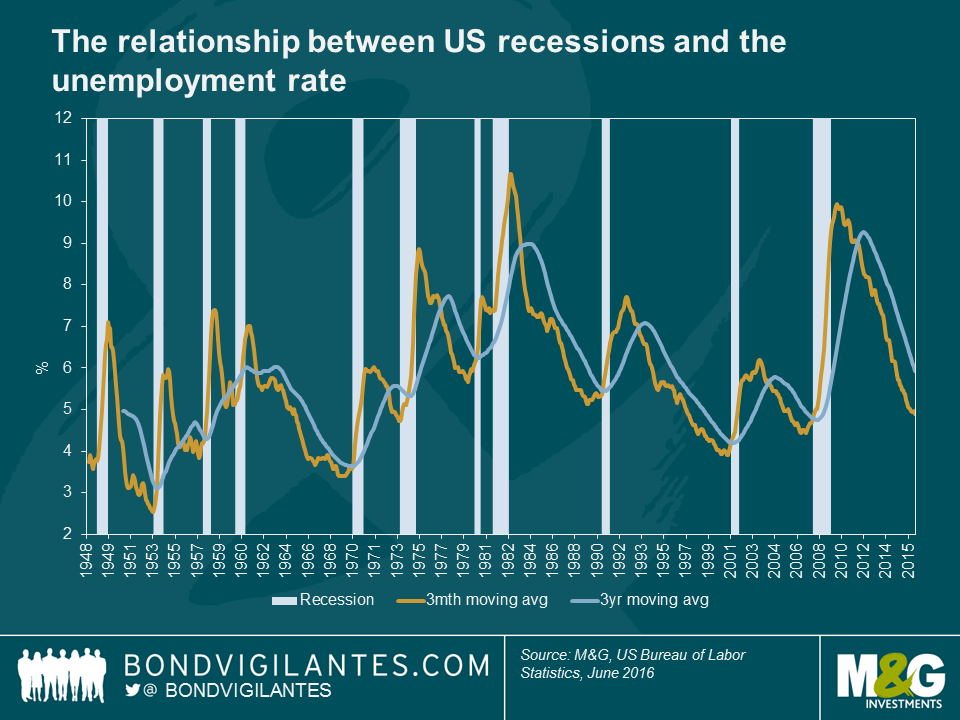

Of course, this is speculation. However, unlike most reactions to the employment report, we don’t think the FOMC will be worried that the US economy is slowing. Nor do we think that May’s employment report is an indication that the US may be headed for recession. Using the unemployment rate as an indicator of possible recession, the US has not historically entered into a contractionary environment until the three-month moving average crosses the three-year moving average. As the chart indicates, there are no early signs of this recession indicator turning for now.

If the US economy is continuing to expand, then there could be another reason why the payrolls numbers were disappointingly low. That is, the economy could be getting close to full employment (as an unemployment rate of 4.7% would suggest). This means that employers are finding it difficult to hire suitable workers for the jobs that are available. If this is indeed the case we would expect to see labour cost measures, like the Employment Cost Index (currently 2.4% yoy), quickly start to rise over the remainder of 2016.

The market is now pricing in a rate hike in December (moved out from July). This appears too cautious to us. As Richard has outlined previously, employment markets are healthy and the economy is probably very close to full employment. Given the inherent lag in monetary policy, it is important that the FOMC reaffirms its stance of gradually removing policy accommodation. Otherwise, it risks tapping on the brakes too late.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox