The Bank of England could be about to unveil a bumper monetary policy package

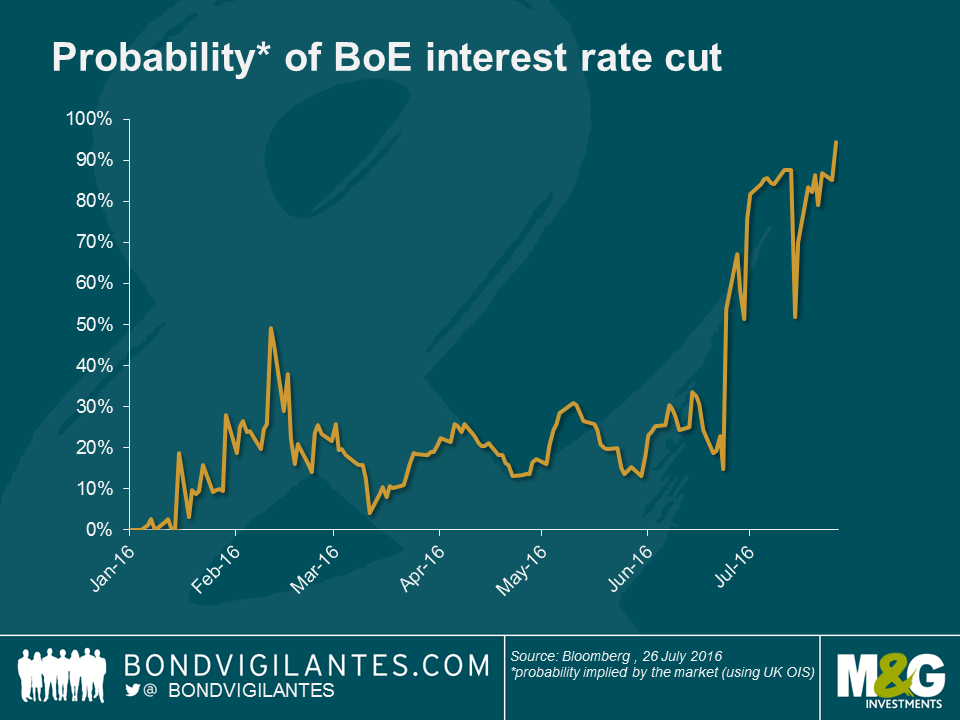

Despite keeping interest rates on hold at the 4th July meeting, the minutes of the Monetary Policy Committee indicated that “most members expect an easing in August” (even long-time hawk Martin Weale has shifted to a dovish stance). Subsequently, markets are pricing in a staggering 98.3% probability of a rate cut at the next meeting in 8 days’ time. With UK data expected to deteriorate over the next few months, market pricing seems appropriate.

However, something else that stood out from Governor Carney’s 30th June speech (other than his expectation of some summer monetary policy easing), was this: “In August, we will also discuss further the range of instruments at our disposal.” With interest rates close to zero, Governor Carney could be indicating that the BoE is limbering up to provide a bumper stimulus monetary package, alongside an interest rate cut, akin to that unveiled by the ECB in March this year.

Here are five options that could be available to the MPC.

- Quantitative easing

A renewal of the BoE’s quantitative easing programme seems the most likely easing measure that the MPC could take outside of cutting interest rates; the ultimate goal of the policy being to facilitate an expansion of private bank lending, via central bank asset purchases. Should this occur, we would expect the belly of the UK government bond curve to be well supported. In particular, gilts with maturities in the 7-15yr range could benefit given that there are fewer bonds in this maturity bucket (assuming the BoE aims to make purchases in line with its QE reinvestment rules which we have discussed here) and this is the duration neutral part of the curve. More pertinent to the UK perhaps would be what Fathom Consulting have coined “Operation Anti-Twist” (based on the FOMC’s 2011 “Operation Twist”) which would entail selling long dated gilts and buying short dated gilt issues. This would engineer a steeper yield curve and could support those with longer term pension liabilities looking for higher yields.

- Corporate bond purchases

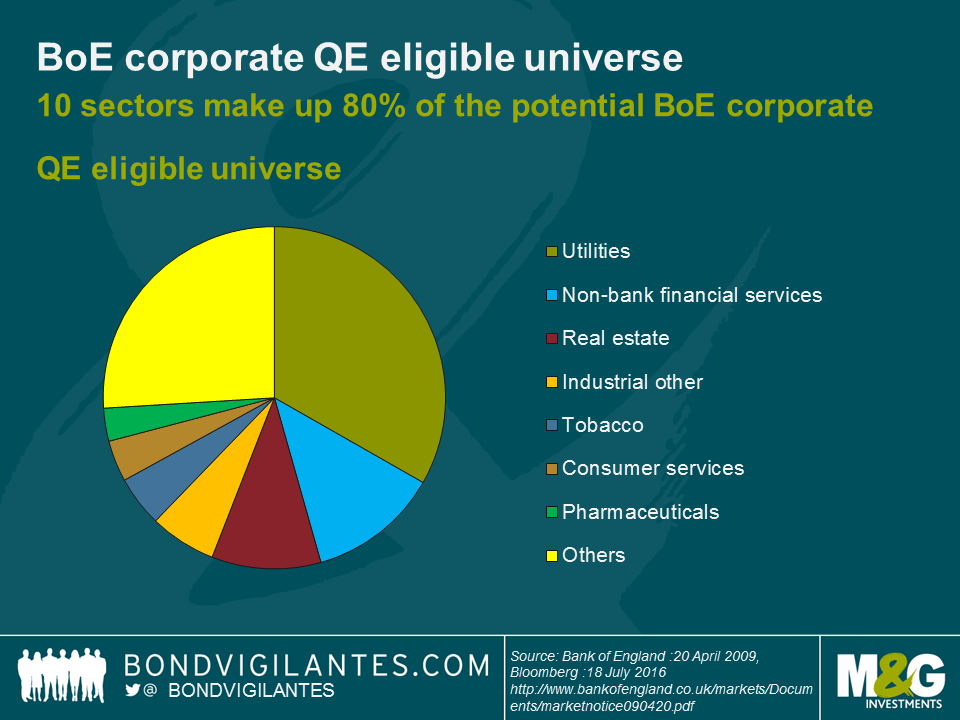

In order to improve market liquidity in 2009-2012, the BoE purchased corporate bonds as part of its QE programme. Though this is not necessarily an imminent priority – there does not appear to be a corporate funding crisis; GBP non-financial investment grade corporate spreads did spike up, but have fallen since the referendum – this nevertheless presents a credible policy option.

If the BoE were to resume corporate bond purchases, along the same criteria used previously (which was much stricter than that currently used by the ECB, especially with regards to rules regarding credit ratings), I estimate that the investment universe would be in excess of £100bn, with utility companies representing the lion’s share of eligible purchases. Real estate companies also appear set to benefit notably from corporate QE, which could offer some targeted support to a sector that’s already been particularly hard hit.

- Further support for bank lending

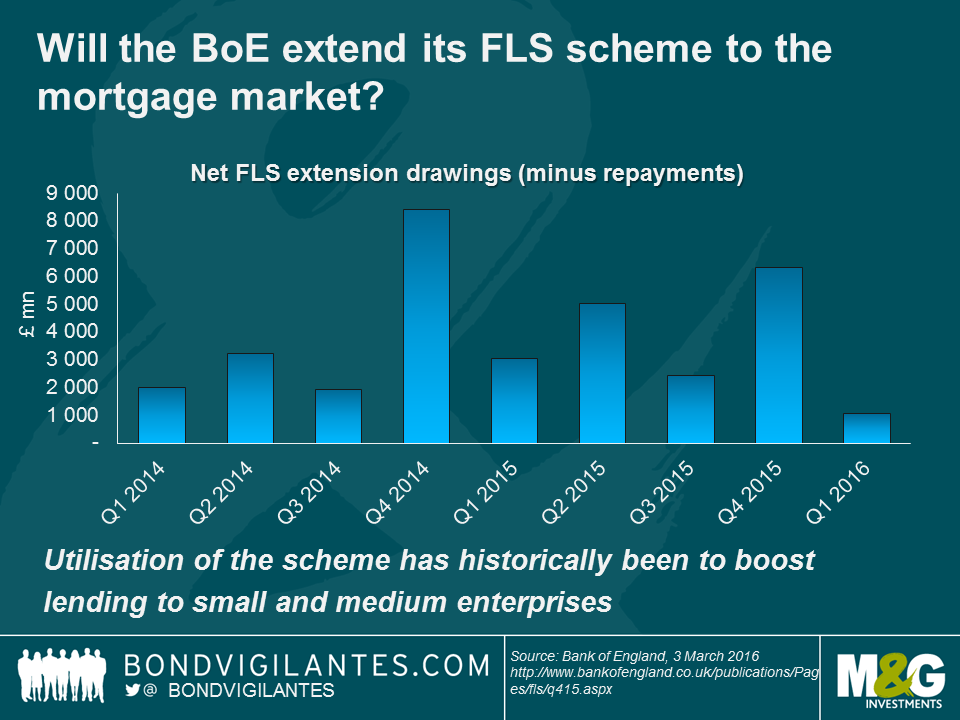

Earlier this month the BoE reduced the UK countercyclical capital buffer rate – for banks, building societies and large investment firms – to zero from 0.5% until at least June 2017. Governor Carney noted that this will lower UK banks’ required capital buffers by £5.7bn, essentially freeing up capital for them to lend to the real economy. Should upcoming data warrant it, the BoE could extend its Funding for Lending Scheme (FLS), to further ease credit conditions for households. The current scheme incentivises banks to boost lending, with a skew towards small and medium sized enterprises – arguably those who will be hardest hit from the ongoing uncertain outlook. They could however extend this scheme in a further targeted manner, for example, towards mortgage lending in a bid to subsidise loans for house purchases (should market conditions warrant this). The FLS has been extended many times since it was introduced in July 2012, with the last extension taking place in November. Though we have previously questioned the success of the scheme, we could potentially see another amendment.

- Joined up fiscal and monetary policy response

Investors and markets are positioned for a low growth, low inflation world, but this could be about to change. With the limits of global monetary policy arguably exhibiting diminishing returns to scale, there is now the potential to see expansionary UK fiscal policy working alongside monetary policy. Given the reshuffling of the cabinet, Osborne’s fiscal tightening and austerity budget have fallen by the wayside and it is time for Hammond to show his hand. Given the unusual circumstances, the new chancellor could plausibly move his autumn statement to coincide with the BoE meeting on the 3rd November and offer something original. If he takes the advice of the IMF and OECD, both of which have been calling for a boost in infrastructure spending, we could potentially see the government opting for pro-growth infrastructure projects, funded via bonds that the BoE ultimately buys.

- Negative rates

Could the BoE introduce negative interest rates, like we’ve seen in the Euro area and Japan? In theory yes, but in practice I believe that this is some way off. Negative rates are still in their experimental phase (Jim has noted some great anecdotes on this here and here) and the BoE still have some leeway with regards to traditional monetary policy. With interest rates at 0.5%, there is still space for a few cuts before we reach the zero bound and have to contemplate any unconventional measures.

Evidently there are many tools in the toolbox (and I have focused predominantly on the tried and tested), but will the BoE look to use them? Every monetary policy meeting should be noted in your diary, every meeting is ‘live’. Roll on the next BoE monetary policy decision.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox