Is QE unquestionably supportive for risk assets? I think not.

We have written about quantitative easing (QE) many times over the years, yet there remains more to be said: the great QE experiment is not yet over. Given the result of the EU referendum, speculation is rife as to whether the Bank of England will embark on another round of QE to stimulate the UK economy; arguably making this a good time to debate the efficacy of such strategies.

It’s safe to say that the most surprising aspect of QE has been the lack of inflation, but central banks which have undertaken – or are still undertaking – QE claim that it has worked by preventing deflation through portfolio rebalancing. The shift in funds into riskier assets has led to higher stock markets. My take on this? Central banks are over exaggerating their claims at best, or grabbing at straws at worst.

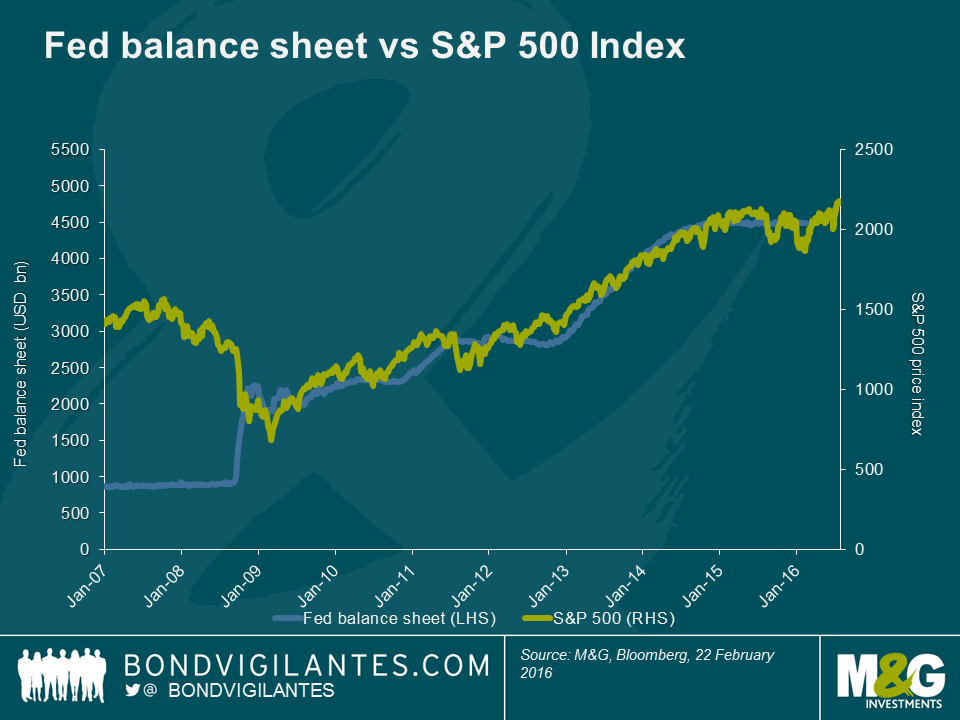

Let’s take the US model experience as an example. I agree that the Fed’s balance sheet and S&P 500 index have been positively correlated since 2009, but I would argue that the relationship is casual, not causal. The Fed announced its QE programme only after US stock markets had collapsed to cheap levels, and stopped it only once those markets had recovered. As such, the Fed seemed to use the S&P index as a temperature gauge for the economy (“the share price of the country” as it were), rather than the index appreciation being the direct result of the QE activity undertaken. QE started when stocks were cheap, and finished when they became fair value.

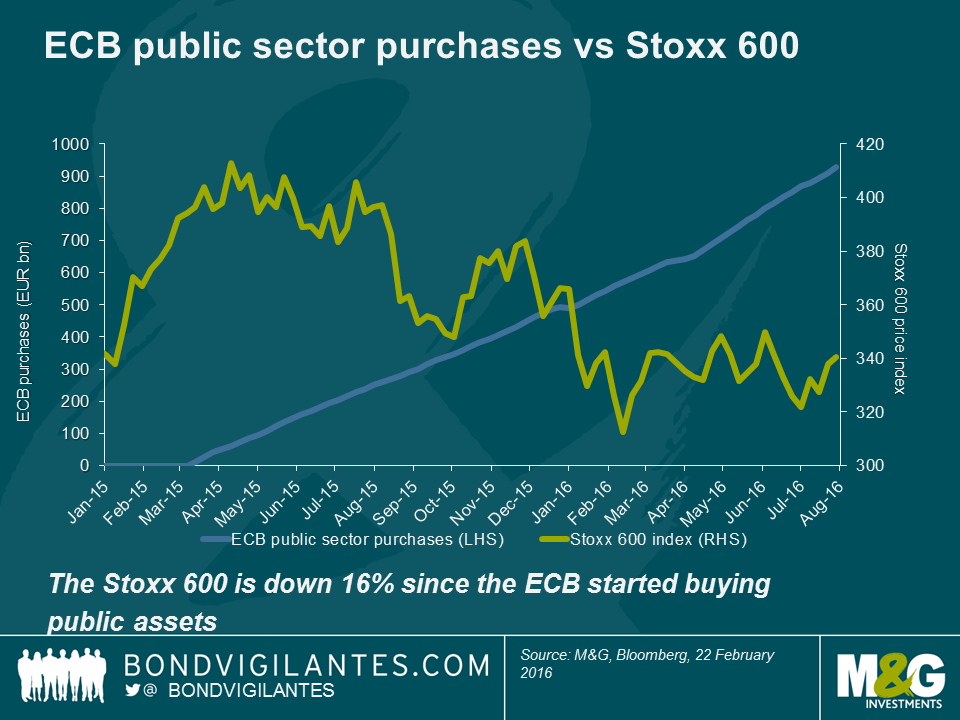

Not yet convinced? The above chart demonstrates a coincidental relationship, but what about other economies? The QE experiment in Europe was initiated in March 2015, a time when the Stoxx 600 equity market was much more buoyant, and not trading at distressed valuation levels. It seems ludicrous to argue that a causal link has been in play in Europe. This is illustrated below.

So what have we learnt? QE appeared positive for risk assets when their valuations were depressed in the US, but had little impact when equities were fairly priced in Europe. Because interest rates have already fallen to a large extent (thereby lowering the discount rate that equity investors use), investors will not be able to boost the present value of future cash flows. This means that it is difficult for equity market valuations to increase to the same extent as previously when yields collapsed. Given the sluggish economic outlook and potentially higher interest rates in the US, it is also difficult to argue that profits in the future will be much higher as well.

QE does have some economic effects; it’s just (I’m not ashamed to say) still difficult to discern just what these are. It hasn’t yet been inflationary (even though the basic principles of QE suggest that increasing the supply of money should reduce its value) and I believe that the link to stock market strength is somewhat illusory. Arguably, the greatest effect of QE has been the reduction in bond yields across the curve and not a portfolio rebalancing into riskier assets. In theory, the portfolio rebalancing effect is most powerful when investors view equities as an alternative to bonds. Given the difference in volatility characteristics of both asset classes, it is unlikely that this will ever be the case (some investors still choose to buy negative yielding fixed income securities for example). If the Bank of England is hoping that QE will prop up the UK economy and inflation through a causal link then the current economic data supporting this theory is mixed at best.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox