10 years of the M&G Bond Vigilantes blog. A new book and fundraising for Cancer Research UK.

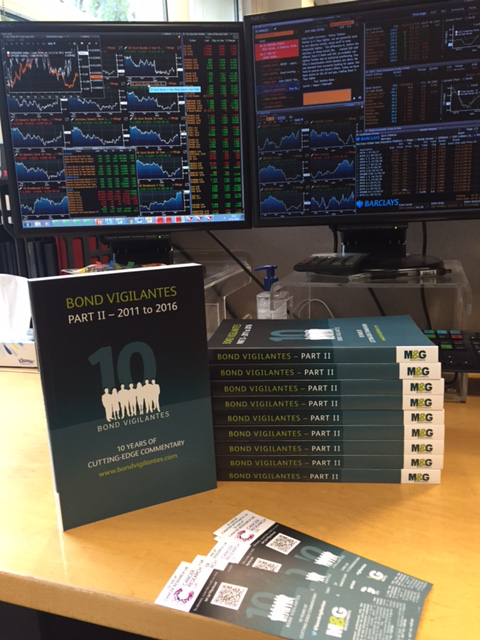

Today is the 10th anniversary of the Bond Vigilantes blog. Here’s a look back at the incredible changes to bond markets and monetary policy that we’ve been through over that decade. Also today we are launching our new book (the difficult second album) in support of Cancer Research UK. There’s a link to our Just Giving page at the bottom if you like what we do and can spare a few quid.

My first ever piece on the blog, back in November 2006, reported that the Bank of England had just raised interest rates to 5%, and suggested that with inflation at 3.6% (the highest for 8 years) and house prices rising, nobody should have been surprised. We know what happened next though.

With the US Federal Reserve having also raised rates to 5.25%, earlier in the year, the American housing market began to cool rapidly, and after annual price gains of between 5% and 12% since the turn of the millennium and significant speculative overbuilding, boom turned to bust. Consumers sank underwater on housing loans, and delinquencies and defaults ballooned. Mortgages had always been regarded as “safe” loans, and financial institutions had not only taken on huge leverage themselves to finance them, but had also originated and repackaged these debts to sell to financial institutions globally. In what was then considered a low yielding world, Asset Backed Securities (ABS) and new financially engineered instruments such as Collateralised Debt Obligations (CDOs) offering potentially higher returns for theoretically low credit risk, became widely held. This meant that when the housing crash came, and US house prices fell by an average of 5% per year from 2007 to 2011, the distress was widespread and not confined to American banks.

Closures of ABS funds were followed by skyrocketing funding costs for banks in desperate need of liquidity, and collapsing bank equity prices. Eventually Lehman Brothers defaulted, and US financial institutions were bailed out by taxpayers and the Federal Reserve. Queues formed outside distressed banks in the UK, and Northern Rock and the Royal Bank of Scotland were nationalised as policymakers realised that what was happening had echoes of America’s Great Depression. Bailouts and nationalisation were not the only emergency responses though. Monetary policy changed forever in response to the supply side shock of weak banks (lack of lending), poor consumer demand (over-leveraged and experiencing negative equity on housing loans), lack of business investment (low confidence in future growth) and deflation fears. Interest rates were slashed by central banks (0% – 0.25% by the end of 2008 in the US), and extraordinary policies such as subsidised lending to the banking sector were implemented. Most importantly, we also saw central banks print money to buy back government bonds from investors – Quantitative Easing (QE).

QE was designed to generate both growth and inflation. By lowering borrowing costs in capital markets, businesses would become more profitable and might invest more. Households would see interest costs reduced. And the so-called “portfolio rebalancing” effect would encourage investors such as ourselves to sell our expensive and low yielding government bonds to take riskier, higher yielding positions which would help finance the real economy. Did it work? Well the academic literature – much written by the central bankers themselves – says yes. Inflation and growth were both higher than they would have been without QE. But as a politician once said, “you can’t put a counterfactual on a bumper sticker”. We will never know how bad things would have got if QE hadn’t happened, or indeed whether more “creative destruction” – letting failed institutions go bust, rather than limp on as bailed-out zombies – might have been a better outcome. Anyway, no feel good factor returned, and what started off as a financial sector crisis had, by the time the Bond Vigilantes blog reached its 5th anniversary, become a sovereign debt crisis in Europe. Weak growth, poor demographics, badly capitalised banks, government indebtedness and imbalances within the Eurozone proved a toxic mix. Spanish, Italian, Irish and Portuguese government bond yields spiked. Greece had to be bailed out by creditors including the International Monetary Fund (IMF).

Government indebtedness became an economic football. On the one hand books like “This Time is Different” by Reinhart and Rogoff warned of dire consequences for nations that allowed government borrowing to hit 90% of GDP. This helped inspire a cult of austerity (for example in the UK under Chancellor George Osborne) where fiscal tightening was thought to be needed, despite the huge shock to growth that had been experienced. Others, like Olivier Blanchard of the IMF, warned that the negative multiplier effects from austerity would cause the downturn to persist, and that Keynesian stimulus was desirable. On the whole the austerians won, and monetary policy rather than fiscal policy was left to do the heavy lifting. Which brings us to the start of our new book, covering the next five years of the ongoing Great Financial Crisis.

First the good news. Unemployment has fallen dramatically from the levels we saw in 2009. From 10% in the US, we now have just 4.9% of the American workforce out of work. We have a similar level of joblessness in the UK, and even in the Eurozone the unemployment rate is falling. Another reason to be cheerful is the relative stability in the financial sector. Having been forced to raise capital, been subjected to periodic regulatory “stress tests”, and having access to cheap central bank money, banks are less of a threat to the economic system. But things still just don’t feel “right”, even though in December 2015 the Federal Reserve felt able to finally hike rates by 25 bps.

For although unemployment rates have fallen, workers have not seen the wage rises that we might have expected. Partly this could be due to lower participation rates in the US (people leaving the workforce because they are discouraged by fruitless job-seeking, flattering the unemployment numbers), but there are also good arguments to say that we now exist in a global labour market and that capital will move jobs to lower cost regions (for example emerging markets) rather than pay higher wages. “The Rise of the Robots” by Martin Ford makes the scary prediction that we are entering a period of rapid robotisation and use of artificial intelligence that will steal jobs and wages from not just manual workers, as has always been the case, but high skilled middle class jobs too. Unemployment will rise as a result, and because robots don’t buy stuff, our consumer based economies will enter a negative spiral. The feeling that the average citizen has not seen incomes rise by much in real terms for many years now is likely to be a factor in both the lack of economic animal spirits and the rise of anti-establishment politics.

The Greek economic crisis (its unemployment rate hit nearly 30%) led to the rise of both far right (Golden Dawn) and far left (Syriza) political parties. Populist parties also emerged in Spain (for example Podemos who have suggested government debt forgiveness), and you could argue that the success of UKIP and Jeremy Corbyn, and the Front National in the UK and France respectively, as well as Trump and Sanders’s popularity in the US, can be linked to the perception that incomes have stagnated for most workers whilst the “1%” have become richer as the result of QE and other post-crisis policies. The UK’s two referendums, the first on Scottish independence, the second on EU membership, also look like self-inflicted wounds from a purely economic standpoint, but may reflect voter dissatisfaction with remote “elites”. Whilst most studies show that immigration may have only a marginal impact on wages (depressing them), globalisation is certainly no longer regarded as only a good thing.

When China joined the World Trade Organisation in 2001, it felt like the movement towards global free trade was a one way street. No longer. Might we see the return of tariffs and trade barriers? And as monetary policy runs out of power, many nations have attempted to weaken their currencies in the hope that a competitive devaluation might stimulate their export trade in a way that lower rates couldn’t. Currency wars are of course a zero sum game.

Five years ago, China was still a bright spot in an otherwise gloomy picture for global growth. Having bounced back from the Great Financial Crisis with some well-timed fiscal stimulus, its official GDP number was growing at around 10% per year. As an example of an investment led economic miracle, China was a poster child. No other nation had invested a larger share of GDP for as big a boost to economic output as China had, and on a Purchasing Power Parity measure, it became the world’s biggest economy in 2014. But not all investment is good investment, and the “bang for the buck” China was getting for each additional project started, has fallen dramatically in recent years. I remember attending an IMF meeting in Tokyo in 2012 where I heard Professor Michael Pettis speak. He told the audience that Chinese growth would average below 5% for many years as a result of over investment and bad loans, especially to the State Owned Enterprises (SOEs). I saw almost all the audience snigger and make “he’s gone mad” faces to each other, and I realised that a China slowdown was not on anyone’s investment radar. And with China being the biggest export market for many other emerging markets, and commodity producers such as Australia, when the continual slowdown began at the end of 2012, there was pain for countries like South Africa, as well as for metals and mining companies.

Simultaneously, oil prices were hit from the supply side. The opening up of shale oil fields in the lower American states led to oil prices halving, and then halving again, between 2014 and the end of 2015, provoking a new deflation scare as headline inflation rates (where direct energy contributions are around 10% to 15% of the basket) turned negative.

And if inflation rates turn negative and central bank rates are already at zero, what can you do? Switzerland had briefly instated negative interest rates in the 1970s to deter foreign currency speculators, but aside from this the world entered new monetary policy territory in the past couple of years. Switzerland, Denmark, Japan, Sweden and the Eurozone now all have negative rates. Will they work to stimulate growth and inflation? There’s little evidence so far to suggest it. Theoretically the impact of negative and positive rates should be symmetrical, but in a world where we can take our cash out of banks as notes, we can avoid paying a financial institution for the privilege of looking after our money. Safe deposit box sales have soared. Worse still for the central bankers, in a world where the banks realise that they can’t pass on negative rates to depositors for fears that they’ll withdraw all their money, they have to maintain their profits by increasing their lending rates. Swiss mortgage rates went up when the SNB cut rates. This is an unintended consequence that only the abolition of cash and a move to pure electronic money could prevent – the latter action would be intensely unpopular with populations. You should see the hate mail I got from the American Tea Party when I discussed the abolition of physical money in a newspaper article. It was almost as bad as that I received when I suggested that Scotland might not merit a AAA credit rating if it became independent.

Given the adverse impact on the banking sector in particular, I suspect that global rates won’t go much more negative than they already are. If that’s the case, is it time to suggest that we are also near the end of the bull market in government bonds that’s run since the start of the 1980s, when Paul Volker took over control of the Federal Reserve and set out to kill the inflation that had eroded returns for bond investors for two decades? We are now at record low government bond yields in virtually all developed markets, and there is over $11 trillion worth of negative yielding bonds outstanding worldwide.

If negative rates are not effective then, what do we do next if we have a new slowdown? Governments still seem reluctant to ease fiscal policy, and central bankers are running out of assets to buy as part of QE programmes. Having been seen as a crackpot idea even a few years ago, the idea that the authorities might use “Helicopter Money” to stimulate an economy is slowly edging into the mainstream of economic thinking. Rather than printing money to buy financial assets and hope that institutions use the cash they receive to make new loans and investments, central banks could print money to short circuit that transmission mechanism and give the money directly to individuals to spend (akin to dropping banknotes out of a helicopter) or they could directly finance infrastructure spending and other activities with high economic multiplier effects. Having been the first to suggest it might happen in a 2012 blog, I also wouldn’t rule out some form of government debt cancellation involving the bonds held on central banks’ balance sheets as part of QE. A cancellation of student debt owed to governments might however be far more powerful economically. The M&G bond team has covered all of the topics above on the Bond Vigilantes blog in recent years, and we’ve very much enjoyed doing it. We’re obviously fund managers and investment specialists rather than journalists, and the “day job” comes first, but setting out our views and creating charts really does help us to challenge or crystallise our own thinking.

Thanks very much for continuing to support us by reading our articles, for following us on Twitter, watching our YouTube videos and coming to our events. It’s much appreciated. As before all proceeds of the sale of this book will go to Cancer Research UK. Our last book raised over £10,000, so thanks also for your generous support.

If you’d like to, you can donate at our Just Giving page www.justgiving.com/fundraising/bond-vigilantes-anniversary-book. Also, we need to thank M&G for supporting the blog over the last decade, and all of the economists, strategists and experts who have helped us formulate our views.

It’s hard to imagine that the next five years can be as eventful as the past ten, but the whole global economic and political system just seems a little…odd, doesn’t it? So I’m not ruling it out. We go into our second decade with a new American president who appears to be about to initiate a Reaganomics-style stimulus. It was the Reagan era deficits and resulting Treasury market revulsion that led to Ed Yardeni coining the term “bond vigilantes”. When I named this blog the term was a mildly amusing historical relic. It feels like that’s about to change.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox