Argentina’s century bond: much ado about nothing

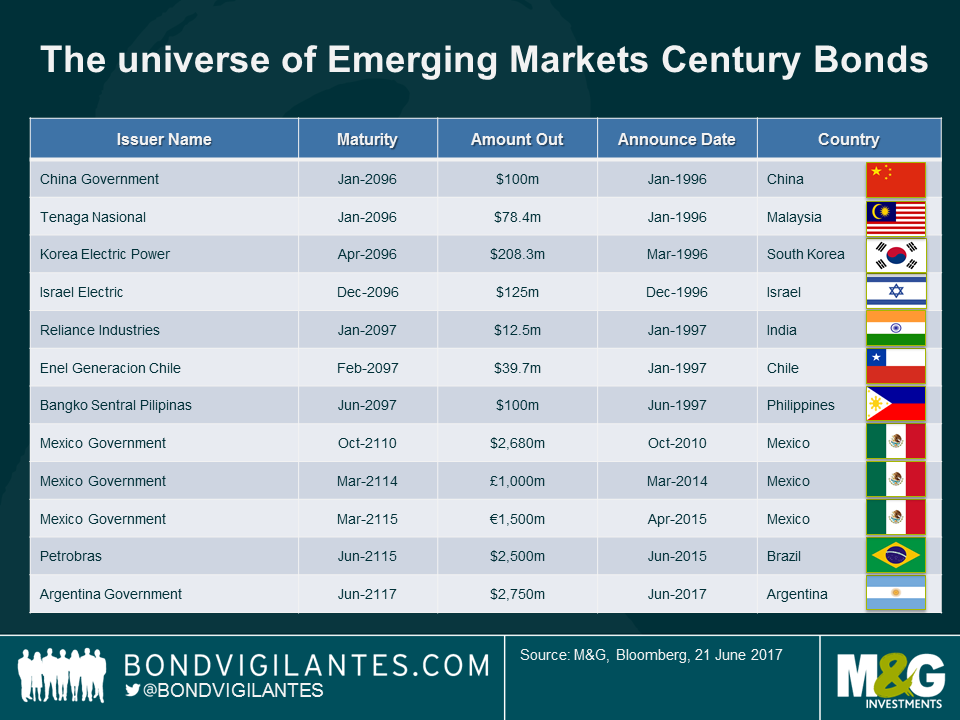

Argentina’s recently issued century bond deal was unexpected in terms of timing and maturity. Century bonds in Emerging Markets (EM) are rare (we think the table below is pretty exhaustive) and they grab the headlines, especially when issued by a credit that has defaulted many (many) times, like Argentina.

Are century bonds that much riskier?

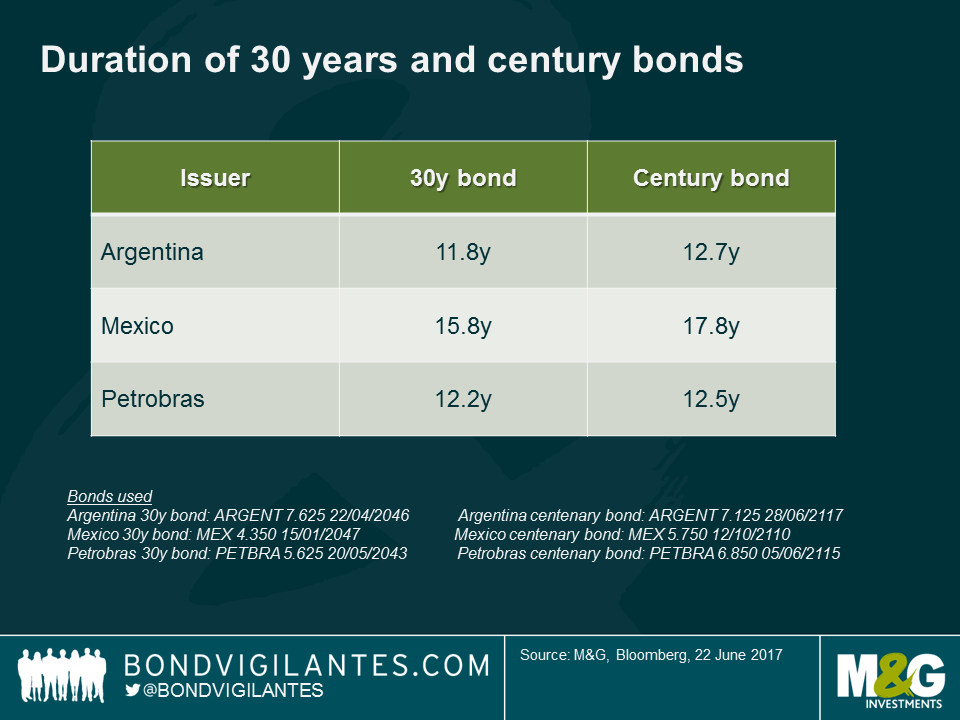

- Duration: As we wrote previously, the duration of century bonds is not much longer than the duration of 30-year bonds, which themselves are quite common amongst emerging markets, including Argentina.

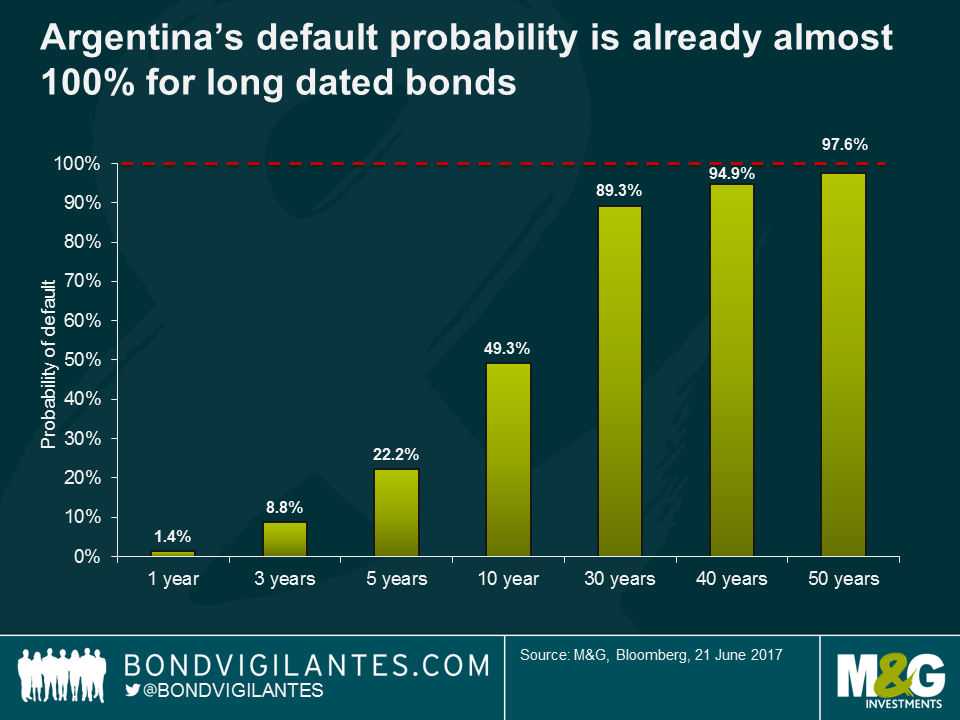

- Implied probability of default. Another way to measure the risk of this bond is to calculate its implied probability of default. Using a standard ISDA model, we assigned a 30% recovery value (similar to the last Argentinean default in 2001) and the term premia of the recently issued century bonds (T+ 515 bps) to extrapolate the spread curve. Under these assumptions (ignoring any CDS-bond basis), the probability of default is as per below:

Given the unusual maturity of the bond, the model choked after 50 years. However, we can see that the implied probability of default given these assumptions is already at 97% for a bond maturing in 50 years. Given this, a century bond should not be seen as being much riskier. In other words, the current level of Argentinean spreads is at an unstable equilibrium: either fundamentals will continue improving and credit spreads will continue to fall over the next decades or history will repeat itself, fundamentals will not improve and Argentina will default again. In this latter scenario, it almost does not matter then whether you are holding a 50-year bond or a century bond.

‘In the long run we are all dead’ John Maynard Keynes

To conclude then, the duration of a 30 year Argentinian bond at 11.8 years is little different to that of a century bond (12.7 years), so spread risk is not significantly higher. The default risk of a 30 year bond is close to 100% anyway given current pricing of long term Argentinian risk – how much worse can it be in a 100 year bond?

| What about the prospects for Argentina’s economy?

In terms of fundamentals, Argentina’s new administration is trying to address deep challenges that were inherited from the prior administration. There has been rapid progress on liberalizing capital controls and they have unified the currency market under a new floating exchange rate regime. Relations with investors have improved markedly and this bond attests to that. On the domestic side, however, the improvements have been more gradual. Inflation (measured by the City of Buenos Aires CPI) is declining as the pass-through the Peso depreciation dissipates but is still hovering above 20%. Growth is picking up, led by investment, and this will be critical in addressing two of Argentina’s medium term risks:

|

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox