Did the ECB get their fingers burned with Steinhoff bonds?

Credit risk is real. It’s easy to forget this platitude in times when both investment grade and high yield credit markets go from strength to strength. Even one of Europe’s foremost credit investors – the European Central Bank (ECB) – has recently been reminded that there is indeed the risk of permanent loss of capital when buying corporate bonds.

Every week the ECB updates the consolidated list of corporate bond holdings which have been accumulated under the Corporate Sector Purchase Programme (CSPP). Yesterday we took a look at the latest CSPP spreadsheet and there was one striking change compared to the prior data release: Steinhoff bonds – SHFSJ 1.875 01/25 (ISIN XS1650590349), to be precise – had vanished. The bonds have not been redeemed, nor has the issuer defaulted. So if it isn’t some sort of clerical error, this would suggest that the ECB has actively and deliberately liquidated its Steinhoff position.

When we say “ECB”, strictly speaking this isn’t true. Bond purchases – and apparently bond sales – are carried out by six national central banks within the Eurosystem. So which central bank actually bought the Steinhoff bonds? Steinhoff is an international retail holding company which owns amongst many other subsidiaries Poundland in the UK. The company was originally founded in Germany in the 1960s but moved headquarters to South Africa in the late 1990s. But all of that doesn’t help you much as the SHFSJ 25s were issued from Steinhoff Europe AG, which is domiciled in Austria. Like other Austrian corporates, Steinhoff bonds fall, rather surprisingly, within the remit of Suomen Pankki or Bank of Finland (BOF), if you prefer. Why is Finland’s central bank buying Austrian bonds, you may wonder. Both Finland and Austria are geographically located at the Eastern fringe of the Eurozone, albeit at very different latitudes, would be our best guess. Anyway, we checked the BOF’s list of CSPP holdings and the SHFSJ 25s disappeared there as well, just like in the consolidated ECB spreadsheet. This supports the presumption that the bonds were indeed actively sold.

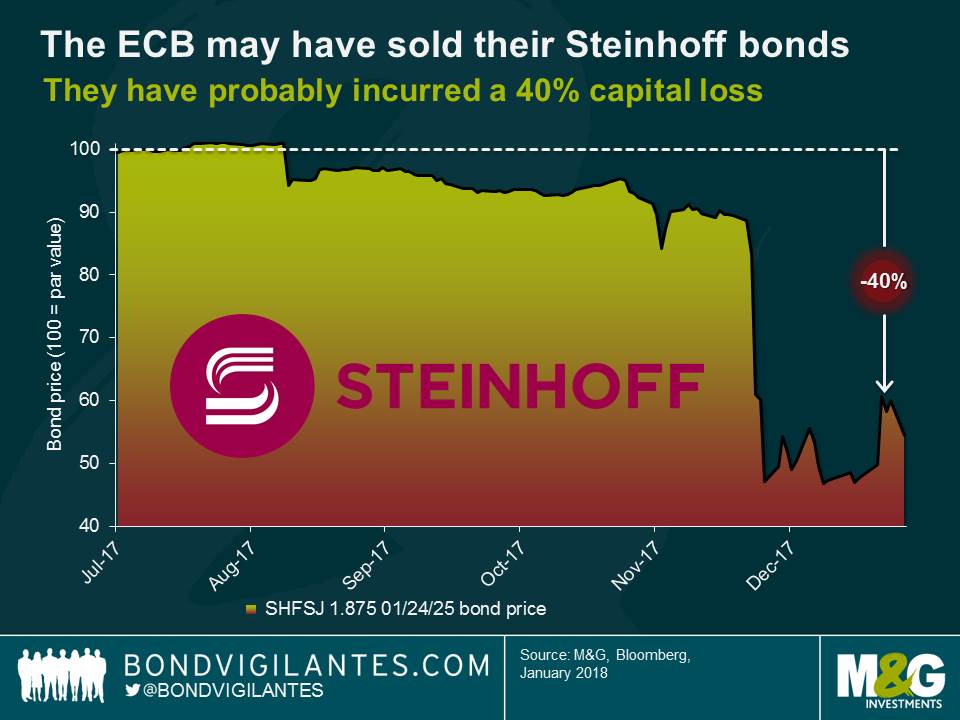

Back in late July 2017, when the ECB / BOF first bought the SHFSJ 25s, the bonds had only one weak investment grade (IG) credit rating from Moody’s (Baa3) but were nonetheless CSPP eligible. However, in early December news of accounting irregularities at Steinhoff broke, CEO Markus Jooste resigned with immediate effect and the SHFSJ 25s fell off a cliff. Moody’s reacted by cutting Steinhoff’s credit rating on 7th December by four notches deep into high yield territory to B1, triggering another sell-off which pushed the cash price of the SHFSJ 25s below 50 cents on the euro.

It is important to point out that the loss of IG status, and thus CSPP eligibility, did not automatically make the ECB / BOF a forced seller, though. For instance, the German fertiliser company K+S AG lost its only IG rating in October 2016 after it had been bought under the CSPP. But the Bundesbank continues to hold two of their bonds – SDFGR 3.125 12/06/18 (ISIN XS0997941199) and SDFGR 4.125 12/06/21 (ISIN XS0997941355) – on their books to this day. The Steinhoff case however is a lot more severe. Moody’s lowered the credit rating further on 28th December 2017 to Caa1 which is associated with “very high credit risk”, according to the Moody’s rating scale definitions. It seems that at this point the ECB / BOF got increasingly nervous about a perceived risk of a default or restructuring event and wanted to limit the potential fallout – both financial and reputational. And so it appears that they liquidated their position in early January 2018, even if this meant crystallising significant capital losses.

But how much has the ECB lost on the Steinhoff trade? We can’t say for sure, I’m afraid. We don’t know the exact points in time when the ECB / BOF bought and sold the bonds as holdings are only published on a weekly basis. We don’t know either whether the ECB / BOF scaled their position up or down during the holding period since holding sizes are not published. For the sake of simplicity, let’s assume the bonds were originally bought at issuance at the reoffer price just below par (99.44) and that there was no further trading activity in 2017. The bonds dropped off the lists of the ECB and the BOF on 5th January and 8th January 2018, respectively. Let’s assume the best case scenario which would be a sale on 3rd January at a cash price of around 60 cents on the euro. Under these assumptions, the permanent capital loss incurred by the ECB / BOF would thus be a whopping 40%, which is only very marginally softened by accrued interest of c. 0.8% over the holding period of around five months.

It is impossible to calculate the monetary loss as a euro amount since CSPP holding sizes are not disclosed, as mentioned above. In any case, losses would be dwarfed by the size of the CSPP book, which currently stands at around EUR 132 billion. Furthermore, buying European IG corporates has been very profitable for the ECB. Since the CSPP purchases started in late June 2016, the ICE BofAML EMU Corporate Excluding Banking Index – a rough proxy for the CSPP eligible universe – has generated a total return of around 3.75%.

Finally, are there any lessons to be learnt here? The conclusion is that investors should not treat corporate bonds as risk-free assets. Even for bonds with IG ratings in the current ultra-low default environment there is a non-zero probability of incurring permanent capital losses. It is therefore important and worthwhile to focus on credit fundamentals and in-depth analysis in order to tilt the odds in our favour and increase the likelihood of avoiding the occasional blow-up. As far as the future of the CSPP is concerned, the Steinhoff case might give critics another argument to push for a timely end of the programme.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox