Panoramic Weekly – Black Friday: Credit goes on sale

November is proving to be even worse than October, especially for Credit markets, amid plunging oil prices, corporate woes, executive scandals and protracted unconvincing economic data, all on top of a global interest rate rising cycle. Corporate bonds, which have been supported by loose monetary policy for over a decade, particularly felt the cold: US Investment Grade (IG) spreads last week posted their biggest weekly jump (11%) since 2011, when the world feared a European Union break-up. IG spreads continued to rise this week to 132 basis points (bps) over Treasuries, the highest level since Trump won the US election in 2016 (more below).

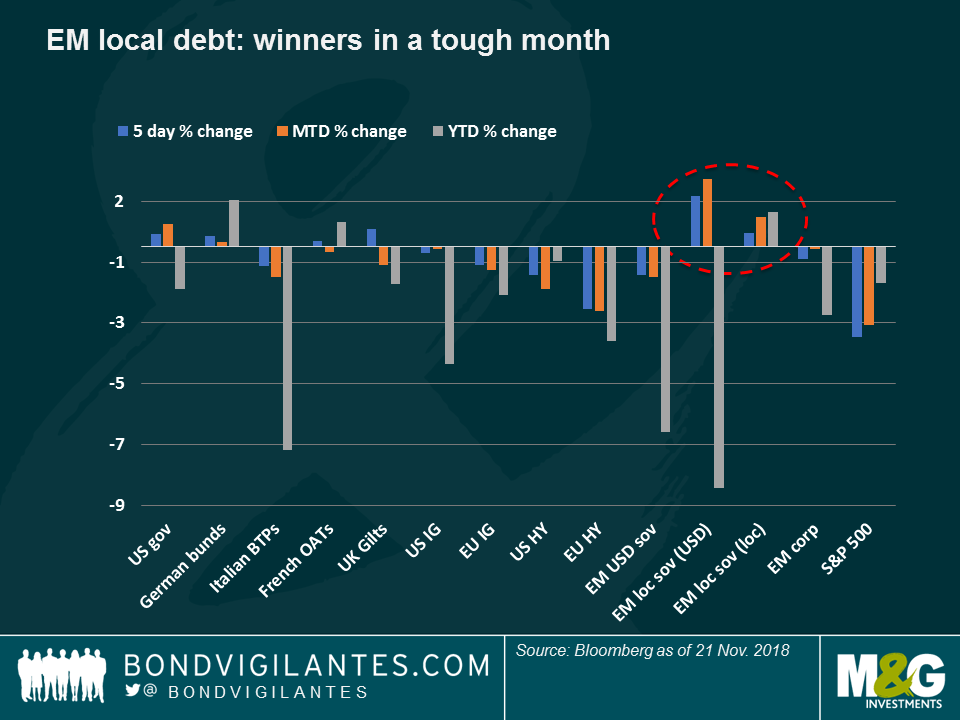

The sharp corporate bond and equity losses increased market expectations that the Fed may reduce or even halt its rate hiking path. Inflation expectations dropped, supporting Treasuries and German bunds, whose yields also fell on safe-haven demand. Some Emerging Markets (EMs) showed resilience, especially in Asia, as cheaper oil is positive for its energy-importing economies. Still, a generally stronger US dollar over the past two months led (among other reasons) to defensive interest rate hikes in Indonesia, the Philippines and Mexico. Oil exporting countries, including Nigeria, Angola and Ghana, suffered as the commodity plunged, following a drop in expected demand. Some value investors returned to the market in search of bargains, following the sell-off.

Heading up:

EM local – November MTD global winner: EM locally-denominated sovereign debt has returned 1% to investors so far this month, and 2.2% when translated into US dollars, as some currencies have posted strong gains against the greenback. Asia, a traditionally good performer in times of trouble given its relatively healthy foreign accounts, led gains, as its oil-importing countries are also set to benefit from cheaper energy. Asian countries are also somewhat supported by China, which seems committed to fiscal stimulus in order to offset any potential damage caused by the ongoing trade war with the US. This support has kept the returns of Chinese government bonds in the black so far, both this year and also over the past 12 months (3.1%). On a country basis, it was Russian sovereign debt that posted the best 5-day return (4.5%), among 100 Fixed Income asset classes, as concerns over the US sanctions that it faces wane. The fears have pushed the ruble down 12% against the dollar so far this year, something which may help the country beat its record 2008 Current Account surplus in 2018, according to some analysts. Chilean local bonds were the second-best performing Fixed Income asset class over the same period, on the back of rising copper prices and below-target annual inflation.

Gilts – que sera, sera? UK borrowing costs fell over the past five trading days, with 10-year gilt yields reaching 1.39%, down from 1.72% barely one month earlier. The week was tumultuous as a draft agreement reached with the EU over Britain’s departure was soon put into question by the resignation of two Cabinet ministers. The safe-haven rally continued as Conservative MPs said they were increasing efforts to oust Prime Minister Theresa May, a move which might lead to a disorderly exit or a new general election. For more on Britain’s Brexit scenarios and its potential market outcomes, watch M&G fund manager Ben Lord.

Heading down:

Credit’s Thanksgiving table – cold Turkey: After more than doubling in size (to $5 trillion) over the past decade, US IG debt is suddenly remembering what higher rates, a less supportive central bank and a less expansive economy look like. As M&G fund manager Lu Yu warned a few weeks ago in “Beware of the debt binge”, companies that have (mis)used debt to increase dividends or buy back shares, instead of shoring up their balance sheets, are now forced to reverse those policies, upsetting equity holders and raising questions about their debt servicing capabilities at higher rates. Financial companies have been the worst hit within the US IG universe, as the economic pick-up has failed to lift long-term rates, resulting in a year-to-date flatter yield curve that depresses their profit margins. Oil, which represents a heavy c. 15% on both US IG and High Yield (HY) indices, has also suffered. European HY has fared even worse in November, mostly dragged down by struggling Italian infrastructure companies and by a loss of growth momentum: Germany’s economy shrunk in the third quarter. Fears of the impact of a downgrade of US industrial giant General Electric down to HY are also raising concerns of a sharp increase in US HY supply, usually a negative for prices. Finally, and as seen on the chart, US issuers also face competition from Libor, the rate at which banks lend money to each other; often seen as a proxy for risk-free rates, Libor is now higher than the Bloomberg Barclays Global Aggregate yield, something which could deter investors from buying corporate or sovereign bonds, as they receive better compensation elsewhere, with, in principle, less risk. Some investors, however, argue that this week’s sell-off is overdone as the US economy is still growing at a fast pace. Companies also tend to pay fixed coupons to investors, so the effect of higher rates might not be as dire as markets are pricing in.

Argentina – new rate floor? Trying to bring the beleaguered economy back to normal while keeping investors happy may be trickier than it seems: at 62.5%, the benchmark interest rate has lured yield-hungry international investors, bringing a certain stability to a country reliant on an IMF rescue package. Investors, though, speculate that the central bank’s 60% floor for interest rates may be eliminated soon if inflation expectations continue to drop, depressed by the economic recession. Lower rates may bring a relief to the economy, and to Prime Minister Macri, who will seek re-election in October next year – but they may not be as welcome by carry-seeking investors: Argentinean bonds fell 2.7% over the past five trading days, the second-worst performance in the Fixed Income universe.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox