Panoramic Weekly: The ayes to the left, the noes to the right: the pound has it

Although world markets depend more on Fedspeak and China than on British politics, when the UK House speaker announced (in traditional centuries-old fashion) that the “noes” opposing the government’s Brexit plan had won – inadvertently, he helped reduce sugar levels in Europe. Investors’ interpretation that a hard or disorderly departure from the EU is now less likely strengthened the pound and lifted gilt yields – the latter, on lower safe-haven, chaos-escaping demand. Britain’s relief rally capped a strong start to the year, with more than 90 out of 100 Fixed Income asset classes tracked by Panoramic Weekly delivering positive returns. Only long US Treasury bonds and traditionally rock-solid assets such as Swiss and Singapore sovereigns have lost money to investors so far this year – less likely as they are to join a cheerful party.

In the US, the ongoing government shutdown, lukewarm economic data and mixed bank earnings vindicated the recent dovish tone of the US Federal Reserve (Fed), dragging down future rate projections even more: the market-implied probability of a US rate hike in March has now plunged to 0.5%, down from 41% in early December. This year’s oil rally and China’s reassurance of its economic stimulus plans also helped underpin risk assets: Russian, Nigerian and Mexican bonds are up by more than 4.2% in 2019, while US High Yield spreads continued to tighten: after spiking by almost 1.5% in a dismal December, they are now back down to 446 basis points (bps), their level in mid-December. News from Europe were not as positive: gloomy German data reduced inflation expectations at the same time that China posted a record low current account surplus, confirming that lower Asian appetite is hurting Europe’s industrial bastion (more below).

Heading up:

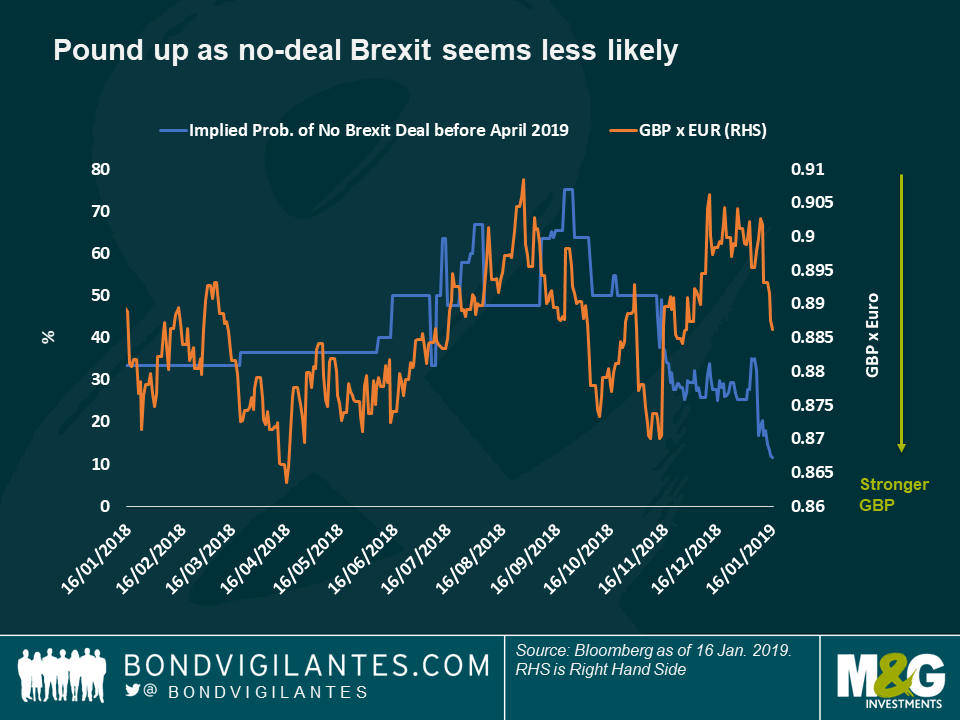

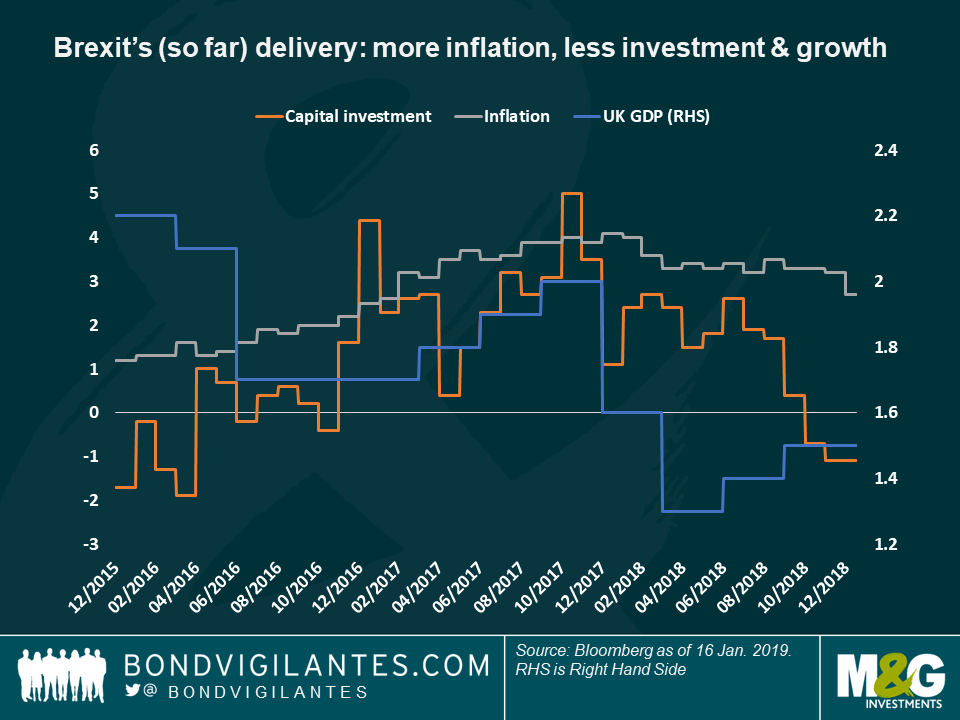

Sterling – avoiding chaos: A lower likelihood of food shortages and collapsed roads brought relief to sterling as investors started ruling out a sudden and unorganised EU departure. While many options are still open (general election, second referendum, even no Brexit at all), the pound strengthened to 1.286 per US dollar, the highest since November. The level, however, is still 13% below its price just before the 2016 referendum, when it crashed 20% on prospects of higher inflation and lower growth in the country. As seen in the first chart, sterling’s value has been largely driven by Brexit politics over the past two years – only diverging just before Christmas, when the crucial Parliament vote was delayed, finally taking place on Tuesday. While the government and Parliament have spent more than 2 years debating on Brexit execution, growth and investment have dropped, while inflation has gone up (second chart). At lease, Britons have one reason to cheer: the market-implied probability of a rate hike in March has dropped to 3%, down from 43% in October last year, mainly due to falling oil prices. December inflation rose by 2.1% from a year earlier, the lowest level in two years.

Argentina – see who’s rising: A history of defaults, an ongoing IMF programme and a decade-long legal battle with funds trying to recoup their money are not deterring investors from believing in Argentina again: the Latin American country’s bonds have gained 7.5% so far this year, the best-performing mark among the 100 Fixed Income asset classes tracked. The central bank has been the first among world leading countries to move this year – it is slowly cutting down the reference Leliq rate, now at 57.4%, down from a peak of 73% reached in October, at the height of the country’s crisis. Engulfed in a recession and under a stringent IMF programme, President Macri is trying to bring the country back to normality, especially ahead of this year’s general election, scheduled for Oct. 27. Read more about this year’s EM elections, and other factors affecting the asset class this year, in Claudia Calich’s recent blog: “EMs: 5 key issues to watch in 2019.”

Heading down:

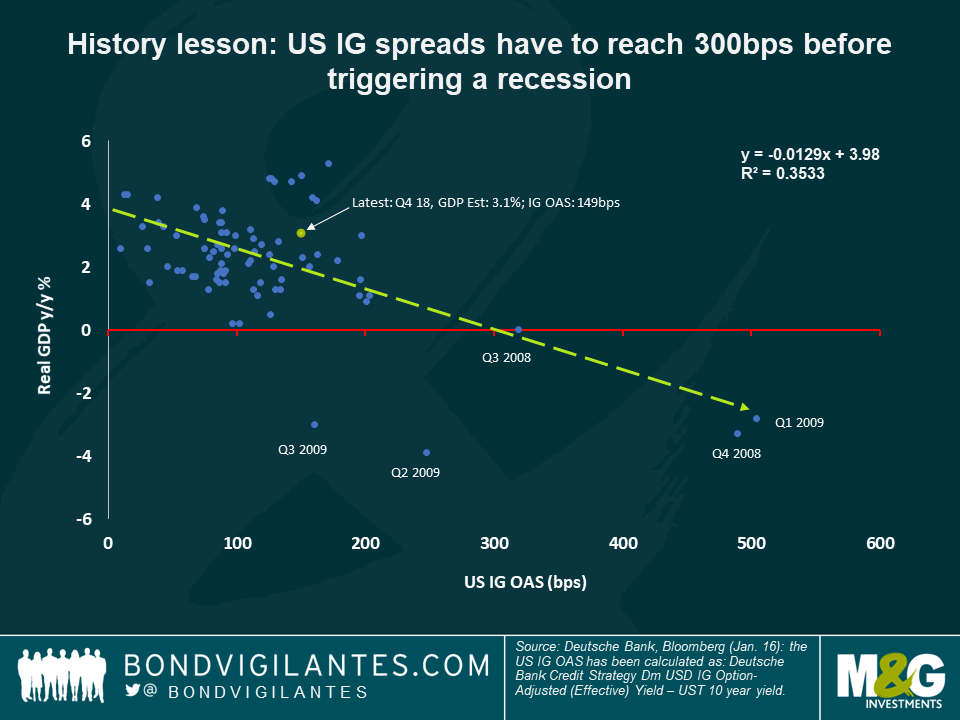

Probability of US recession? The Fed is becoming more dovish, interest rate hikes and inflation expectations are plunging and the New York Fed’s probability of recession index has climbed to 21%, the highest since 2008 – yet, credit spreads seem to tell a different story: according to Deutsche Bank Chief International Economist Torsten Slok, the premium that investors demand to hold US Investment Grade-rated companies has to reach 300 bps to trigger a recession (as seen on Slok’s regression chart below). This is well above the present level of 144 bps and not too far from a 30-year average of 134 bps. According to Slok, while manufacturing data points towards a gloomy scenario, other factors could still underpin the US economy or at least protect it from falling into recession – mainly the recent stabilisation of oil and equity prices, and the possibility that the US-China trade war might have already peaked. Capital expenditure is still projected to sustain growth over the next two years, as the Return on Invested Capital is still above corporate borrowing costs. According to market prices, the Fed will be on hold this year, backtracking from its present plans to hike rates twice more.

China’s current account and Germany’s economy – no coincidence: Germany’s economic growth slowed down to 1.5% last year, the weakest in five years, mostly due to lower global demand and disruption in its car industry, hit by new clean regulation. At the same time, China’s current account fell to a meagre 0.4% of GDP, a 20 year-low and a reflection of the country’s efforts to focus more on internal demand than on cheap exports. German carmakers and other industrialists are suffering from the shift, only exacerbated by last year’s increased trade wars. German woes helped drag down Europe’s general economic sentiment, which reached in December the lowest level in about two years.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox