Bond Vigilantes Weekly: Globalisation-mecca Davos loses shine as trade wanes

When the presidents of the US, France and Britain cancel their trip to the World Economic Forum at Davos – the mecca of globalisation over the past two decades – to face domestic challenges, no wonder investors are worried about falling global trade, inward-looking policies and hence, lower global growth. This week’s data seems to vindicate such fears: US-China trade tensions escalated on speculation that a meeting had been cancelled; China posted 2018 growth of 6.6%, the slowest pace in almost three decades; US housing data was dismal and Germany’s Zew survey of economic growth prospects hit a four-year low. The International Monetary Fund (IMF), which has warned for months that less trade could hit economies, cut again its global growth forecast for 2019 to 3.5%, down from a previous 3.7%. The reduction was mostly due to slower growth in Germany and Italy, and a deeper-than-expected contraction in Turkey. The IMF kept its US growth forecast for this year at 2.5%.

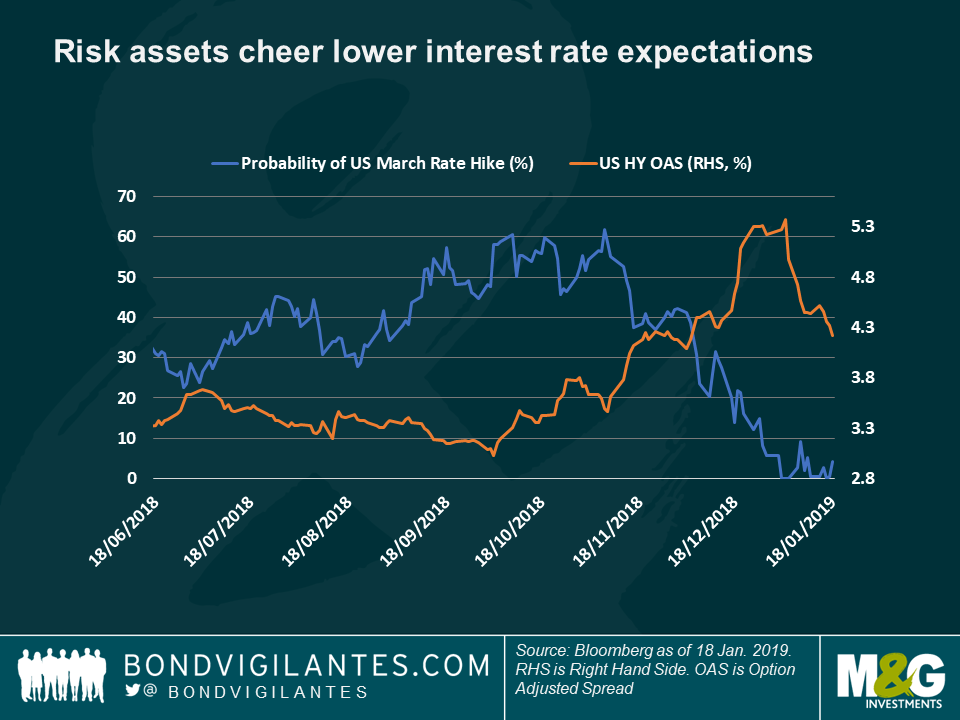

Against this backdrop, and the market sell-off late last year, central banks are sending dovish messages, especially the US Federal Reserve (Fed). Over the past five trading days, the anticipation of lower or at least stable rates helped fuel risk assets, especially US Investment Grade (IG) companies, which particularly suffered in 2018 due to massive supply and deteriorating credit quality. High Yield (HY) spreads continued to tighten this week, taking their year-to-date gain to 3.7%, more than offsetting their 2018 loss of 2%. Emerging Markets (EMs) fell behind this week, after a very strong start to the year and as the US dollar gained against most developed and developing currencies, reflecting the US’s better growth prospects. US inflation expectations, on a downward spiral since October, have recovered in January after the Fed signalled a potential halt in its rate rising cycle, a move that may generate inflation. Also underpinning inflation expectations, oil surged to $53 per barrel, up from $45 at the beginning of the year.

Heading up:

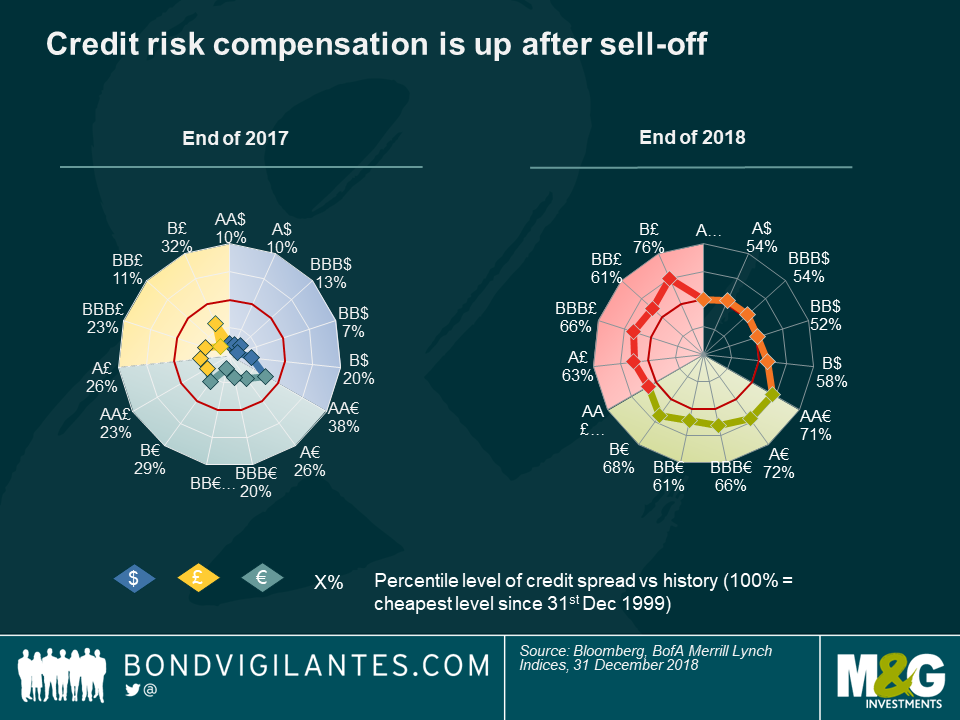

Credit – bargains after the sell-off? The sharp rise in global credit spreads last year has brought yields to a level that some investors say are high enough to compensate for the risk taken. As seen in the chart below, developed by M&G’s Fixed Income Investment Specialist team, leading global credit classes were trading below the mean level of a 20-year range (red circle) at the end of 2017. One year and a big sell-off later, only US credit is right at that 50% level, while sterling and euro-denominated corporate debt is trading closer to their cheapest level since 1999. The cheapest of all is Single-B rated pound debt (considered HY), which trades only 25% below its lowest price over 20 years, hit by Brexit concerns and by gloomy European growth forecasts. This outlook is also weighing on European credit – as seen by green line expanding further out in the right-hand chart. Lower valuations mean that investors have a bigger cushion before losing money from the credit component of the bond: for instance, for A-rated euro debt, which has a spread of 123 basis points (bps) over the risk-free rate and a spread duration (sensitivity to spread changes) of 5.12 years, the spread would need to widen by a further 62 bps before investors lose money (again, on the credit component of the bond). Such a move would take the spread to 185 bps, a level that has only been breached twice over the past 20 years: during the 2007-2008 financial crisis and during the European sovereign debt crisis in 2010-12.

Pound & UK economy – defying gravity: At the height of the Brexit uncertainty, when Britain’s scheduled departure from the EU is barely two months away and still there is no plan, the country posted some of its strongest data of recent times: unemployment dropped to 4%, more than expected and the lowest since Abba and The Bee Gees topped UK the charts (1975). Wages also rose, as the labour market tightens, and sterling rallied against a rising US dollar – it is up 2.27% so far this year, making it the top performing G10 currency against the greenback. The optimism comes as investors are pricing in less chances of a disorderly Brexit or other alternatives, such as a general election or a second referendum. UK linkers, however, didn’t join the optimism, as their 3.6% drop over the past five trading days makes them the worst-performing Fixed Income asset class of the 100 tracked by Bond Vigilantes Weekly: the House of Lords proposed changing inflation linked bonds’ reference index to one that tends to be a bit lower, leaving investors less protected. For more details, don’t miss M&G fund manager Ben Lord’s “The war of the indices: Which inflation measure to use?” post.

Heading down:

US rate hike forecasts – Fed on hold? Market-implied chances that the Fed will raise rates in March have plunged to meagre levels, down from more than 60% about two months ago. Fed officials have publicly recognised they are considering a halt in their interest rate rising cycle, following lukewarm economic data, protracted low inflation and the severe market sell-off in November and December last year, something that can hit consumer spending given the high degree of ownership of financial assets by US consumers. The ongoing month-long US government shutdown is also expected to hinder activity. As a result, corporate bonds are enjoying a strong January, on hopes that their positive return on invested capital will continue to be above borrowing costs, keeping their investments plans profitable. According to economic forecasts, US capital investment is expected to grow by 3.7% this year, more than any other Gross Domestic Product (GDP) component. As seen in the chart, US High Yield spreads have tightened in January, matching the drop in rate hike expectations.

Europe’s inflation expectations – back to square 1? Just as the European Central Bank (ECB) is preparing to withdraw its multi-billion euro QE support measures, inflation expectations have plunged, a reflection of the region’s dismal prospects: the IMF said earlier this week that lower European growth would drag down the global economy, especially due to the slowdown in Germany. Europe’s economic engine is being hit by soft private consumption and weak industrial production following the introduction of revised auto emission standards. Italy also faces weak domestic demand and higher borrowing costs, while French growth is being challenged by the ongoing “yellow vest” protests. The ECB’s favourite inflation expectations measure, the 5-year/5-year euro inflation swap rate, has dropped to 1.53%, the lowest level since June 2017, and about the same level it had in March 2015, when the ECB unveiled its stimulus programme.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox