High Yield managers need to up their ESG game: 4 recommendations

Not that we needed anybody’s reassurance, but the UK government’s decision that pension fund trustees must consider financially material ESG (Environmental, Social and Governance) factors in their assessments, definitely helps those who believe that sustainability is becoming a need more than a choice – for society and investors alike.

In my view, an ESG lens can help monitor qualitative risks and assess corporate management style as well as priorities in order to prevent single name idiosyncratic drawdowns. ESG considerations are particularly important for High Yield (HY) issuers, usually more leveraged and therefore more likely to amplify any positive or negative news.

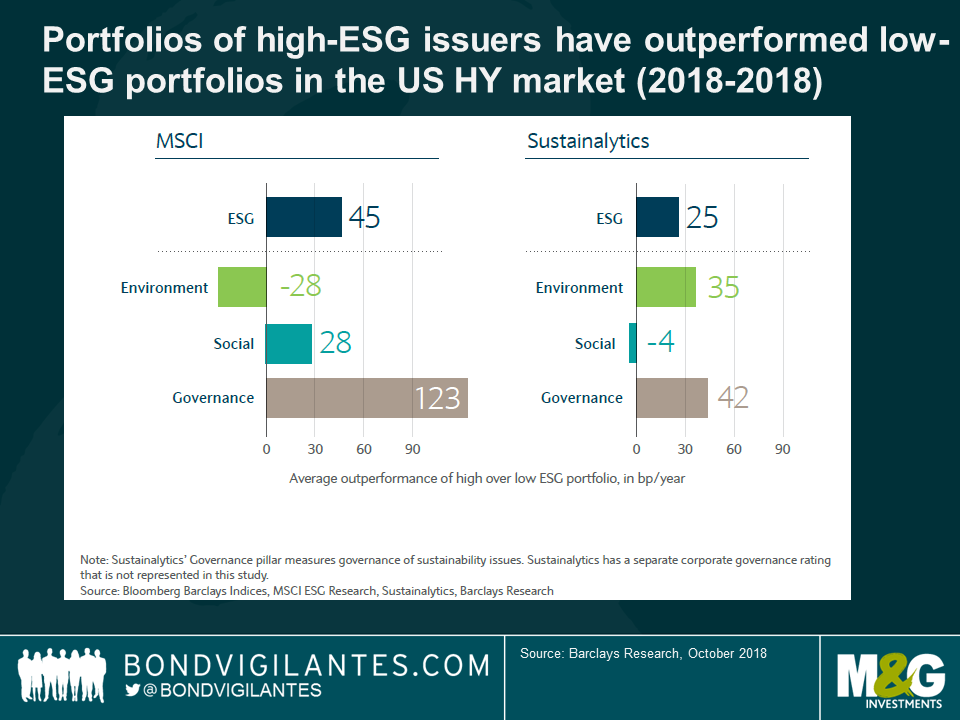

A Barclays study recently found that HY portfolios with a high-ESG tilt tended to outperform, with the Governance component being the most important of all. Intuitively, this makes sense as lending to well-run companies, where interests are aligned with bondholders, should pay-off in the long run.

We should also remind ourselves that what’s good for the share price is not always good for credit risk. Take for example a private equity ownership which incentivises maximum leverage and/or major shareholder returns.

While performance links of Environmental and Social factors are less clear, I still argue that companies must also consider the externality of poor environmental and social practices in the long term. The short-term cost saving of cutting wages or avoiding clean-up costs is increasingly outweighed by the long-term financial damage of such actions.

Investors are increasingly focused on these qualitative factors and this, combined with the explosion of big data, is bringing a level of transparency that is leaving many faces blushed. Excessive behaviour will be more quickly punished as non-financial information is now readily available and can be measured in real time. For instance, the presence of social media means that even in remote areas of Africa, a company that leaves a mine full of contaminants might not be granted access to exploit a new mine in Chile. A handful of ESG data providers have already emerged to tap increasing demand and I forecast a bright future for those service providers.

However, asset managers need more than third party ESG research. Here are some recommendations that may help:

- Define the financially material ESG factors: The ESG data provider’s definition of material ESG factors for an industry as well as their weight for the overall ESG assessment is highly subjective and might disagree with the asset manager’s opinion. For example, MSCI’s Governance quality score focuses on issues such as board composition and executive compensation. On the other hand, Sustainalytics prioritises other factors, including the company’s handling of environmental and social issues, which results in different outputs. As more and more providers offer ESG solutions, more methodologies will be available to digest for data users potentially producing conflicting results. Experienced in-house sector analysts are in my view best placed to assess what they consider the most important financially relevant ESG issues for an industry.

- Review: ESG data providers tend to assess thousands of issuers, something that reduces score revisions to about once a year – and in such case, there seems to be little probability of any rating change. The Barclays study says that an issuer with a top-tier ESG score at the beginning of a year had a 79% probability of keeping it a year later (according to MSCI), and 88% (according to Sustainalytics). This status-quo-friendly approach makes me question whether ESG scores might be more a reactive than leading indicator – what they are supposed to be. Again, I believe that internal analysts feeding up-to-date research into a tailor-made ESG framework to monitor (potential) holdings might be more efficient than using any external sources.

- Engage: Engagement activity is not undergone by ESG data providers which is why asset managers need to step in and have a dialogue with companies to ensure that they walk the talk. Compared to Investment Grade (IG) businesses, HY issuers are more likely to engage with bondholders and open to negotiate the terms of an issue, given the debt market is often the primary source of financing. Big HY lenders should be well placed to make an impact by helping drive change.

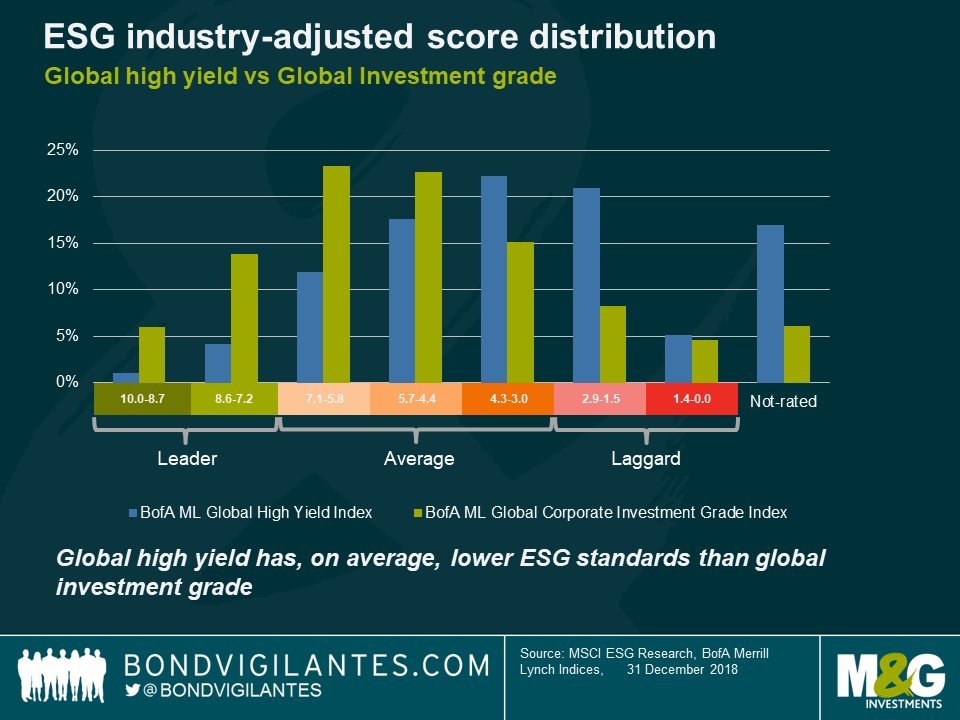

- Beware of the information bias: IG issuers tend to have a better ESG rating than their HY peers, leading many investors to assume a positive correlation between credit and ESG – as seen in the chart below:

In principle it makes sense that better ESG performance leads to higher profits, and therefore to a stronger balance sheet and a better rating, but I don’t think this logic holds given that ESG data is not efficiently priced into markets yet.

I think IG’s better ESG performance is largely due to an information bias: IG companies are usually blessed with a PR department that showcases the company’s ESG efforts; in contrast, and according to a recent PRI report (“ESG Engagement For Fixed Income investors”), only 20% of global HY issuers reviewed and confirmed MSCI’s summary of the data it uses for their ESG scores, dropping to just 3% for privately-owned companies. This may mean that the HY ESG data might not capture the full picture and therefore may be unsuitable to draw any conclusions from. Asset managers with big in-house analyst teams may be able to access more relevant but less available data in order to reach a more comprehensive conclusion.

All in all, while ESG data providers can offer an initial framework and some guidance, active asset managers need to up their ESG capabilities to maximise alpha for their investors.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox