The moon landing, the Fed and a “pro-bubble”

Economists usually think of “bubbles” as being negative for economies and societies. Think of the US housing bubble and its role in the 2008 Global Financial Crisis as a great example. Defining a bubble is tricky, and often its causes are difficult to explain even with the benefit of hindsight. In their paper “Bubbles in Society – the Example of the Apollo Program” Gisler & Sornette say that during bubbles “people take inordinate risks that would not otherwise be justified by standard cost-benefit and portfolio analysis (and they are) characterised by collective over-enthusiasm as well as unreasonable investments and efforts”.

Making a case for bubbles, they declare them to be a “necessary evil to foster our collective attitude towards risk and break the stalemate of society resulting from its tendency towards stronger risk avoidance. An absence of bubble psychology would lead to stagnation”. They call this the “pro-bubble” hypothesis and suggest five examples of pro-bubbles: the 1840s British railway boom; the Human Genome project; the internet boom of the late 1990s; animal cloning (Dolly the sheep) and finally, the US Apollo programme.

As we reach the 50th anniversary of the first moon landing by Apollo 11, it’s interesting to look back to the 1960s and the period following John F Kennedy’s 1961 speech, which challenged the US to “land a man on the moon and return him safely to the earth” by the end of the decade. This endeavour is important for the technological advances it brought about. In 1965, Gordon Moore postulated his eponymous theory that the number of transistors in an integrated circuit doubles every two years. It was the need for this lightweight computing power onboard the Apollo spacecraft that helped kickstart and sustain the development of Silicon Valley, but also led to the development of the device you are reading this blog on. Interestingly, it also caused a change in emphasis on monetary and fiscal policy. During the 1960s, fiscal policy was used as an accelerant on a “normal” peacetime economy on a sustained basis, which saw the normalisation of budget deficits. The Fed also moved away from preventing financial imbalances towards an inflation fighting role – one which it failed to fulfil. As with echoes of Trump’s pressure on Powell today, it was persuaded (including by physical force) to let the US economy run hot.

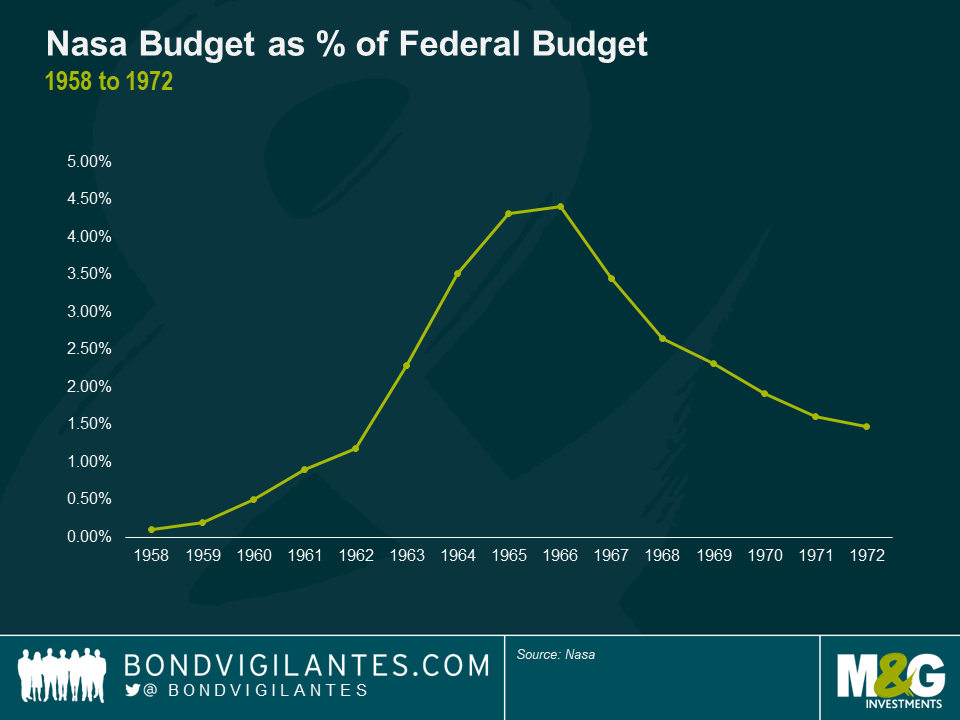

The US started the 1960s in recession, with GDP falling by 1.6% between April 1960 and February 1961 and unemployment hitting 7.1% later that year. President Kennedy had been elected on a programme of higher spending and tax cuts, and of coping with a “New Frontier” – a catch-all which included the space and military race with the Soviet Union, and domestic issues around racial and economic inequality. Congress passed legislation for spending on public works, farm assistance, food stamps, minimum wages and hospital construction. There were also permanent tax cuts for individuals and businesses. And to fund the goal to put a man on the moon, NASA’s budget rose from less than 0.25% of the total federal budget in 1960, to around 4.5% by the end of the decade. The moon landings cost $25 billion, more than $150 billion in today’s money. They also resulted in NASA and its contractors employing over 400,000 people. There was unease about the extent of government spending on these projects (and Kennedy himself had grave doubts about the value of the moon-shot just two months before he died) but after JFK’s assassination the new President Lyndon Johnson (LBJ), with a backdrop of overwhelming public grief, declared that the project would continue, and that the launch centre would be named after Kennedy. On top of government spending, the private sector also loosened its purse-strings (thanks in part to spill-over effects from the space and other programmes, but also due to the corporate tax cuts), with capital spending doubling over the course of the 1960s.

With the fiscal levers all set to “go”, the economy recovered quickly. Real GDP rose to 6.1% year on year in 1962, and peaked at 6.6% in 1966. Inflation was initially well-behaved, averaging around 1.5% between 1960 to 1964, but in the second half of the decade it began to accelerate, averaging around 4% per year. So did the Fed take away the punchbowl? No.

Going back a decade, in 1951 the Treasury-Fed Accord ended a period of conflict between the Truman White House and the Fed, resulting from Truman’s insistence that the Federal Reserve supported government bond prices to finance the Korean War, despite rising inflation (10%+ in 1951). The Accord separated the responsibility for debt issuance from the monetary policy function to “minimise monetarisation of the public debt”. From then on it was “bills only” for the Fed, rather than it manipulating longer dated bond prices. The Fed’s independence and its role in “leaning against the wind” led to it hiking in the late 1950s as inflation rose to 3%, triggering the recession that Kennedy inherited.

The new administration was hostile to this inflation-fighting Federal Reserve so Operation Twist was introduced to once again reduce longer term US Treasury yields – it also boosted shorter bond yields to reduce capital flight as the administration feared a gold crisis. With price pressures emerging as fiscal stimulus took effect and invigorated the economy, LBJ and Congress believed that any move by the Fed to tighten monetary policy by hiking rates would be going against the democratic will of the people. Both Kennedy and Johnson also appointed Keynesian Governors to the Fed’s FOMC, making it more difficult for Fed President William McChesney Martin to hike. The pressure was even more intense that this implies – in 1964 President Johnson invited Martin to his Texas ranch and “physically shoved him around his living room, yelling in his face, “Boys are dying in Vietnam, and Bill Martin doesn’t care”” (from The Man Who Knew. The Life and Times of Alan Greenspan by Sebastian Mallaby). The parallels with the Trump administration’s pressure on Fed President Jay Powell do not go unnoticed.

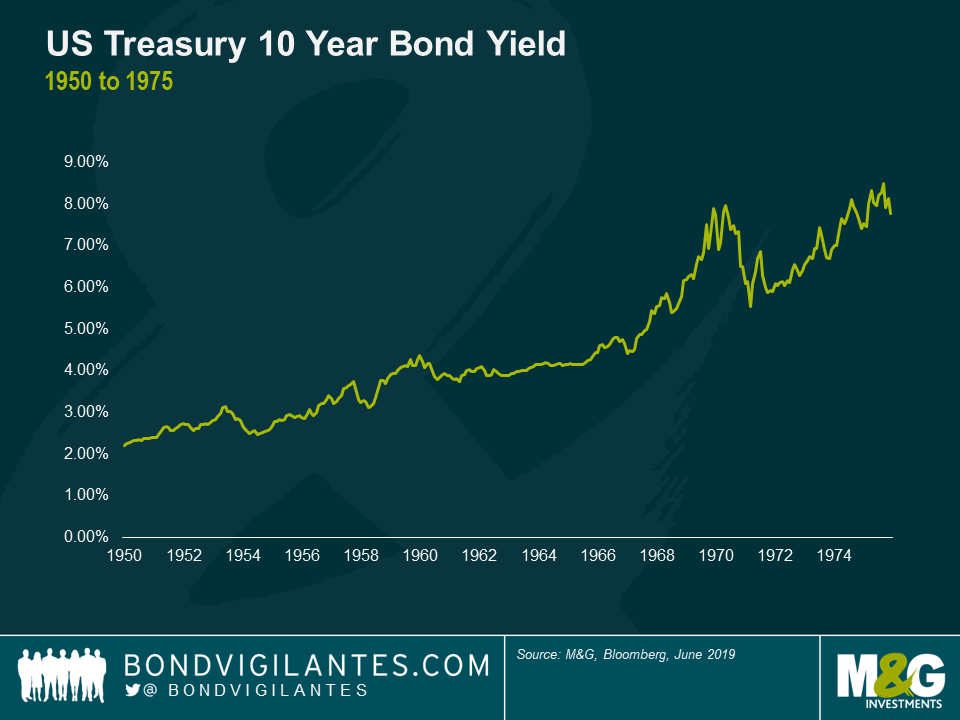

The Fed did hike rates, but not until 1966 when inflation had already accelerated. Anticipating fiscal consolidation (that never really arrived) it wasn’t until 1969 Martin realised that restrictive monetary policy was required. It was too little too late, and the inflation genie was out of the bottle. Martin’s term ended in 1970 (in his view, in failure) and US inflation averaged around 6% for the next few years, accelerating into the mid-teens by 1975. US Treasury bond yields rose alongside inflation, hitting 8% at 10 years by the end of the 1960s.

So the arguments that the space programme was a “pro-bubble” aren’t entirely clear cut. There were consequences from running the US economy too hot for a decade, and the 1970s became known for high inflation, recessions, western manufacturing decline and high unemployment. The 1960s normalised budget deficits; under Kennedy and Johnson the deficit was around 1% of GDP (but as growth was so strong the post-World War 2 debt to GDP ratio fell dramatically over the decade, from around 55% to below 40%). Under Nixon it was -1.6%, and Ford -3.5%. By the time Reagan decided to repeat the Kennedy/LBJ economic stimulus policies the deficit was at 4.3%. But the goal to land a man on the moon certainly did have significant technological benefits for humankind, and likely accelerated that progress by decades. It also showed what is possible when humans set out to solve a problem by throwing money and resource at it – something that can give us a glimmer of hope when it comes to thinking about the problems of today, like the current climate emergency.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox