Will the Bank of England join the loose money bandwagon?

As the year of the 325th anniversary of the Bank of England’s foundation, and as the month of one of the Bank’s more important rate-setting decisions since 2008, September provides a congruous occasion on which to reflect on the history of the BoE and consider what the future holds for it. Founded in 1694 as a private bank to the government, it was in 1998 that the BoE was granted independence from the government in setting monetary policy. Now the UK faces perhaps its greatest political uncertainty in a generation, it is worth asking the question: to what extent will this independence continue?

We have already seen the effect of populist leaders on central banks that are ostensibly independent. The obvious case is that of the US, but there are other examples to be found of central banks facing political pressure to keep monetary policy easy, from Turkish President Erdogan’s sacking of the then central bank governor, to the ECB’s reaction to persistently low growth in Europe. Even if Trump doesn’t control the Fed directly, he certainly controls the market, which in turn has forced the hand of the central bank and led to the Fed cutting rates with the economy in expansion. And with ever more monetary sweets to choose from in the jar, which politician could resist raiding the cupboard and giving their economy a sugar high of rate cuts, QE and lending?

Pressure on the Fed is likely only to increase as the 2020 elections approach: if President Trump is able to engineer further cuts, and then get the markets soaring with a trade deal and promises of tax cuts just in time for elections, we might begin to agree he is – in his words – “a very stable genius”.

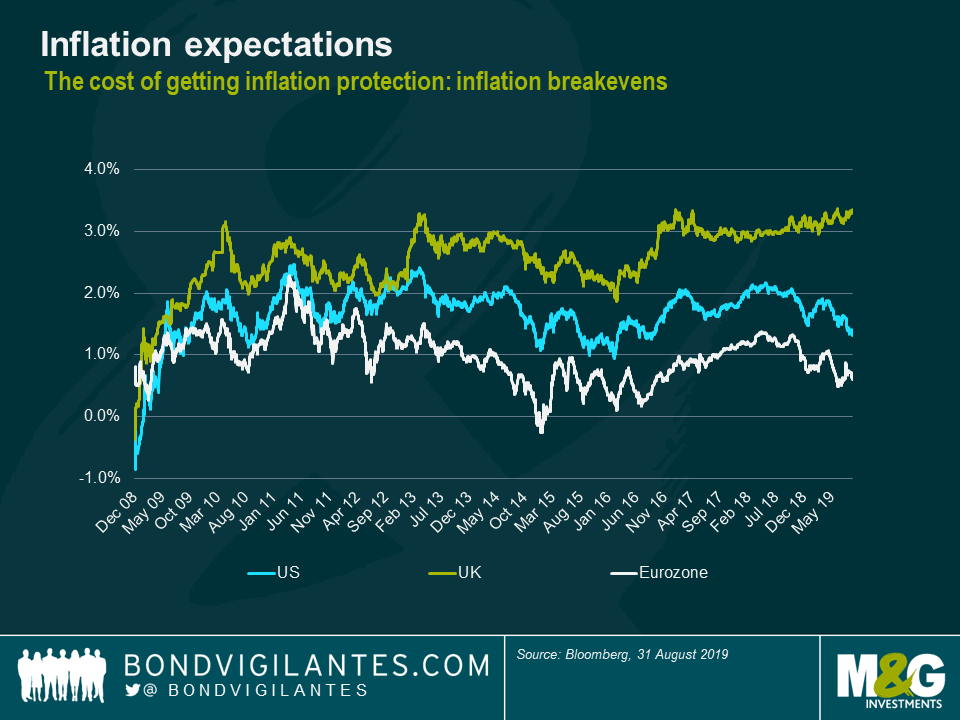

For now the UK seems to have escaped the global disinflation which started in Japan and is now being seen in Europe. That fits the BoE’s line, which is that they plan to hike rates, irrespective of the outcome of Brexit. Mark Carney has even warned investors that they are underestimating how much interest rates could rise. Does the market believe him? It’s certainly not our base case: the strategy of hawkish language to prep the market for rate hikes evidently didn’t work for Jerome Powell. If the UK does leave the European Union on 31st October without a deal, UK growth is likely to suffer – if the BoE’s goal is financial stability, it would be hard to justify a rate hold, let alone hike. So far the BoE’s forecasts are based on the assumption of an orderly Brexit, but they have made no public change to this in light of the ever-growing likelihood of a hard exit.

Some investors argue that a lower sterling (inevitable in the event of a ‘no deal’ Brexit, and also likely if the BoE engages in quantitative easing) would lead to considerable imported inflation due to increased export demand. This would justify a hawkish policy response. Here, however, a direct parallel may be drawn with that which we have witnessed in the US this year. The data in the US (strong wages, low unemployment, a solid consumer) may well justify a continued hiking cycle, but with a nervous market which has been placated by the promise of monetary easing, would a rate hike really help economic stability? The Fed evidently asked themselves this question and didn’t think so. Unlike in the US, rate cuts are not priced in by the UK market so far: currently, the implied probability of no change at the next MPC meeting is close to 100%, while in the US the implied probability of another cut in September’s FOMC meeting is close to 100%. But in the event of a ‘no deal’ Brexit in a month’s time, market expectations going forward may well be very different.

There are other uncertainties which will follow Brexit. Many now expect a general election to take place shortly after 31st October. Would a Corbyn-led government follow a similar nationalization of governmental institutions as of infrastructure? It would certainly increase fiscal spend, leading to considerable debt issuance and downward pressure on gilt prices from increased supply. And given that higher interest rates promote the interests of asset-owners/lenders over borrowers, it is likely that such a government would seek to lower the cost of borrowing in any way possible.

And which rate should be thought of as “neutral” anyway? The 2% CPI target which the BoE follows has been changed in the past. In a post-Brexit world of potentially dampened growth prospects, it may be that this already fairly arbitrary number faces pressure. With low inflation and growth around the world, we would argue that it is fiscal policy which should concern itself with growth, and monetary with inflation.

For now the Bank of England continues to plough its lone furrow of hawkishness. But as the clock ticks down to 31st October and a hard Brexit seems ever more likely, it may be hard for the new BoE governor to avoid joining the loose money bandwagon.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox