Liquidity stress in the US mortgage market

The intricacies of the US residential mortgage market may be unfamiliar to many European investors but the recent technical factors at play have made it one of the most interesting parts of the credit markets recently. Over the last few weeks, we have seen acute liquidity issues and forced selling from market participants in certain areas.

The US residential mortgage market covers a wide variety of mortgage related issuers, from those that are backed by the government agencies Fannie Mae, Freddie Mac or Ginnie Mae (so called “Agency” mortgages) and those that are not, for example jumbo mortgages, fix and flip mortgages, non-qualifying mortgages, single family rental, scratch and dent, and reperforming mortgages (“non-Agency” mortgages).

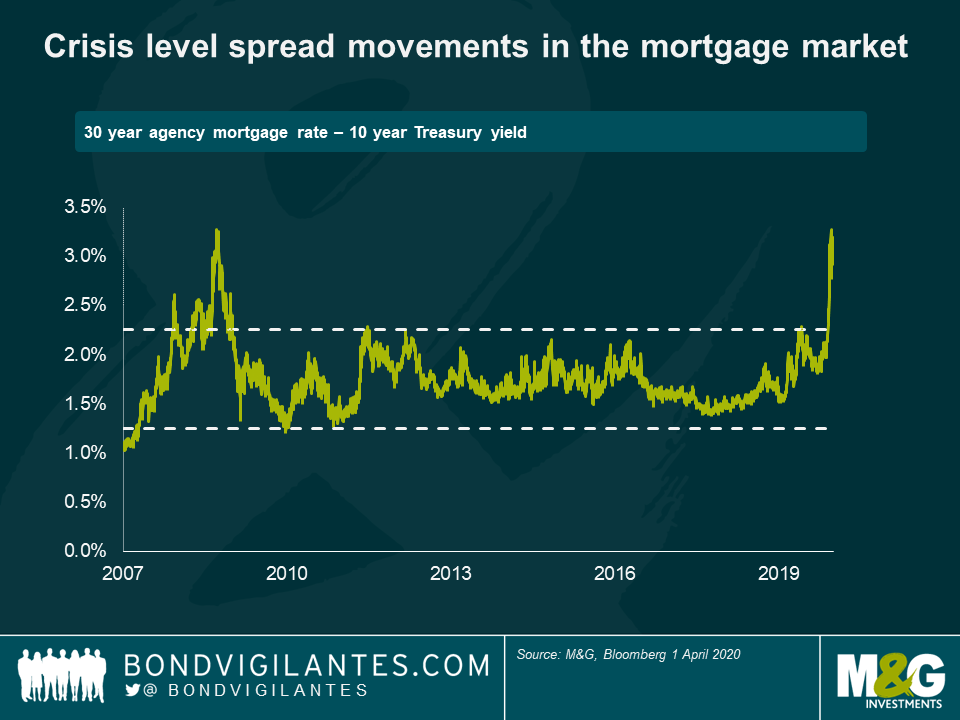

US mortgage rates, particularly agency mortgage rates, have historically tracked US Treasury yields within a small range and only deviate in times of acute consumer stress, for example in 2008–09. However, as Covid-19 spread globally in early March, banks, brokers and the end-buyers, usually so prevalent in trading US agency mortgage bonds, began to shrink their holdings as liquidity became ever more valuable. As a result (see chart below), the 30 year agency mortgage rate spread above US Treasury yields widened to levels not seen since 2008, driven by liquidity issues rather than fundamental risk.

This posed a significant problem for the Fed, who partly rely on the transmission from rate cuts to Agency mortgage rates to stimulate the consumer. Even as the Fed was cutting rates, mortgage rates were rising. The resulting price drops in Agency RMBS also created extreme paper losses for many levered holders of Agency RMBS, who had to pay increasing cash collateral amounts to cover these mark-to-market movements under the terms of their repo arrangements with the banks, or be forced to sell the assets. In these repo agreements, holders of securities (in this case, RMBS) use them as collateral for short-term, mark-to-market, recourse borrowing from banks – should the value of the collateral fall below an agreed amount, the borrower must post extra cash collateral with the bank.

The same and more was true in non-Agency mortgages. Whilst the non-Agency mortgage market is not as big as it was in the lofty heights of 2006 (which saw $1.28trn of new issuance in the space), the market is still extremely large with $63.7bn of new issuance in 2019 and $850bn outstanding as at Q2 2019. The non-Agency market has been subject to an even greater technical effect and liquidity crisis and, in addition, the prospect of higher credit risk, resulting in even greater price falls than in Agency RMBS.

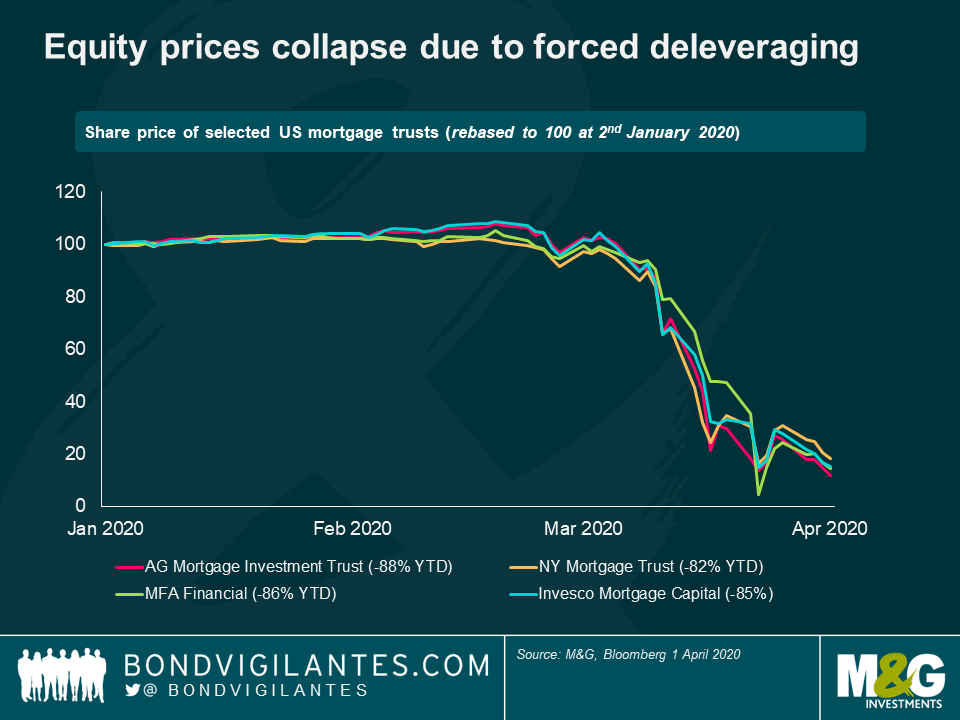

Over the weekend of 21st–22nd March, a number of publicly listed Mortgage Real Estate Investment Trusts (“REITs”) which invest primarily in non-Agency RMBS products all made public statements that they were no longer able to meet the continuing cash collateral calls for their repo lines and were seeking forbearance from their lenders. Public statements were issued by Angelo Gordon Mortgage Investment Trust, MFA Financial Inc., New York Mortgage Trust and Invesco Mortgage Capital Inc. amongst others. They have all seen significant falls in their share prices over the same period (see chart below). The associated liquidations created further downward pressure on prices in an illiquid market.

In response, and partly to remedy the increasing agency mortgage rates and provide much needed stability to the Agency RMBS market, the Fed announced an unprecedented unlimited purchase programme of Agency MBS. Unlimited – and they meant it. In the week commencing 23rd March 2020, the Fed purchased a staggering $183bn of Agency RMBS, an average of nearly $37bn a day. To put this into context, the largest purchase of Agency RMBS ever in a single week period in 2009–2010 was $130bn. Other measures introduced by central banks to contain the stresses on the financial system brought about by the COVID-19 crisis, including the Fed’s second Term Asset Backed Securities Loan Facility (TALF), have also helped to improve market sentiment in non-mortgage Consumer ABS. So far however, no direct support for the non-Agency mortgage market or the levered investors in it has been provided.

Whilst the acute liquidity concerns across the broader market have eased in recent days, it is worth continuing to pay close attention to these dynamics. It is possible that forbearance will be granted to repo borrowers, and also possible that the Fed will broaden the scope of stimulus to cover the non-Agency RMBS markets. In the absence of either, we could see a downward spiral of technical selling pressure, and fundamental selling pressure caused by the unprecedented recent US Initial Jobless claims data leading in turn to further technical selling pressure from levered buyers. In these fearful situations, it will be the marginal bid that dictates the price, and those with committed capital should monitor the situation for buying opportunities.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox