You can trade ESG credit default swaps later this month: 3 implications for all investors

This month will see a significant step forward in the evolution of ESG (environmental, social and governance factors) as a part of fixed income investing, with the launch of the iTraxx MSCI ESG Screened Europe CDS (credit default swap) index. The past few years have seen a noticeable acceleration in investors’ ESG awareness, driven to varying extents by social conscience and evidence that ESG factors provide a useful framework in fundamental company research. One of the challenges for wider integration is the availability of information, and the ease with which investors can act on it. The launch of the new index will help in both these areas. But even if you don’t count yourself as an ESG investor, the launch of the new “ESG Main” index brings some important considerations:

- A wider opportunity set for relative value (RV) trading;

- The ability to trade “Non-ESG Main” by entering into a long-short position between the Main index (“the Main”) and ESG Main;

- Better access to ESG information, and better ability of credit market participants to act based upon it, will make ESG more important as a Factor (i.e. investment style).

More on these below – first, how is the new index made up?

Credit investors finally show up to the party

There are currently many indices and ETFs giving equity investors access to ESG information and ESG-based trading, but credit investors have come later to the party. While a number of research providers like MSCI provide ESG factor-based analysis of many corporate credits, until now there has been no liquid, tradeable ESG credit index security.

The iTraxx Main index already allows investors to gain long or short exposure to the risk and return profile of a basket of 125 of the most liquid CDS referencing underlying European investment grade bonds, and attracts trading volumes close to €1.5 trillion a year¹. The new ESG index will be an exclusion-based version of the Main, and will start trading from 22 June 2020 at the five year tenor. Starting with the equally-weighted Main, the ESG index is constructed by a three-step screening methodology².

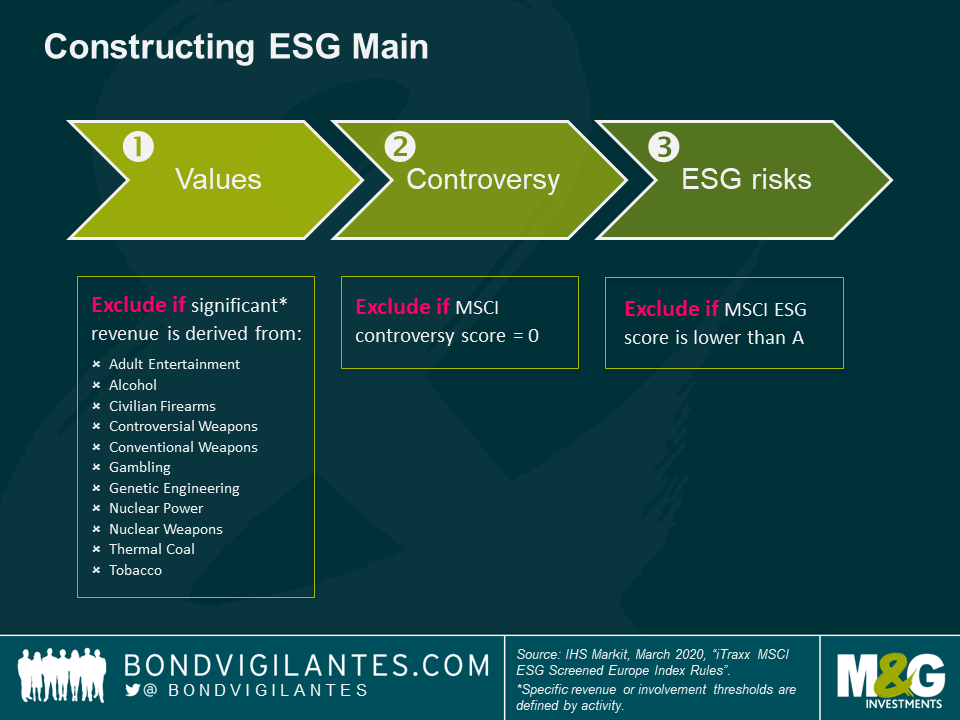

First, a values-based screen if applied. Any issuer which breaches specific thresholds of revenue derived from activities including alcohol, weapons and thermal coal is excluded. Second, any company exposed to major controversies (measured by adherence to certain sustainability and social responsibility principles, such as the United Nations Global Compact and International Labour Organization conventions) is excluded. The final step considers the issuer’s resilience to long-term, financially material ESG risks (is it at risk of regulatory penalty due to environmental damage? How sustainably does it treat the communities in which it operates? Does it have appropriate risks and controls in place to ensure directors act in shareholders’ and creditors’ best interests?).

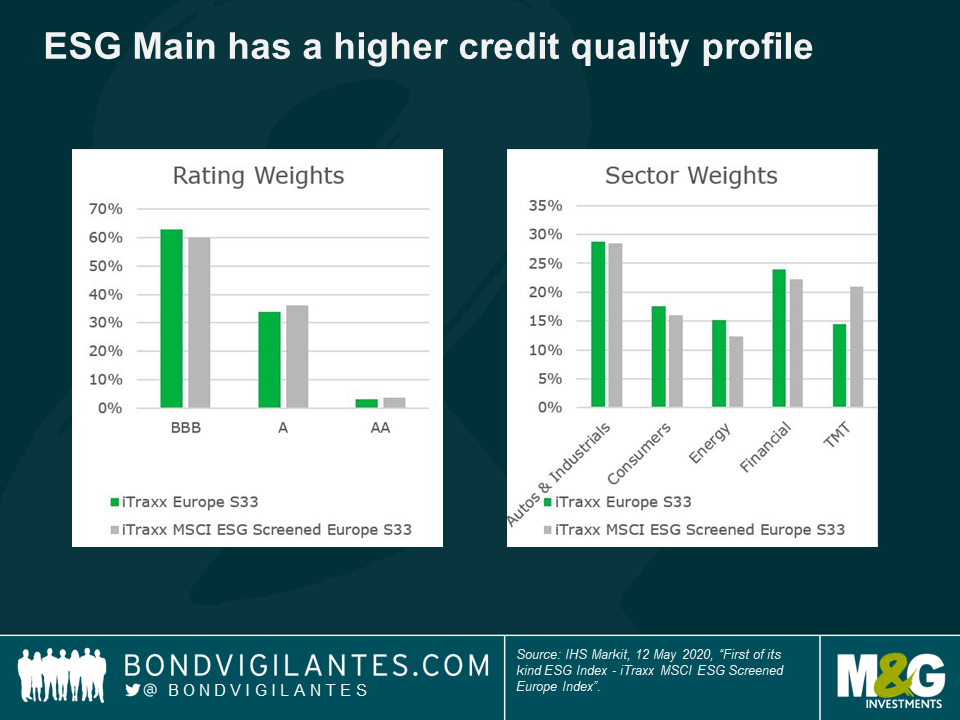

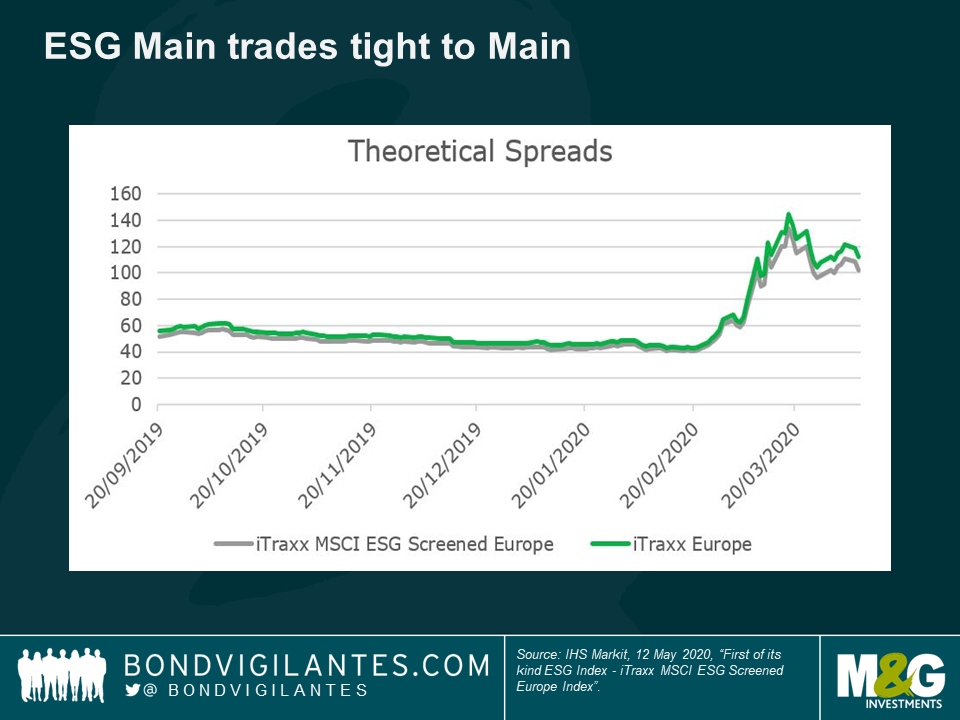

The profile of the resulting basket is what you might expect, with a higher credit quality bias and trading (using backfilled data) at a slightly tighter credit spread than the Main. Interestingly, the exclusions result in an overweight to TMT in the ESG index and an underweight to other sectors, including financials.

For ESG funds, the new CDS contract will offer an easier way to enjoy the benefits which other CDS indices confer: principally liquidity, lower trading costs than physical bonds and the ability to add or remove risk exposure to a basket of credit easily. But even if you don’t currently consider yourself an ESG investor, the arrival of the new index will still have implications.

Three things to consider, even if you’re not an ESG investor

1. Relative value trading

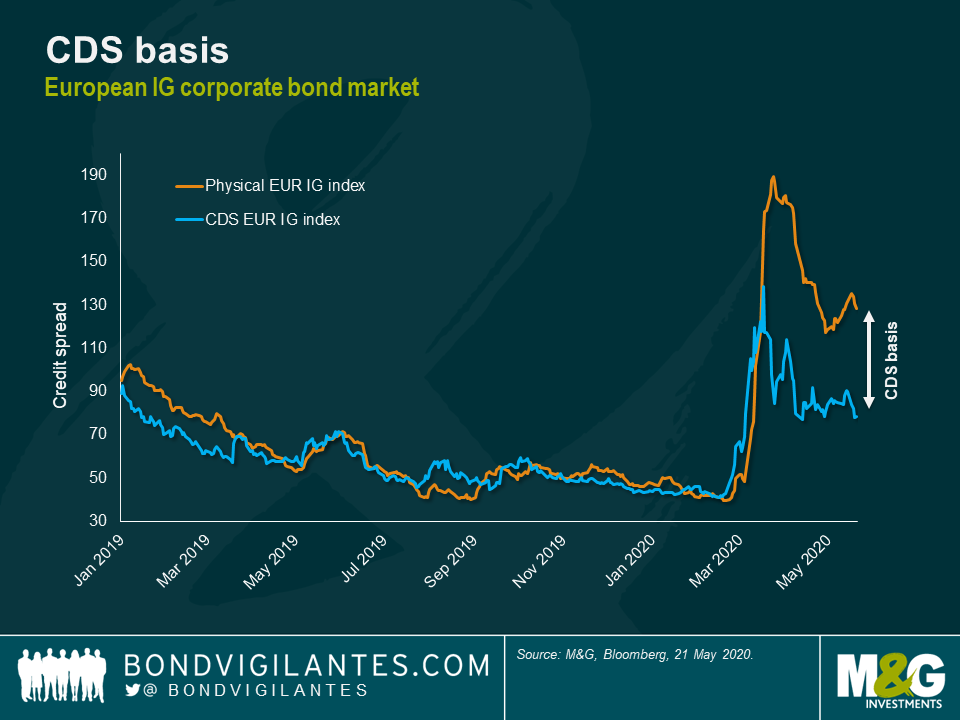

CDS indices already offer investors opportunities to enter relative value trades, firstly between derivatives and the physical securities they reference, and also inter-derivatives (i.e. between the index and individual swaps). For example, spreads offered by physical corporate bonds are currently significantly higher than those available through taking CDS exposure, the result of CDS attracting a high liquidity premium in the current environment, and of excess supply in the physical primary market. The new index will increase the opportunity set available to take advantage of such dislocations.

2. Trading Non-ESG Main

The ability to enter into risk-additive or -subtractive trades in both the ESG and Main indices will allow investors to take a long or short position on a Non-ESG Main index (i.e. to modulate their exposure to the issuers excluded by the three-step screen). This has a variety of use cases. For investors who want to buy CDS protection during times of market stress against ESG laggard names they own, a buy-protection Main, sell-protection ESG trade would achieve this exposure. Likewise, investors may wish to take the other side of this trade to gain exposure to a higher beta investment grade credit instrument with a spread pick-up.

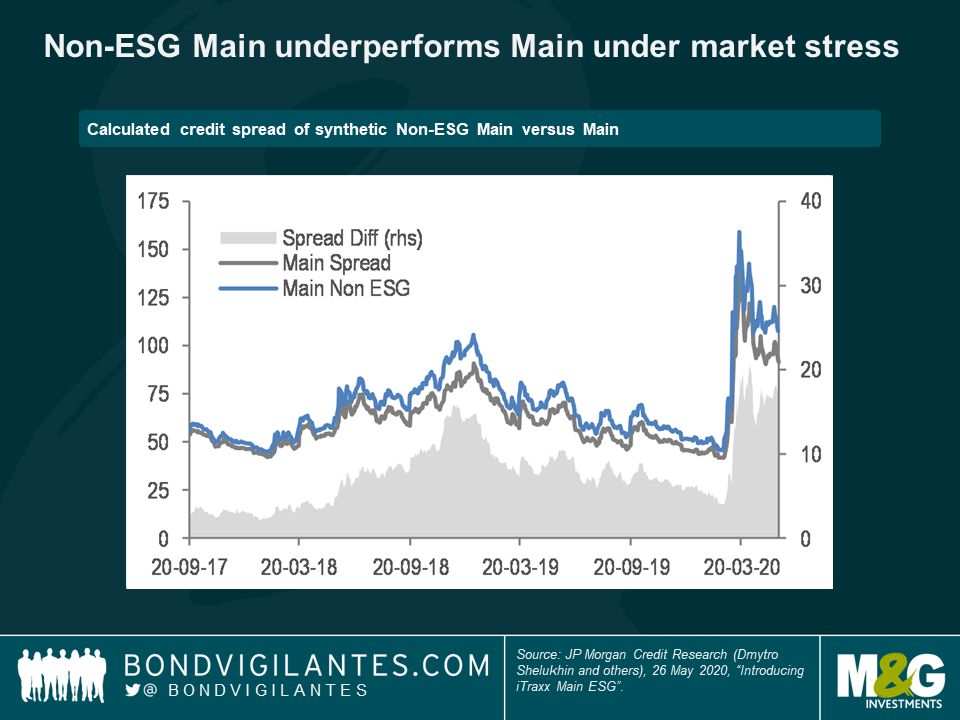

While the ESG index is not yet tradable, calculations by JP Morgan³ of an historical spread (based on the current series 33 basket of included names and backfilled to the September 2017 series 28 roll), reveals that such a synthetic Non-ESG index exhibits underperformance against the Main in times of market stress, while the ESG index outperforms. Based on this time period, the ESG index had a very similar return profile to the Main but with lower volatility and a slightly better drawdown profile in bear markets.

3. Wider access to information and ESG profile-raising

Aside from these more tactical trading opportunities, the launch of the ESG index has a wider implication for all investors. Without a structure against which to consider E, S and G factors, the concept can seem quite esoteric and is hard to quantify. But with growth in the concept which began with the standardisation of data by MSCI and other providers, and has now reached the formation of a tradeable corporate credit index, ESG is a lot easier to nail down as a Factor. It will also be interesting to see if this develops further over the coming months, for example with the launch of an ESG high yield index (which, given the underlying issuer profile, would presumably require less restrictive exclusion thresholds in order not to become overconcentrated).

More transparency and easier trading will make ESG more important as a Factor

The logic of considering the individual ESG risk factors aside, the very fact that market participants will now be better able to act on this new Factor makes it important to consider—whether you think of yourself as an ESG investor or not. The greater liquidity and transparency offered to the market by the index will also make it easier to assess the relative risk-reward profile of ESG credit investments over the longer term. And there is a case to be made that this will lead to ESG outperformance becoming something of a self-fulfilling prophecy—much the same argument as one could apply to technical analysis. Some of these trends, which may have begun for equity investors, have now arrived for corporate credit. Whatever your approach to the new ESG CDS index, its launch this month will be worth watching.

¹ ISDA SwapsInfo, Accessed 1 June 2020, [http://swapsinfo.org].

² IHS Markit, March 2020, “iTraxx MSCI ESG Screened Europe Index Rules”; IHS Markit, May 2020, “First of its kind ESG Index – iTraxx MSCI ESG Screened Europe Index”.

³ JP Morgan Credit Research (Dmytro Shelukhin and others), 26 May 2020, “Introducing iTraxx Main ESG”.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox