QE goes global

Historically, one of the defining characteristics of emerging market (EM) economies has been that they generally have not been able to use monetary policy to stimulate their economies during crises in the way developed markets (DM) have. Usually, they have had to hike rates to limit capital outflows and defend their currencies, in doing so making economic recovery more difficult.

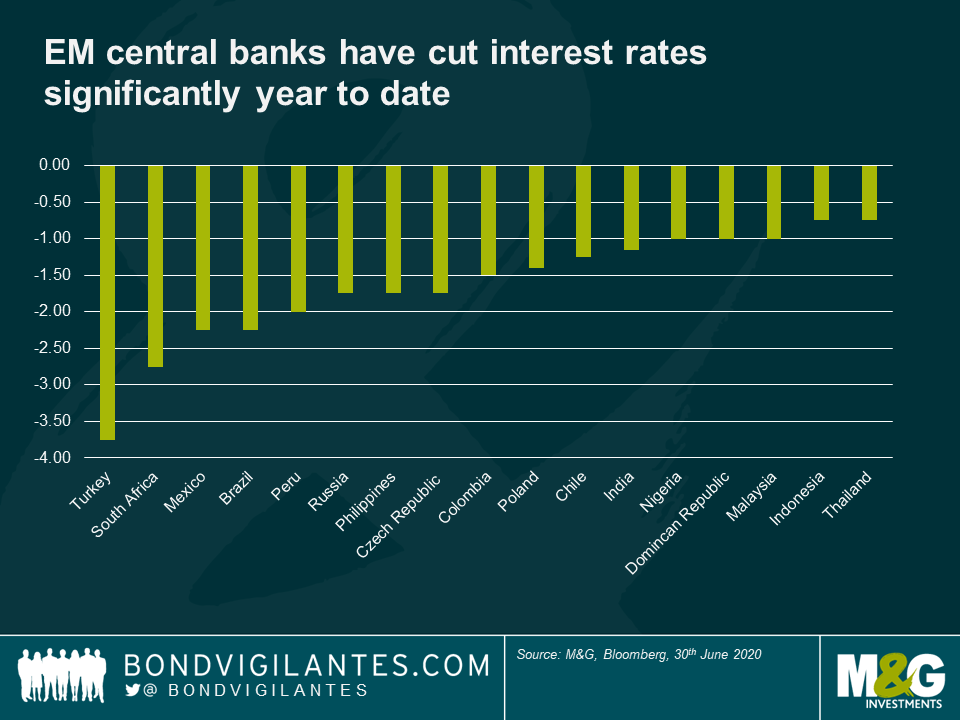

This is why it has been particularly interesting to observe the actions of emerging markets during the Covid-19 crisis that has just swept the world. We witnessed most EM central banks easing policy by cutting rates, some quite aggressively (see chart below), and I believe there could still be room for more. This is a very welcome development, and will be helpful in supporting economic activity during these difficult times. This is particularly true as local financing has gradually become more important across many EM countries that used to issue debt predominantly in foreign currencies, Brazil being a good example. While many EM currencies fell sharply during the first stage of the crisis, most have rallied significantly since then despite these cuts. One of the main reasons this has been possible is the low inflation we have seen in the recent past across most EM countries, and given expectations that inflation should remain low in the near future as demand has collapsed with the pandemic. The fact that the Fed has dropped rates to near zero has also been particularly helpful.

While this has resulted in interest rates in EM dropping to historical lows, potentially providing less support for EM currencies, the differential between EM rates and DM rates remains elevated, with most EM real rates still in positive territory (unlike those in developed markets). In my view, emerging markets therefore remain one area of the market in which investors looking for yield should be able to find it.

Perhaps even more surprisingly, several EM central banks have engaged in purchases of sovereign bonds, aka quantitative easing (QE), until now a tool used only by major developed market central banks (see below table for more details). As can be expected, the size of these purchases remains significantly lower than in developed markets, and in most cases is below 2% of GDP. Central bank balance sheets in EM remain smaller that in DM, and those with large balance sheets are typically those with large FX reserves rather than government assets. Another important difference is that central banks in EM typically have not reached the zero bound when setting interest rates, and most are unlikely to be able to do so. This raises the question of the relative effectiveness of QE given that conventional monitory policy is not yet exhausted.

To date, most EM central banks have been carrying out QE by buying sovereign bonds on the secondary market, as opposed to the primary market. While it can be argued that the end result is very similar, purchasing through the secondary market can help allay concerns that EM central banks are directly financing governments deficits, and can instead be seen as operations aiming to provide liquidity and support to the market in a period of stress.

The majority of those countries that have engaged in QE benefit from a relatively high credit quality (most of them have investment grade ratings) and have developed their local markets, gaining credibility in their ability to set fiscal and monetary policy. The actions of some countries, like South Africa and Turkey for instance, which are also engaging in asset purchases but were already suffering from some lack of credibility and questions about central bank independence, may raise more questions with investors in the longer run.

Taking into account the unprecedented nature of the current crisis, this stimulus has been very helpful in supporting local markets, and QE could be an important tool in the short term to help finance increasing budget deficits resulting from the crisis. However, at the end of the day, QE can be seen as a form of printing money. This could become problematic in the longer run if investors believe countries are using it as an alternative to fiscal discipline, and could lead to significant outflows from local markets if the market loses confidence, in turn fuelling potential currency depreciation and imported inflation. The fact that asset purchases have slowed since March in most countries as the market stabilised and asset prices recovered is a positive sign, as is the fact that EM countries have been able to issue significant amounts of local debt in the last two months. However, how easy it will be to reverse course remains an open question, and the track record of developed markets in winding down QE does not set a particularly encouraging precedent.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox