Sustainability-Linked Bond – Look beneath the surface

Last week saw the first ever issuance of a Sustainability-Linked Bond (SLB) from an emerging market issuer. Brazilian pulp & paper producer Suzano issued US$750 million of Jan-2031 bonds at a yield of 3.95%. The bond coupon (3.75%) is subject to a sustainability performance target and shall increase by 25bps per annum from July 2026, if the issuer does not meet its target in 2025. It is different to a green bond. Green bond proceeds have to be used for environmentally-friendly projects. Sustainability-linked bonds can see their proceeds used for general corporate purposes.

It is only the second time in bond history that a company has used such a structure. Last year, Italian energy company Enel issued the first ever bond featuring a coupon increase (also 25bps) in the event of not meeting a sustainability performance target.

Suzano’s official rationale for using a similar structure is to reduce greenhouse gas (GHG) emissions intensity as “a key strategy for the company to mitigate climate change and address the climate crisis”. The fact that a Brazilian company innovates on the sustainable front may have come as a surprise to many investors, after Brazil and its President Jair Bolsonaro were centre stage of global criticism last year when parts of the Brazilian Amazon forest were devastated by flames. Listening to Suzano’s Chief Financial Officer, it might well be another reason why they issued the bond: “The fires and deforestation are caused by criminals, and we want to make sure that everyone understands that Suzano has a completely different story.”

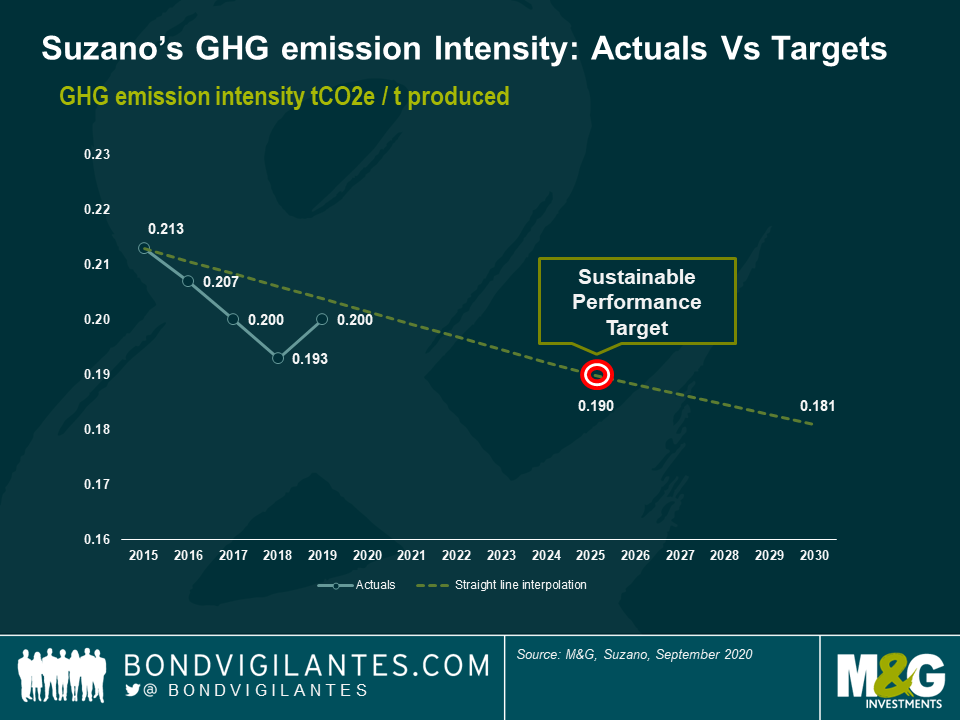

The company’s key performance indicator for GHG emission will be measured as tonnes of CO2 equivalent (tCO2e) per tonnes produced of paper and pulp, per year. The Sustainability Performance Target (SPT) is a reduction to or less than 0.190 tCO2e/tonne produced as measured by the average of years 2024 and 2025. As can be seen in the chart below, the company has set the baseline as their 2015 performance of 0.213 tCO2e/tonne produced. Reaching their target by 2025 would therefore correspond to a 11% reduction in GHG emission intensity since 2015.

However, looking behind the surface, the company reached 0.193 tCO2e/tonne produced in 2018, very near their 2025 target which all of a sudden looks considerably less ambitious. During the conference call to bond investors, the company claimed that 2018 was an exceptional year in terms of production (the denominator of the performance target ratio). But last year Suzano was already very close to the 2025 target with 0.200 tCO2e/tonne. Sceptics may also be worried that if the company falls short of the target, it would be incentivised to increase production (denominator) in order to meet objectives. Management reassured investors by saying the goal clearly was to improve efficiencies of processes and energy procurement (i.e. the numerator) rather than inflating production, the latter being demand driven.

Another source of disappointment came from the fact that the bond coupon was linked to the GHG emission intensity target only. A common pitfall in the green bond market has been to overlook a company’s overall ESG credentials, just because they issue a green or sustainability-linked bond. We think an issuer’s ESG profile prevails over an instrument’s E, S or G structure and we do not buy green bonds of environmentally-unfriendly issuers in our emerging market corporate ESG-dedicated fund. Why is GHG emission intensity more important to a pulp producer than water management or industrial waste? Suzano’s water stress credentials are good but its toxic emissions & waste intensities are fairly weak. An ambitious target would have included the latter.

Suzano said that GHG emissions remained the key material topic for stakeholders and that the ICMA Sustainability-Linked Bond Principles recommended to use KPIs that have at least three years of history, which wasn’t available for other KPIs although the company kept the door open to issuing new sustainability-linked bonds with different KPIs in the future.

We did not participate in the new sustainability-linked bond issue as pricing was not in line with our expectations and our views of the company’s credit profile (including ESG credentials) and sector. The investment grade bond priced at 3.95% with little to no new issue premium, perhaps as a result of strong demand from ESG funds (the book was said to be $7 billion for a $750 million bond). Whilst it is good practice to perform in-depth due-diligence and challenge management teams on new bond structures, we also need to give credit to Suzano who is one of two pulp and paper issuers to have a green gas emission target in the developing world: there are only 8 globally.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox