Egypt’s maiden green bond – a first for the Middle East and Africa

Egypt has just entered the green bond market, pricing a debut $750 million five-year issue. The bonds join a small but growing asset class of emerging market sovereign green bonds. Since Poland issued a green bond in 2016, there’s been growing green emerging sovereign issuance including by Fiji, Nigeria, Indonesia, Hungary and Chile. These have been joined by broader social, sustainable and pandemic bonds, including from Mexico, Ecuador and Guatemala this year.

Egypt’s new issue is the first US dollar sovereign green bond for both Africa and the Middle East, two regions that the country bridges. It counts as Africa’s first: Nigeria’s green bonds were issued in its local currency, and the Seychelles’ $15 million issuance was marketed as a blue bond since it financed projects to protect the archipelago’s oceans. While this is the first US dollar sovereign green bond, there have been numerous Middle East financials issuing in the green space.

More innovative issuance

Egypt’s green bond is part of the country’s innovative debt management strategy that aims to diversify its investor base, while shifting to longer-term borrowing. The plan is for long-term debt to constitute 52% of its borrowing by mid-2022. The government has regularly issued in USD and EUR, and is working to make its local currency debt more appealing and more easily cleared. It has also signalled its intention to soon add sukuks to its portfolio.

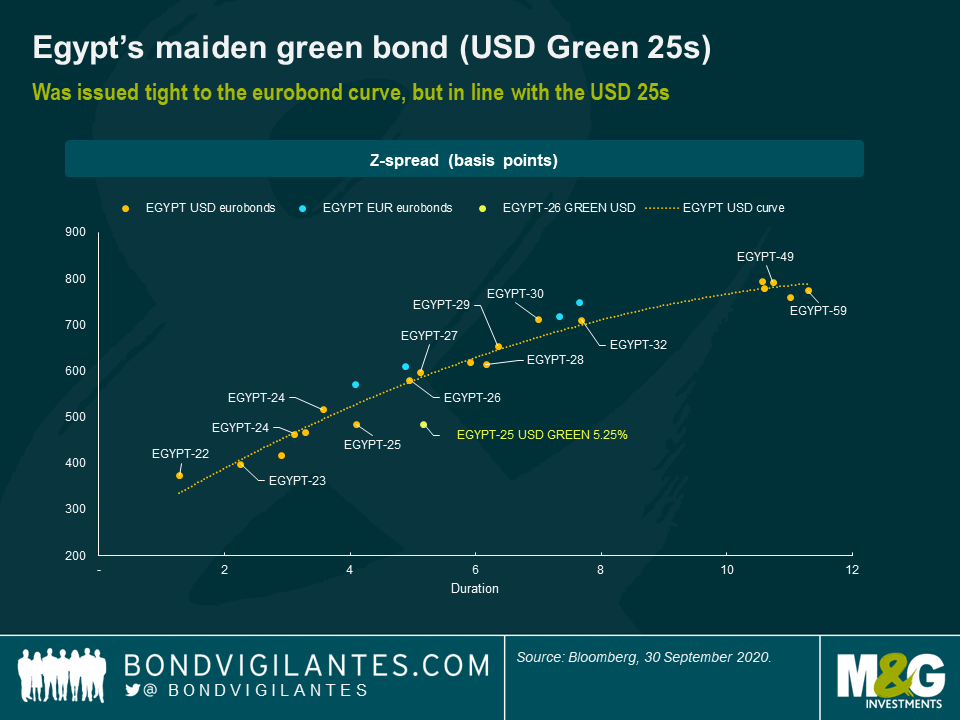

The debut green bond was issued at a yield of 5.25%, close to where a standard Egypt USD with similar duration trades. The order attracted a strong book, prompting the government to increase its offering from $500 million to $750 million. There are still too few other pioneers from which to assess where a green bond should trade relative to a country’s standard debt. Chile, which issued Latin America’s first sovereign green bond in mid-2019, suggests that once issued the green bonds get mixed with other standard bonds and trade similarly. Chile’s green bonds due in 2050 currently have a yield of 2.77%, almost the same as the 2.78% yield on a standard USD eurobond maturing in 2047.

Egypt’s green issuance follows its $5 billion of standard eurobond issuance in May 2020 — the country’s largest multi-tranche deal — that helped Egypt finance its Covid-19 response alongside financing from the IMF and other official lenders, plus the return of foreign appetite for Egyptian pound-denominated Treasury bills and bonds. Egypt’s appeal to investors reflects three factors. First is a good economic policy record and IMF-anchored reforms over the past few years. Second are signs of resilience during this crisis. And third is the government’s clear intention to improve environmental outcomes.

Green use of proceeds

The $750 million raised, plus that from future planned green issuance, will contribute directly to the financing of $1.95 billion of public investment projects tagged as green by the government. These projects are split across six eligible categories, each aligned to one or more of the United Nation’s Sustainable Development Goals (SDG). The net proceeds will enter the general treasury account, so there won’t be a separate account for the funds although they will be tracked internally.

The finance ministry, with support from the World Bank, has developed a framework to label and track what is green financing. What should and what shouldn’t count as green activity can be a contentious topic: I survey the main strengths and weaknesses of the framework below.

Strengths of Egypt’s green financing framework

- It helps nurture a sustainability narrative for the country. The issuance is linked to a wider Sustainable Development Strategy. This will help Egypt position for those seeking to support sustainability goals, not only lending or portfolio flows, but also FDI and private equity.

- It puts focus on Egypt’s climate objectives. This includes a clear over-arching environmental goal that can be used to assess whether the green plans become reality. The goal is to ensure renewable sources of generation provide 20% of electricity by 2020 and 42% from 2035. This would represent a big increase from 9% in 2016 when the strategy was launched. External eyes from the bond market should provide some further pressure on the government to achieve this climate goal.

- The green framework is clearly defined and explained. There is a lot of detail on how the $1.95 billion of public investment projects have been spent or will be spent. The six eligible categories for government investment are (with the proportion of planned investment between 2017 and 2022 in brackets): (i) pollution prevention and control (39%); sustainable water and wastewater management (26%); clean transportation (19%); renewable energy (16%); energy efficiency (0%); and climate change adaptation (0%). Green-motivated investments in these fields will also have associated health and economic benefits.

- The framework has been externally and independently verified. Vigeo Eiri — an ESG solutions company — was tasked with providing an independent verification of the framework. The company had the opinion that the framework is aligned with the four core components of the Green Bond Principles 2018. An external reviewer will also assess the green investment on an annual basis, with reporting made public.

Weaknesses of Egypt’s green financing framework

- Lack of government investment in the ‘energy efficiency’ or ‘climate change adaptation’ categories. The government is planning zero investment in these crucial areas. Yes, the private sector might step in, or regulation might provide results. But climate adaptation efforts — that is a response to climate impacts — should not be neglected.

- Risk of greenwashing. All investment projects should not be earmarked as green. If this were the case then the definition is likely to be too broad. In this fiscal year the government labels 14% of total public investments as green. But in its green financing framework it has a target to increase the proportion of green investment projects’ proportion to 30% by 2022 and eventually 100% by 2025. This is a concern and hopefully one part of the framework that will be revisited.

- Additionality arguments will be weakened if proceeds are earmarked has having “financed” past investment. The ‘look back’ period is 36 months meaning the proceeds from the green bond could be linked to investments in 2018. In this scenario the benefits of new green investment — already hard to demonstrate — would be very hard to claim.

- Some of the most important environmental outcomes are policy not investment related. The most important positive move for climate has been Egypt’s moves to reduce its fuel subsides over the past few years from 2.7% GDP in 2018 to 0.4% this year. On the negative side has been Egypt’s blocking of the completion of Ethiopia’s hydroelectric dam that could provide clean energy and improve livelihoods in Ethiopia.

Conclusion

This is an excellent first move in expressing Egypt’s sustainable credentials. A lot of hard work has gone into the framework, which with experience can be further improved. The clear environmental objectives will help strengthen Egypt’s ESG credentials. Other frontier sovereigns should look carefully at Egypt’s approach, not only in terms of the green bond and financing framework, but also in how efforts are being made to deepen domestic debt markets to reduce debt risks. Hopefully there is more green issuance to come, but more importantly better environment and health outcomes for Egypt as a result of the investment.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox