The high yield primary market can be a battleground between issuers and investors to determine which covenants (the legal language that protects the right of bondholders) are included or excluded in the bond documentation. For investors, this can offer the opportunity to influence the structure of deals, and include valuable protections in the terms of the offering memorandum, which sets out the terms of the bonds.

The power balance between issuers and investors is, amongst other things, a function of supply and demand. In times of increasing demand for high yield bonds terms of the documentation can get permissive, disadvantaging investors. When there is decreasing demand, the balance may shift to favour investors. At such times, the inclusion of creditor-friendly covenants, or for that matter exclusion of creditor-unfriendly covenants, can make all the difference.

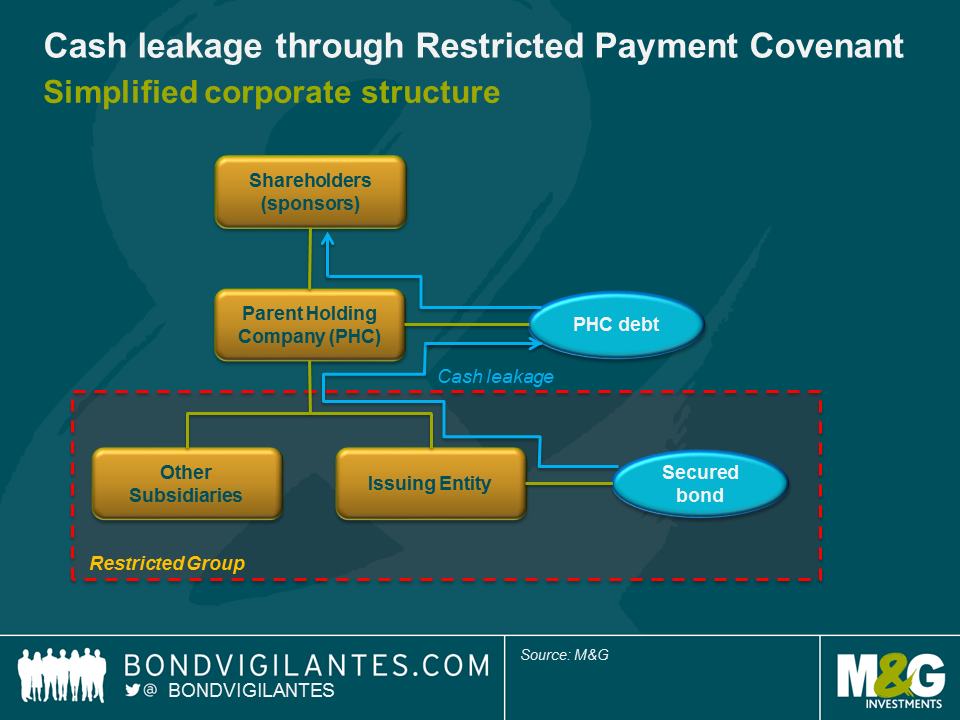

A recent secured bond from a sponsor deal had an exception to the Restricted Payments basket which was unusual and extremely aggressive, as seen from the investors’ perspective. We’ve referred to the importance of covenants in high yield before, and to Restricted Payments in particular. The Restricted Payments covenant typically restricts the payment of dividends (but also prepayment of subordinated debt, equity repurchases and certain investments) out of a Restricted Group, other than that which is permitted, excepted or earned.

During the roadshow for the secured bond, the Restricted Payment definition contained the following exception:

‘dividends or distributions paid to any Parent Holding Company in respect of Indebtedness of such Parent Holding Company which is guaranteed by the Company or any Restricted Subsidiary’

This exception effectively allows the sponsor (owner) the ability to issue debt at the Parent Holding Company level and upstream cash out of the Restricted Group to service it, almost without conditions (other than it be guaranteed by the Restricted Group).

This is objectionable from an investors’ perspective for a number of reasons. Debt raised at the Parent Holding Company level:

- would not need to be down-streamed to the Restricted Group, to support the balance sheet / growth of the business;

- would be reliant on cash being up-streamed out of the Restricted Group to be serviced, reducing the amount left to service debt within the Restricted Group;

- may be paid out to the sponsors as a dividend, enhancing their investment returns, whilst reducing their exposure to the underlying business, resulting in diminished alignment between lenders and owners of the business

Whilst this exception to Restricted Payments is included in some deals, it is rare, contentious and represents a significant loss of investor protections. In fact, it inverts the normal order of priority inherent in high yield, in this case allowing debt outside the Restricted Group to have equal dibs on cashflow as the secured counterpart inside the Restricted Group. Moreover, allowing this clause in the documentation would perpetuate a dangerous precedent.

During the roadshow feedback process investors were able to resist this egregious weakening of covenants. As a result, the exception was eliminated from the language of the docs. From a drafting point of view, this was as simple as omitting the two lines from the language of the document; two very important lines.

To be clear, a number of stars have to align for this feedback process to work in favour of investors. Battles over terms in high yield documentation between investors and issuers are commonplace on a number of fronts. This example, however, represents an important line in the sand, and illustrates that when engaging constructively with banks an active high yield investor base can have influence and drive the outcome of the shape of a transaction, enhancing the protections afforded to bondholders.