‘Responsible Junk’ – The challenge of integrating ESG factors into a global high yield bond portfolio

Whether you call it ‘Green’, ‘Responsible Investing’ or ‘ESG’ (environmental, social and governance), there is no doubt that it is now a firmly established part of the investment landscape, having evolved from something of a niche interest to a mainstream concern in the space of just a few years. Growing awareness of a range of environmental and social issues has seen an ever larger number of investors move their focus away from purely financial goals towards an approach that also considers the social and environmental impact of their investments.

A generational shift is under way

Over the coming years, we think the interest in responsible investing only looks set to grow, with millennial investors, in particular, likely to be a key long-term driver. While responsible investing has proved increasingly popular with investors of all ages, it is the millennial generation (broadly defined as those born between 1982 and 2000) which has shown the strongest enthusiasm for this form of investment.

According to research carried out by M&G and The Wisdom Council1, 9 out of 10 ‘millennials’ said they were interested in socially responsible investing and wanted to know more. Millennials were also twice as likely (64%) than investors over 55 (29%) to invest in a fund if social responsibility was part of the thesis.

While the overall earnings power of millennials is still in its early stages, the wealth and influence of this generation is expected to grow significantly over time. Millennials are set to become the largest demographic in the US over the next few years and, over the coming decades, are expected to inherit trillions of dollars’ worth of assets from the wealthy ‘Baby Boomer’ generation. In this context, we think millennials will become an increasingly powerful driver of the demand for responsible investments.

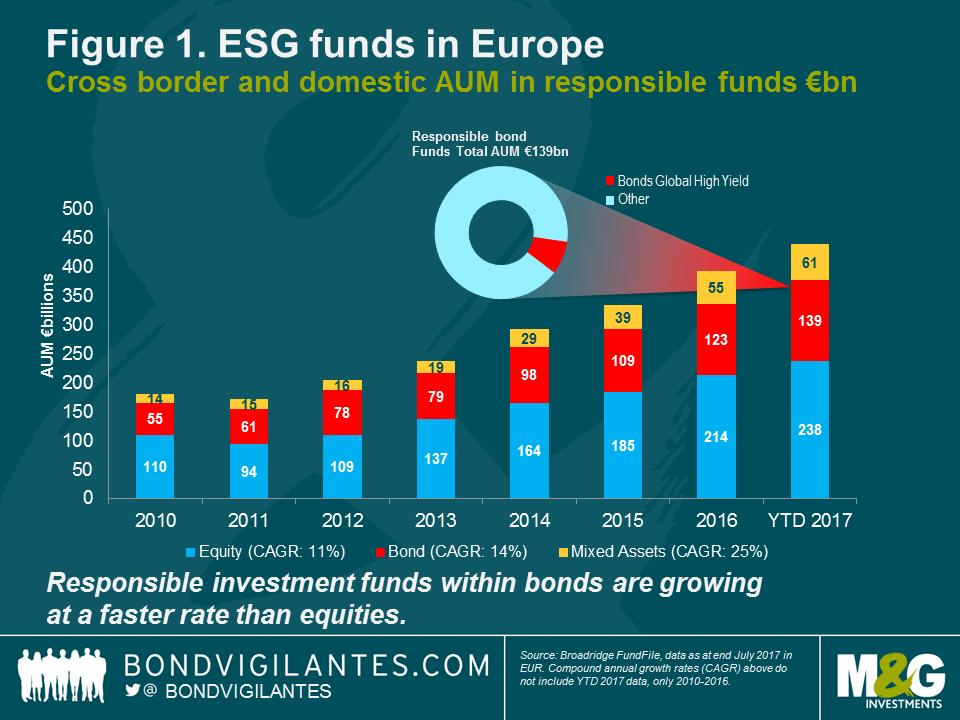

Indeed, this shift in perceptions and priorities is already manifesting itself in assets, especially in Europe, where ESG assets under management (AUM) have increased from €180 billion in 2010 to €438 billion as at 31 July 2017 (see Figure 1).

A notable development has been the growing number of ESG bond funds available to investors. While ESG equity funds still represent the majority of AUM, bond funds are quickly catching up, having grown at a faster rate than ESG equity strategies since 2010, measured using a compound annual growth rate.

Consequently, responsible investing will be a major growth area for both bond investors and the fund management industry alike.

There are, however, three key questions that need to be answered:

- What does ‘responsible investing’ actually mean?

- What outcomes are being targeted and how do we define and measure these?

- How can this framework, once established, be integrated into existing investment processes and portfolios?

In this paper, we take a cross section of ‘responsible investing’ approaches and consider how they may or may not work within the context of a global high yield bond portfolio.

- Research conducted by the Wisdom Council (www.thewisdomcouncil.com) with collaborative partners including M&G Investments, Aberdeen Standard Investments, Equiniti, Nutmeg and Royal London Asset Management.

ESG approaches from a high yield perspective

Fixed income assets make up a considerable proportion of most investor portfolios. However, while bond funds now represent a sizeable portion of the ESG universe, these are predominantly focused on investment grade issuers, with high yield bond funds accounting for only a fraction of assets under management.

One potential reason for this is that the high yield market does not easily fit in with ‘off-the-shelf’ ESG methodologies. Table 1 outlines some of the most common ESG approaches and considers their suitability from a high yield perspective:

Table 1. Some common ESG approaches

| Description | Pros | Cons | |

| ‘Norms’-based screening | Excludes companies that are assessed to be in breach of widely accepted principals, such as the United Nations Global Compact principles on human rights, labour, environment and anti-corruption. | Broad acceptance by the investment community. Compliance has limited impact on the investible high yield universe. | Punishes purely by exclusion – limited scope for positive engagement. No flexibility to deviate from principles laid down – a ‘one-size-fits-all’ framework. |

| Negative screening (sector exclusion) | Excludes companies whose revenues are derived from specified sectors, such as tobacco, gambling or weapons. | Simple to apply and align with client preferences. | Fails to consider companies outside specified sectors that display poor ESG credentials. Subjectivity in terms of deciding which sectors should be excluded – eg, is nuclear energy good or bad? |

| Negative screening (exclusion of industry laggards) | Excludes companies that are deemed to have poor ESG credentials based on an in-depth assessment of a range of ESG factors. | Provides a more comprehensive and sophisticated analysis of a range of ESG factors. | Requires complex analysis and a robust and comparable ESG scoring methodology. |

| Positive screening –‘best-in-class’ approach | Focuses on companies that are deemed to have the strongest ESG credentials based on an in-depth assessment of a range of ESG factors. | Explicitly rewards industry leaders and creates a more positively aligned portfolio | Implementation would leave a very limited choice of high yield names, compromising diversification and implementation of investment-driven views. |

| Green bonds | Issued by governments or companies to raise finance specifically for “green” purposes, such as clean energy plants or energy efficiency projects. | Targets specific projects designed to make a positive environmental impact. Funds are usually ring-fenced and only used to fund the specified project. Self-selecting universe, easy to define. | Very small, concentrated universe of high yield issuers with high idiosyncratic risks. ‘Green’ designation can be somewhat subjective and inconsistent. |

| Impact investing | Covering a range of asset classes, impact investments are designed to solve social and environmental challenges. | Highly tangible. Provides capital for businesses or projects looking to make a positive ESG impact. | Opportunities tend to be illiquid, private and project-based. Can be challenging for a diversified open-ended investment vehicle offering daily liquidity. |

Responsible investing has evolved significantly over the past decade and today covers a variety of related but distinct strategies.

An ESG approach which has gained broad acceptance is the ‘norms’-based screen. This excludes companies that have failed to meet internationally accepted standards, such as breaching the United Nations Global Compact principles on human rights, labour, environment and anti-corruption. A ‘norms’-based screen ensures the removal of companies that have been judged to be in breach of these standards, although this approach only captures approximately 2% of high yield companies so does not provide a comprehensive ESG approach in itself.

Another common approach is to remove companies whose revenues are derived from specific industries, such as tobacco, gambling or weapons. This is an example of negative screening, which seeks to remove companies whose activities are considered to be harmful to society. A sector exclusion approach is easy to implement and to align with client preferences. However, while a good starting point, this approach again has quite a narrow focus. There is also a degree of subjectivity in determining what sort of activities should be considered harmful – nuclear power being one such example of an industry that often divides opinion.

ESG integration offers a more comprehensive approach whereby ESG factors are incorporated into the overall investment decision-making process. This involves a sophisticated analysis of a wide range of complex issues, which might cover everything from energy efficiency and pollution to working conditions and product safety. ESG integration enables companies to be assessed using a robust and comparable ESG methodology. According to our estimates, around 20% of high yield companies would be classified as industry laggards displaying poor ESG credentials.

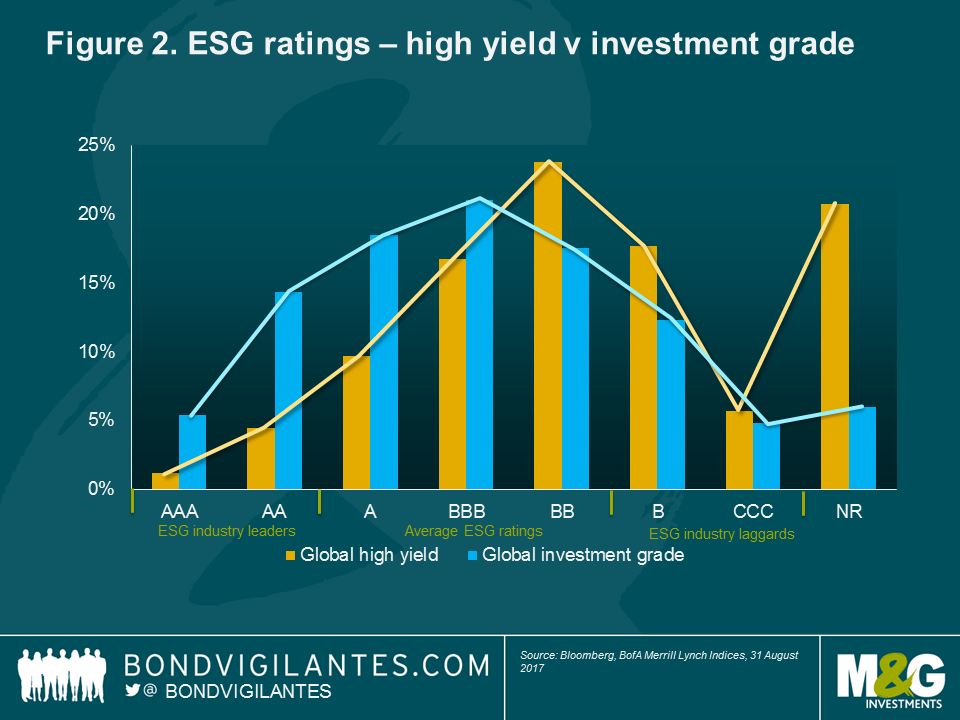

Positive screening is a ‘best-in-class’ approach, which seeks to identify companies demonstrating leadership on social and environmental issues. This is a more proactive approach to ESG investing which explicitly rewards the industry leaders. However, from a high yield perspective, this approach leaves a very limited choice of issuers, compromising diversification and the implementation of investment-driven views. Based on ESG assessments provided by MSCI, around 20% of companies in the global investment grade market qualify as ESG industry leaders (those with AAA or AA ESG ratings) (see Figure 2). In comparison, only 5.6% of the high yield companies have an ESG rating of AAA or AA which would lead to material adverse implications, in terms of portfolio diversification and concentration risk.

Impact investing takes the concept of responsible investing a stage further by specifically focusing on companies or organisations whose core objective is to solve social or environmental challenges. Impact investing covers a wide variety of activities ranging from sustainable agriculture to healthcare to renewable energy. However, opportunities in this area tend to be illiquid, private and project-based and would not generally be suitable for inclusion in a diversified, open-ended investment vehicle offering daily liquidity.

Despite the limitations of the high yield market, we believe that ESG considerations have an important role to play when investing in this asset class. With the right expertise, we think it is possible to build a well-diversified high yield portfolio which offers favourable ESG credentials. Moreover, a careful consideration of ESG factors can, in our view, help ensure a more comprehensive credit analysis which will ultimately lead to more informed investment decisions.

The case of Abengoa Greenfield bond

Green bonds are perhaps the best known example of impact investing from a fixed income perspective. Green bonds pay regular coupons and are no different from conventional bonds, except for the requirement that their proceeds can only be used to fund specified projects designed to generate a positive environmental impact.

However, while the emergence of green bonds is an encouraging development, this remains a very small market in the high yield space, consisting of just 24 bonds across 21 individual high yield issuers.

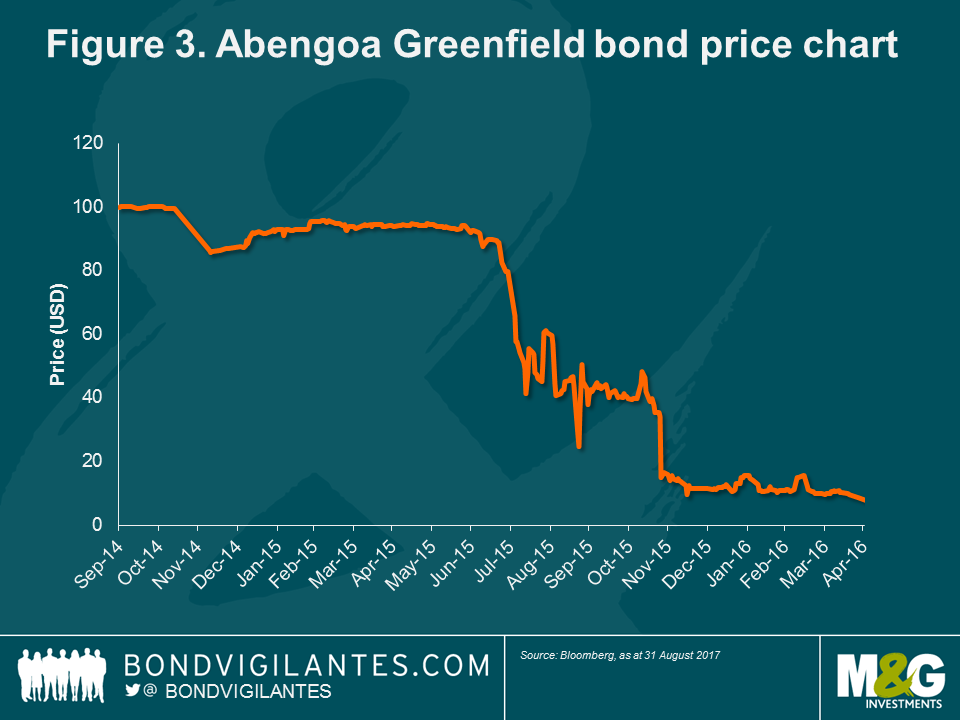

Green bonds can also be exposed to extremely high idiosyncratic risks, as illustrated in the case of an issue from Spanish clean energy firm Abengoa. The Abengoa Greenfield bond was issued in 2014 to finance green energy projects, but tumbled by around 90% the following year when the company ran into financial difficulties as bank lending facilities were withdrawn and the company was forced to restructure all of its outstanding bonds (see Figure 3).

The case of Abengoa serves to illustrate that green bonds can be exposed to adverse credit events in exactly the same way as conventional high yield bonds. As it stands today, a green bond high yield portfolio would be highly concentrated and lack diversification, making it overly exposed to the risk of default.

A three-step ESG approach

From a high yield perspective, we believe that an optimal ESG approach would be one that implements three layers of screens – namely:

- a ‘norms’-based screen,

- a negative sector screen based on revenue thresholds and,

- the removal of any ESG industry laggards following a comprehensive assessment of a range of ESG factors.

The key advantage of this approach is that client needs and expectations for ESG integration can be met without sacrificing an investible opportunity set of bonds. The resulting portfolio would also have a demonstrably and measurably better ESG score than the market average. Hence, an appropriate balance between investment performance, active views and ESG constraints can be struck.

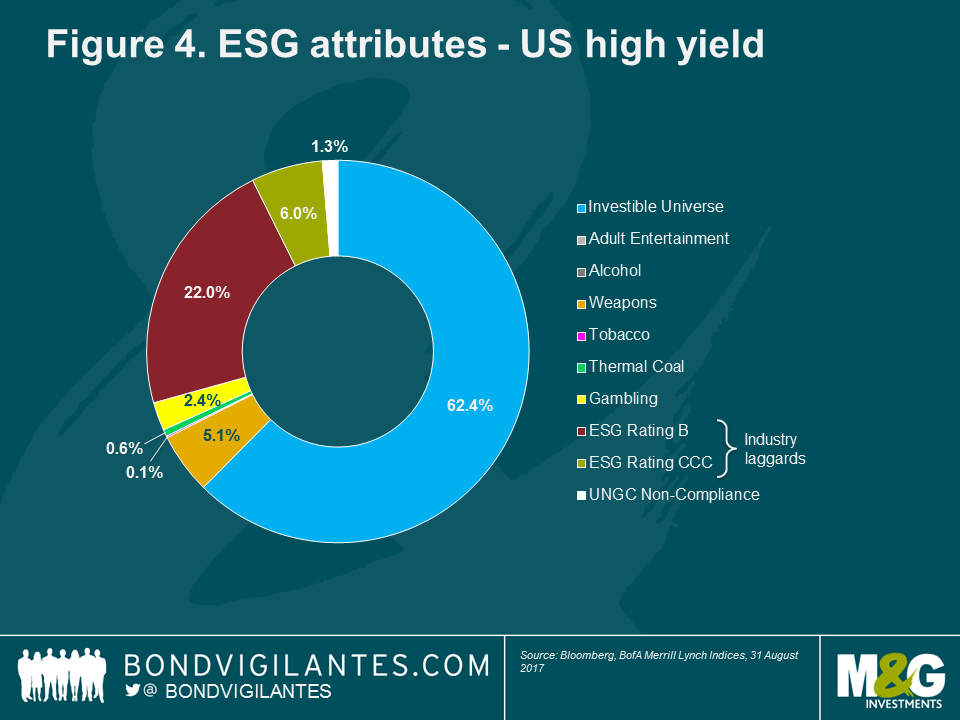

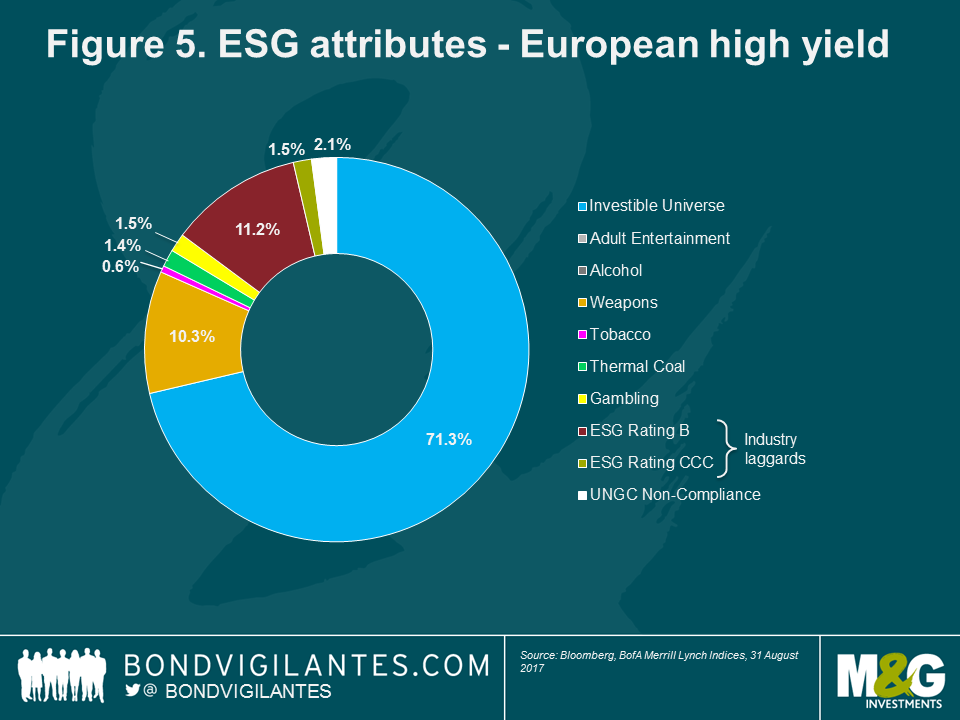

What would an ESG high yield universe look like? We can see that US high yield would be more affected in this respect, with around 38% of this market excluded based on the above ESG criteria. This is largely because the US market contains a relatively high proportion of companies with poor ESG ratings (ie, B or CCC, based on MSCI analysis). The European high yield market is less affected in this respect, with only 28% of companies being excluded. One notable feature of the European high yield market is the relatively high proportion of companies with revenue streams linked to the weapons industry, with this sector alone accounting for around 10% of excluded companies (see Figures 4 and 5).

While a global ESG high yield strategy might therefore be expected to display a slight bias towards Europe, given the region’s stronger ESG credentials, it should be noted that the US high yield market is significantly larger than its European counterpart (with a value of around US$1.3 trillion versus US$0.3 trillion) before applying the ESG screens. In absolute terms, the US market would therefore still contain a greater number of eligible issues and we would therefore not necessarily expect significant geographic differences between an ESG high yield strategy and a conventional high yield strategy.

From a sector perspective, an ESG high yield strategy would differ slightly from a conventional high yield strategy as a result of sector exclusion. However, the excluded sectors account for a relatively small part of the high yield market, and the ESG high yield universe still offers good sector diversification with no single industry dominating. Furthermore, employing a sophisticated ESG rating methodology – which assesses a company’s ESG performance relative to its industry peers rather than in absolute terms – can help ensure that a portfolio is not skewed to a few individual sectors.

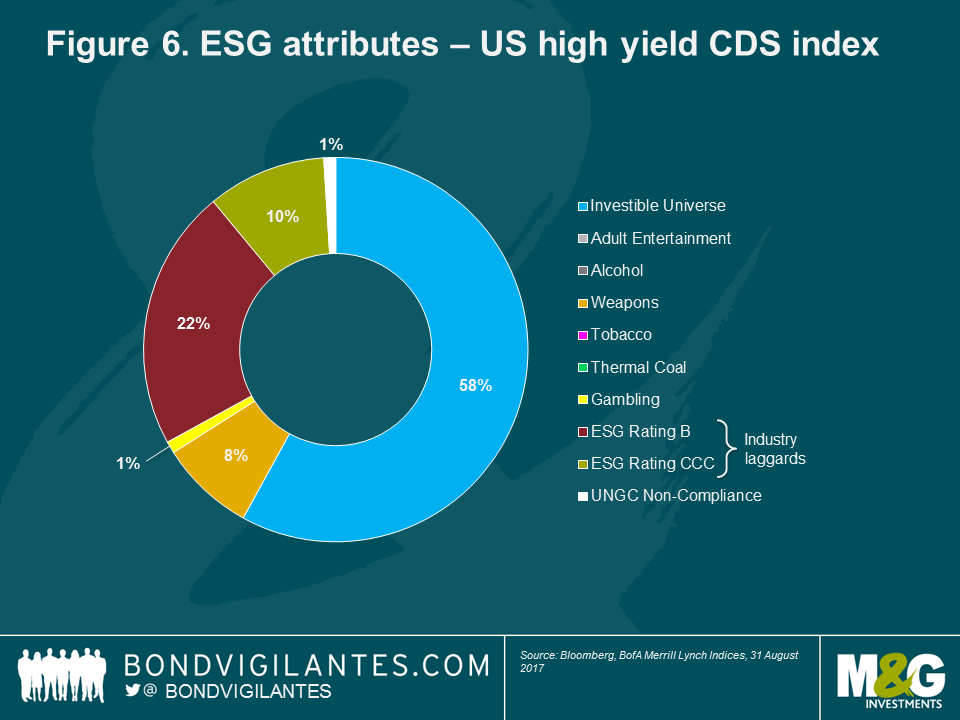

Another difference worth highlighting is that high yield credit default swap (CDS) indices would not be suitable for inclusion within an ESG high yield strategy, given that some of the underlying components are likely to display weaker ESG credentials. For example, around 42% of issuers within the CDX HY Index would be filtered out if applying the three-stage ESG screening process set out above (see Figure 6).

However, in other respects, we would expect an ESG high yield strategy to offer similar characteristics to a conventional high yield strategy, with comparable levels of duration and credit risk and ample opportunities to express investment views via sector allocation and individual credit selection.

Key points

- ESG/responsible investing is a fast-growing area, one that will likely become a prime focus for the next generation of savers and investors.

- There are many different ESG/responsible investing methodologies; however, the high yield market presents a range of different challenges when it comes to adopting these.

- Our view is that a combination of methodologies, focusing on negative screening and ESG integration, strikes the right balance between being able to express investment views and ESG/responsible investing outcomes.

For Investment Professionals, Institutional Investors and Professional Investors only. Not for onward distribution. No other persons should rely on any information contained within. This information is not an offer or solicitation of an offer for the purchase of shares in any of M&G’s funds. Distribution of this document in or from Switzerland is not permissible with the exception of the distribution to Qualified Investors according to the Swiss Collective Investment Schemes Act, the Swiss Collective Investment Schemes Ordinance and the respective Circular issued by the Swiss supervisory authority (“Qualified Investors”). Supplied for the use by the initial recipient (provided it is a Qualified Investor) only. In Hong Kong, this financial promotion is issued by M&G Investments (Hong Kong) Limited, Office: 16/F, Man Yee Building, 68 Des Voeux Road, Central Hong Kong; in Switzerland, by M&G International Investments Switzerland AG, Talstrasse 66, 8001 Zurich, authorised and regulated by the Swiss Federal Financial Market Supervisory Authority; in the UK, by M&G Securities Limited (registered in England, No. 90776) and, elsewhere, by M&G International Investments Ltd (registered in England, No. 4134655). Both M&G Securities Limited and M&G International Investments Ltd are authorised and regulated by the Financial Conduct Authority in the UK and have their registered offices at Laurence Pountney Hill, London EC4R 0HH. M&G International Investments Ltd also has a branch located in France, 6 rue Lamennais, Paris 75008, registered on the Trade Register of Paris, No. 499 832 400 and a branch in Spain, with corporate domicile at Plaza de Colón 2, Torre II, Planta 14, 28046, Madrid registered with the Commercial Registry of Madrid under Volume 32.573, sheet 30, page M-586297, inscription 1, CIF W8264591B and registered with the CNMV under the number 79. For Hong Kong only: If you have any questions about this financial promotion please contact M&G Investments (Hong Kong) Limited. The Portuguese Securities Market Commission (Comissão do Mercado de Valores Mobiliários, the “CMVM”) has received a passporting notification under Directive 2009/65/EC of the European Parliament and of the Council and the Commission Regulation (EU) 584/2010 enabling the fund to be distributed to the public in Portugal. M&G International Limited is duly passported into Portugal to provide certain investment services in such jurisdiction on a cross-border basis and is registered for such purposes with the CMVM and is therefore authorised to conduct the marketing (comercialização) of funds in Portugal. For Singapore: for Investment Professionals and Institutional Investors only.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox