High Yield in 2019 – floating or fixed?

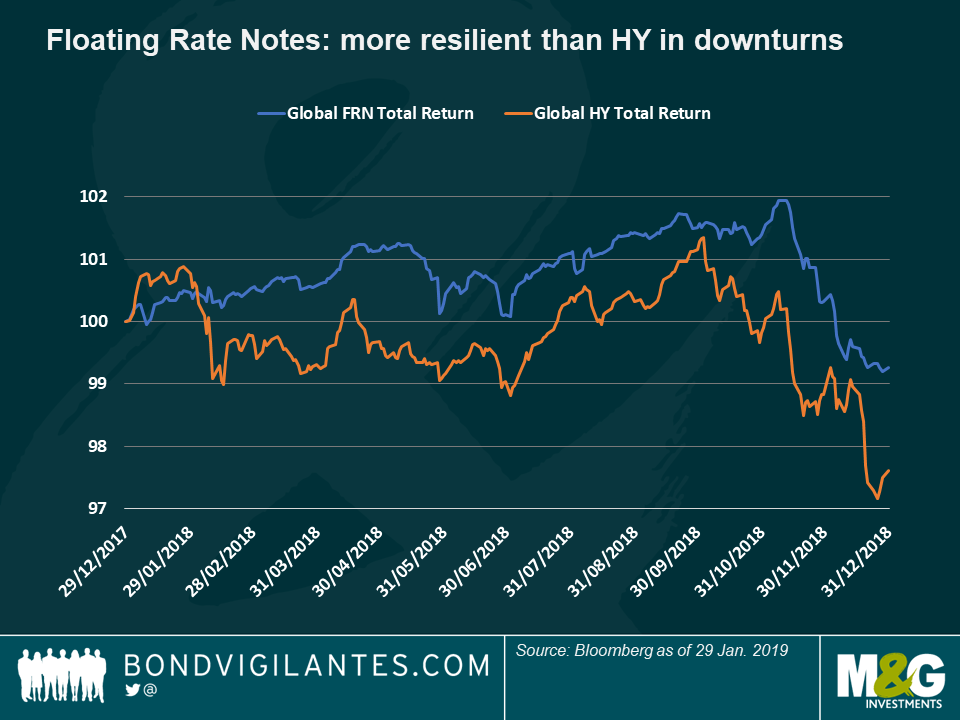

As we all know, 2018 turned out to be a tough year for most asset classes, not least High Yield (HY) bonds. The sell-off in the fourth quarter was particularly quick and brutal compared to the recent lulls of benign volatility under the blanket of central bank largesse. Global HY lost a few percentage points in pure local currency terms in 2018, whilst the lower beta and more senior secured heavy Floating Rate Note (FRN) market held up a little better with a loss of just under 1%. This was a timely reminder that the HY FRN market (which shares many risk characteristics with the senior loan market, including its senior secured nature and floating coupon) is typically less volatile than conventional fixed rate HY bonds in periods of market corrections.

Where does that leave investors looking at 2019? Should they favour floating rate or fixed rate HY?

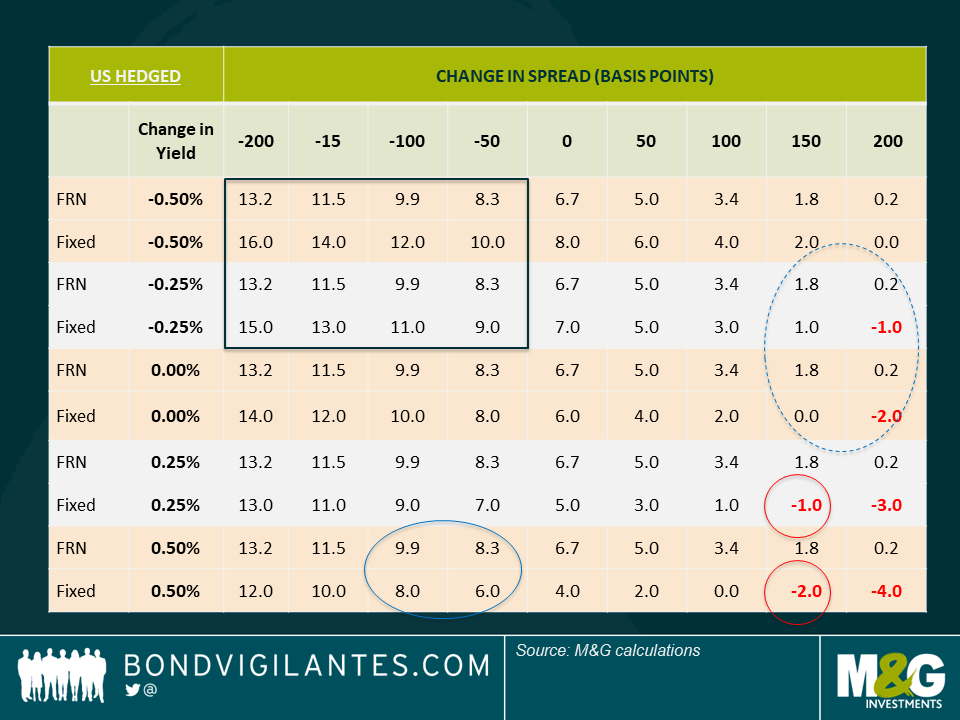

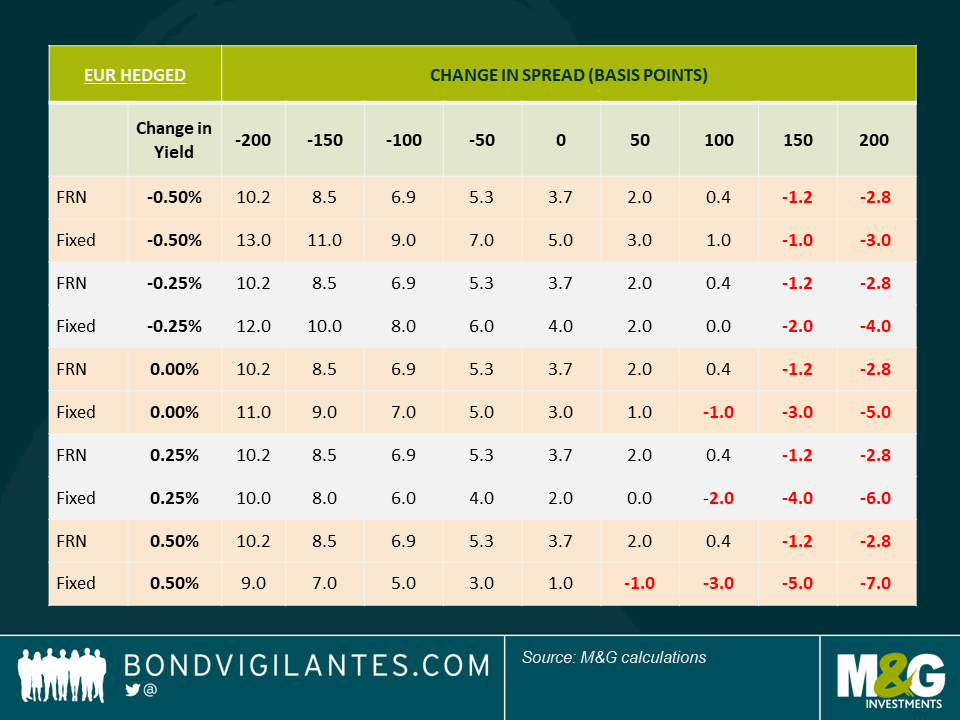

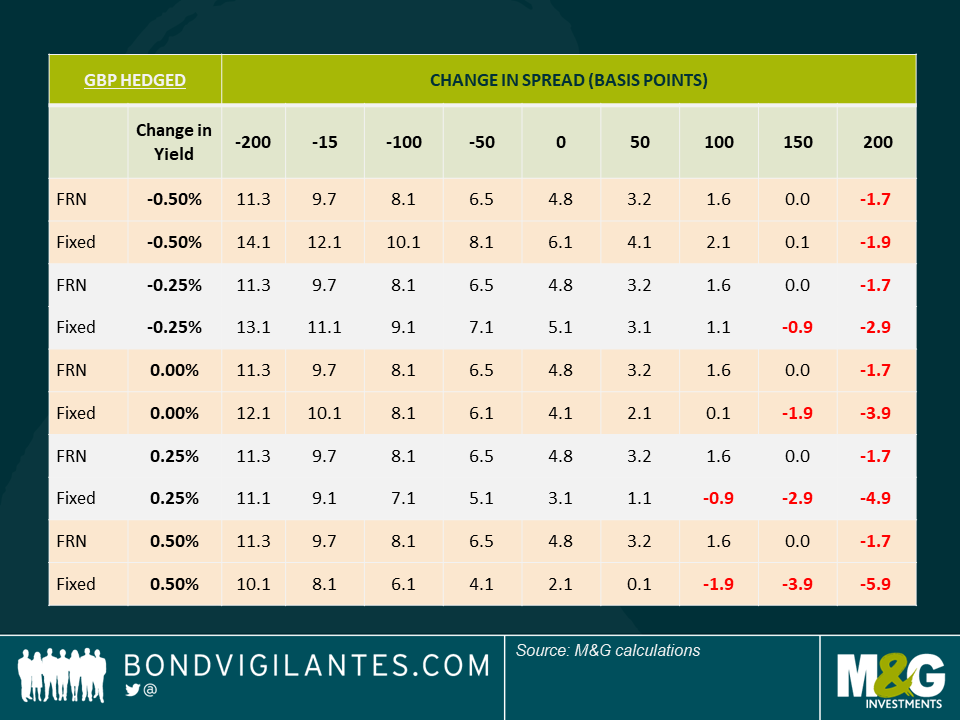

To try and answer this question, I’ve outlined below some total return scenarios based on different changes in spreads and interest rates. These scenarios also take into account an estimate of one-year currency hedging costs in order to give a fully hedged return. I have assumed a 1.5% default rate, with an average recovery rate of 30% for the fixed HY market and a higher 60% for the floating market. I am also assuming that any change in yields is purely a steepening / flattening move, meaning that there are no further rate hikes over the following 12 months. See below the 3 scenarios – for fully hedged US, Euro and UK-denominated FRNs and HY bonds.

What can we infer from the above?

- For USD investors, the risk-reward from an absolute perspective starts to look interesting – the breakeven on spreads is sufficiently attractive that you need over 200 basis points (bps) of spread widening before the FRN market starts to give you losses. For context, this means spreads in the region or around 650 bps and an all-in-yield of near 9% – arguably a level that prices in a recession. In the case of the higher spread duration fixed rate market (it has higher sensitivity to spread changes), outright losses start before, at the 150 bps level (circled). All in all, this suggests a reasonably attractive risk / reward pay-off with potential returns in the high single digits and low double digits. For EUR and GBP investors, the picture is marginally less supportive, given the lower income after the cost of hedging is taken into account.

- Under a bullish scenario, with a big tightening in spreads and a back-up in yields, the low interest rate duration of FRNs works quite well as any rise in government yields would not have an impact on returns (as the coupon resets periodically to match short term money market rates), whereas the longer duration of the fixed rate market acts as a negative drag if rates rise (blue circle).

- Under a bearish scenario, with wider spreads and lower yields, the lower spread duration of the FRN market also plays in its favour relative to the fixed rate market (dashed blue circle).

- Fixed rate HY outperforms if both yields and spreads fall (black box), something that could be consistent perhaps with a return to monetary stimulus such as Quantitative Easing (QE).

Given the relative strength of the US and global economy, a return of QE is quite unlikely – in my view, this should give an edge to FRNs in most likely return scenarios. I do have to caveat that this is based on several assumptions, so should be taken as theoretical. Also, there are other variables that would also have an impact, including FRN’s lack of capital upside, as they trade close to par, and any increase in default rates above 1.5%.

Having said that, the inherent resilience of FRNs, through their low spread and interest rate duration, could be a good tailwind for the asset class in 2019. This could well be a good year for floating rate High Yield.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox