Has Europe really turned the corner?

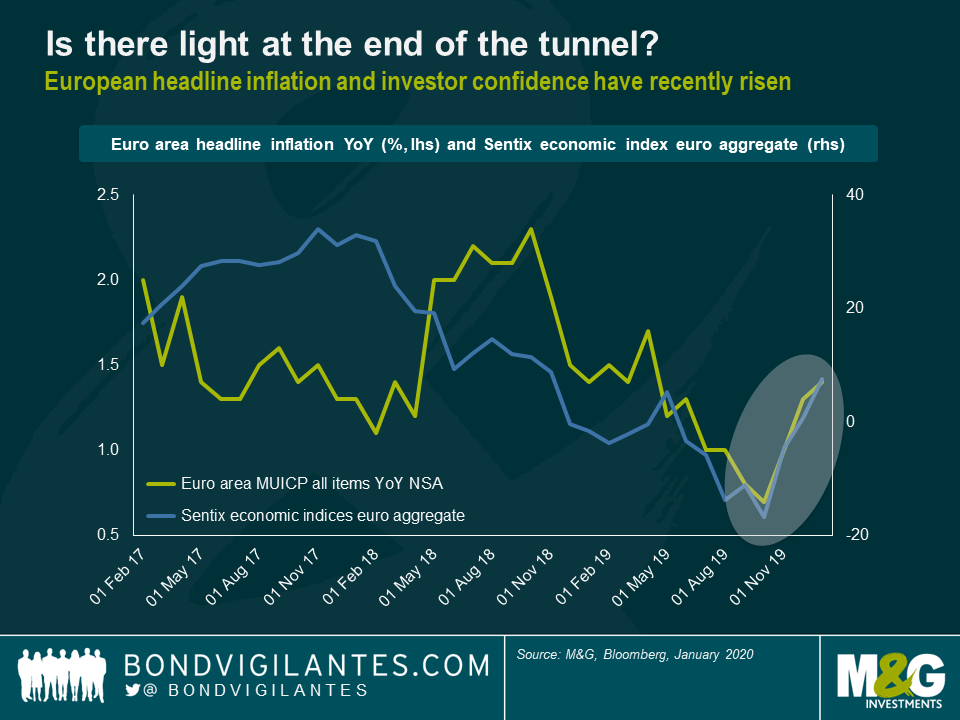

Lately a growing number of indicators have suggested that the European economy might be out of the woods, heading towards a more robust recovery. For instance, while European inflation remains significantly below the ECB’s inflation target of close to but below 2%, it is worth highlighting that the year-on-year headline rate has in fact doubled from 0.7% in October 2019 to 1.4% in January 2020. Even the manufacturing PMI for the euro area, one of the biggest causes of worry to European investors throughout 2018, seems to have bottomed out in September 2019 and is now back on a mild upward trajectory. Sentiment amongst European investors has also improved considerably. Take, for example, the Sentix economic index for the euro area — a gauge for investor confidence — which has sharply rebounded from its October 2019 low-point, climbing in January 2020 to its highest level since November 2018.

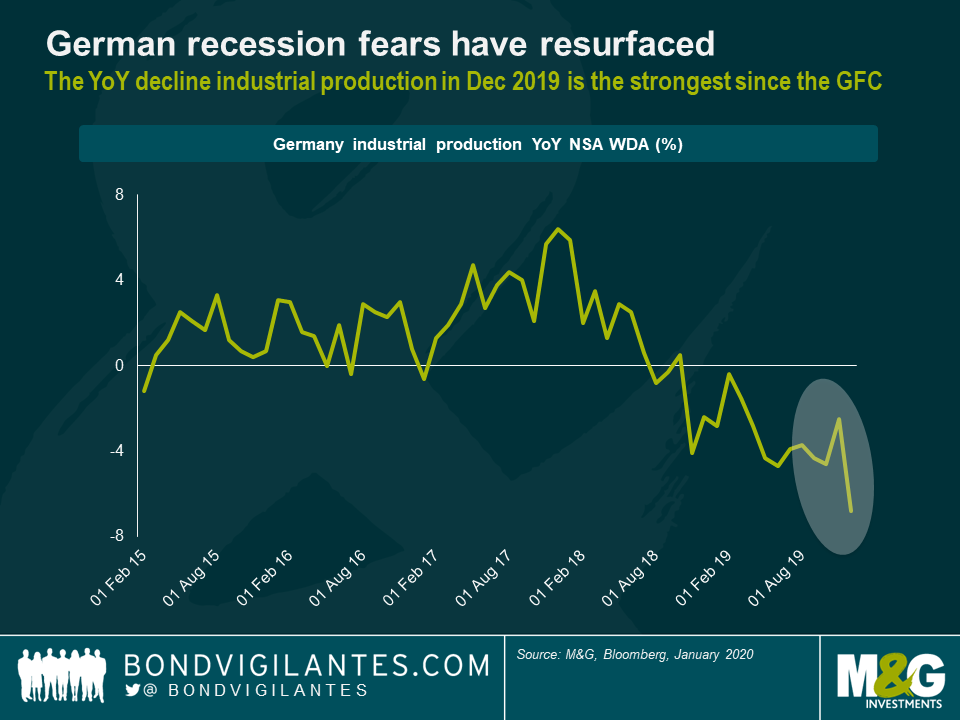

The key question is, of course, whether Europe has genuinely turned the corner or not. I’d argue that it is way too early to give the all-clear signal. First of all, despite the recent green shoots, economic growth in Europe remains anaemic and fragile. In fact, Q4 2019 marks with only 0.1% real GDP growth the weakest quarter in the euro area since Q1 2013. The economies of France (-0.1%) and Italy (-0.3%) outright contracted. In addition, recession risks around Germany have resurfaced with a vengeance. On a year-on-year basis, German industrial production dropped by 6.8% in December 2019, the strongest decline since the global financial crisis. So, things may well get worse before they get better in Europe.

Furthermore, there are several material tail risks lingering in the background that could further darken the outlook for the euro area.

- Coronavirus: It is of course too early predict the full magnitude of the economic impact of the coronavirus outbreak on China — and, by extension, on global growth dynamics — with any reasonable degree of confidence. If however the situation does take a turn for the worse, European GDP growth would most certainly take a hit. Chinese demand for European product may falter and global supply chains could get disrupted. Apart from the economic drag, any further escalation of the coronavirus situation could also trigger distress in global markets through a retrenchment of risk appetite, as the Federal Reserve Board pointed out in their latest Monetary Policy Report.

- Trade wars: Although both the US and China struck a more constructive tone — in fact, China announced to halve tariffs on more than 1,700 US products last week — the tail risk of a sudden deterioration or breakdown of talks remains. Even if the US / China trade disputes get conclusively resolved, it is entirely possible that the focus of the Trump administration would swiftly shift to Europe. It is an election year in the US after all and protectionist measures are popular policies amongst a not insignificant part of the electorate.

- Brexit: After the UK left the European Union on 31st January 2020, the 11-month transition period has begun. The clock is ticking and, if there is no extension, only very little time remains to negotiate a comprehensive trade deal between both parties. The risk for the EU is, of course, that from 1st January 2021 onwards trade with the UK will be conducted on WTO terms, which could disrupt supply chains and dampen economic activity.

- Italian politics: As we have analysed in a recent blog post, even though Salvini’s Lega was defeated in the Emilia Romagna regional election, the Italian national government remains under pressure due to the rising popularity of Lega on the one side and the decline of support for the 5 Star movement on the other side of the political spectrum. A collapse of the Italian government would send shock waves through European markets and increase political uncertainty that would weigh heavily on the already ailing Italian economy.

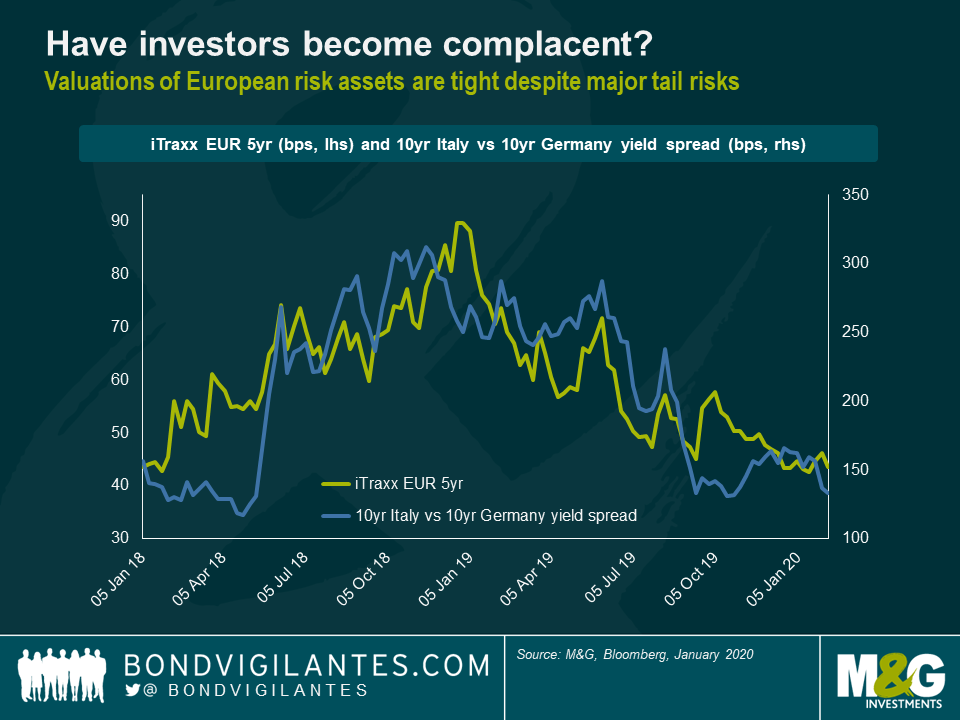

In light of these risks — and considering the persistently weak growth data—I find the valuations of European risk assets rather astonishing. At current levels there is hardly any margin for error left. For example, iTraxx EUR 5yr, a bellwether of the European investment grade credit market, is currently trading only at around 44 basis points (bps) and the yield of 10yr Italian government bonds is a measly 130 bps above the 10yr Bund yield. Essentially, there is hardly any margin for error left as we are (almost) back to market levels last seen at the beginning of 2018. And this is what I find surprising, because back then the mood in markets was distinctly more upbeat than today, borderline euphoric. The prevailing narrative was all about global synchronised growth and European recovery. Political risks in Europe were hardly talked about. In short, market participants became complacent.

We all know what happened next in 2018. Trade wars suddenly escalated, anti-establishment parties Lega and 5 Stars chalked up large gains in the Italian election in March 2018 and global economic data took a nosedive. As a result, investor sentiment soured and markets rapidly entered a prolonged risk-off phase causing risk assets across the board to produce deeply negative annual returns. I am not suggesting that history has to repeat itself. But I can’t help feeling that markets have again gotten ahead of themselves and complacency is reigning supreme. Sure, there is ample support from central banks, from the ECB in particular, providing favourable technicals and thus propping up asset prices. But just as a reminder, the ECB was buying assets to the tune of €30 billion a month from January to September 2018 — 50% more than at the moment — and markets still sold off in a meaningful manner. I therefore believe a rather cautious stance towards European risk assets is warranted. Reducing market risk exposure and trading up in credit quality seem prudent measures to me at this point.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

17 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox