Can a Sustainable Bond become Unsustainable? A Benin case study.

Summary: Benin recently issued its first Sustainable bond (SDG), also the first for a Sub-Saharan issuer. The net proceeds of the €500 million issue will be used to fund expenditures in pre-determined categories, including agriculture, water, health, housing, education, low-carbon energy, biodiversity and others. An annual disclosure of the disbursements is expected and the framework has received a second party opinion which deemed it in line with best practices.

The pricing, 4.95% coupon or +511 bps over swaps, was roughly in line with Benin’s last issuance in January.

Growth declined to 2% last year as a result of the pandemic and the border closure with Nigeria, but it is expected to rebound to 5% this year. Like in many emerging markets countries, that led to a fiscal deterioration, which is expected to normalize as the economy recovers. Living standards, which had previously been improving, suffered a setback. Benin has been able to finance the deficit by a combination of financing from the IMF, World Bank, EU grants, domestic financing and the external bond markets. It decided not to participate in the G20 Debt Suspension initiative.

Benin’s debt burden, which is at around 47% of GDP, is not large. In fact, it has optically fallen after the country rebased its economy. [1] However, a large informal economy and low income, results in a low revenue base (14% of GDP). Consequently, Benin cannot carry as much debt as countries that benefit from a much larger revenue base. It also has very limited room for monetary policy, being part of the West Africa currency regime, whose other members have also seen their financing needs increase at the same time. Until its debut in the bond market in 2019, Benin’s debt stock had been mostly concessionary at low interest rates. Since then, its external bond coupons have ranged from 4.875-6.875%. Benin is a small economy at around $16 billion so the SDG bond translated to 3.7% of its GDP.

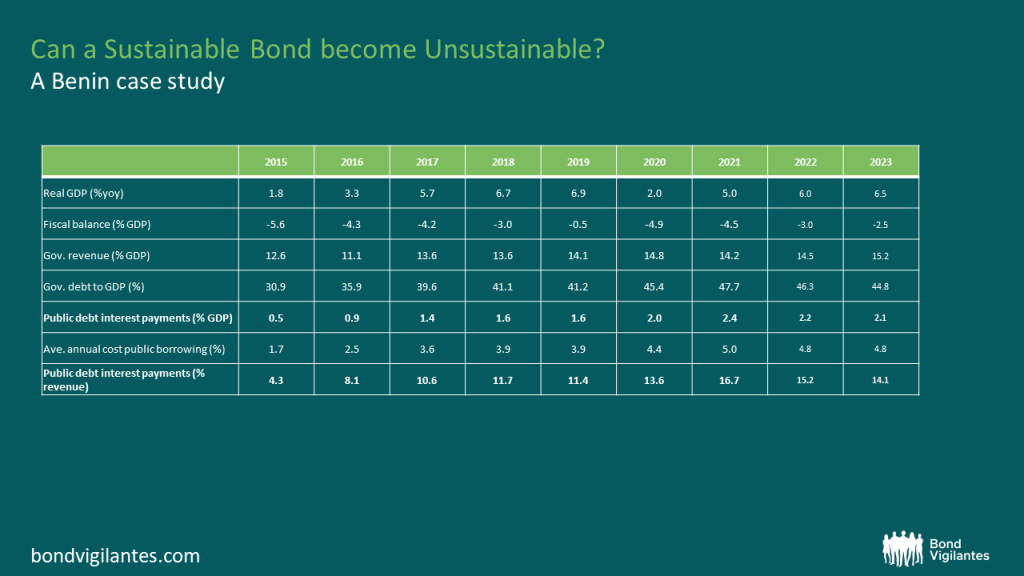

As a result of the debt increase, but also a larger share of costlier market debt, its interest payments as a percentage of revenue has quadrupled since 2015.

Source: IMF April 2021. Estimates from 2020 onwards

This trend, ironically, may have a reverse social impact as the higher the interest spending, the lower the room for other types of spending (for the same level of deficit), including general budgetary purposes or other types of expenditures that do not explicitly fall under the SDG framework, but could still have a social impact (e.g. public sector wages, pensions and transfers).

The IMF deems Benin’s debt as sustainable, but has warned that its risks have increased. The SDG bond ranks pari passu with Benin’s other external bonds and we do not expect it to fare necessarily better in the event of a restructuring.

For now, we concur that Benin’s debt, including its sustainable bond, is sustainable. We continue to monitor closely both ESG factors along with overall macroeconomic and political factors as part of our fundamental assessment of the countries we cover. However, should growth be materially below forecasts for the next few years or revenues do not start increasing, there is a material risk that this sustainable bond becomes unsustainable.

[1] For more details on the rebasing, please refer to Eldar Vakhitov’s blog: https://bondvigilantes.com/blog/2021/12/19/investors-care-gdp-data-revisions-emerging-markets-benin-case-study/

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox