COVID-19 accelerates the issuance of sustainable EM bank bonds

Summary: COVID-19 has had a profound impact on EM banks – and not always for the worse. While banks have had to set aside significant sums to provision for bad loans, government-sponsored loan moratoria and the associated suspension of the usual nonperforming loan (NPL) criteria have bought them the time to manage their way through the crisis relatively smoothly. The pandemic has also hugely accelerated the digitisation process, both in terms of online banking (customers) and remote working (employees), which should allow for significant cost savings in future as banks reduce branches and possibly office space. What has gone largely unnoticed, however, is the explosion of ESG-labelled bond issuance over the past 18 months. Sustainable bonds, in particular, are an ideal tool for banks to raise funding for post-pandemic lending. In an era when interest in ESG investing has never been higher, this matters.

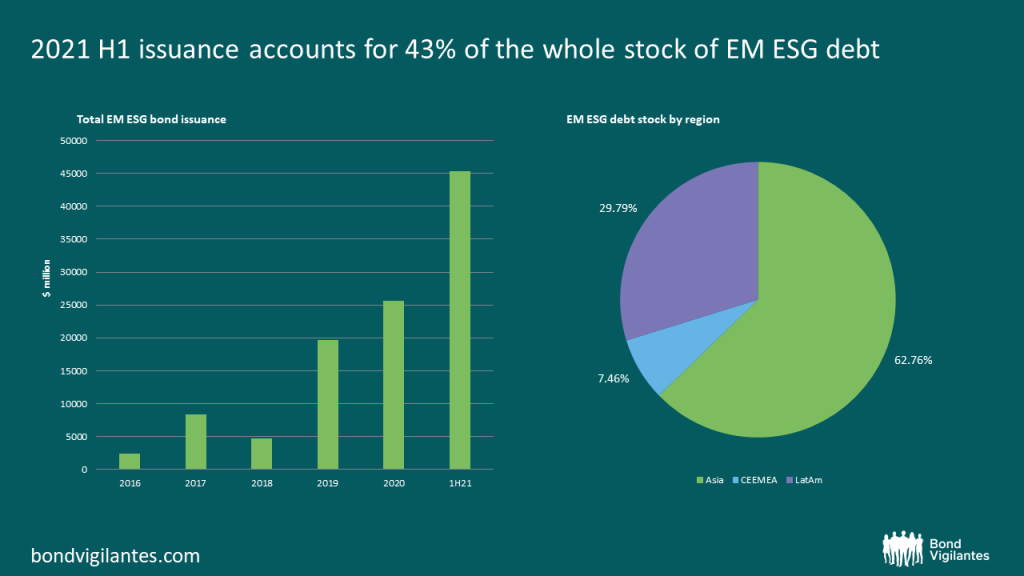

First, it is important to note that banks are not alone here. The EM ESG bond universe (by which we mean bonds given the labels Green, Social, Sustainable or Sustainability-linked – see Mario Eisenegger’s recent article) has grown spectacularly in recent times. Of the $106bn of outstanding bonds, $45bn was issued in the first half of 2021 (1H21) alone, compared to $26bn in all of 2020 and $20bn in 2019. So 1H21 issuance accounts for 43% of the whole stock of EM ESG debt – an impressive fact, indeed. Asia leads the way, accounting for 63% of debt outstanding, with LatAm comprising 30% and CEEMEA just 7%.

Source: M&G, Bloomberg (20 July 2021)

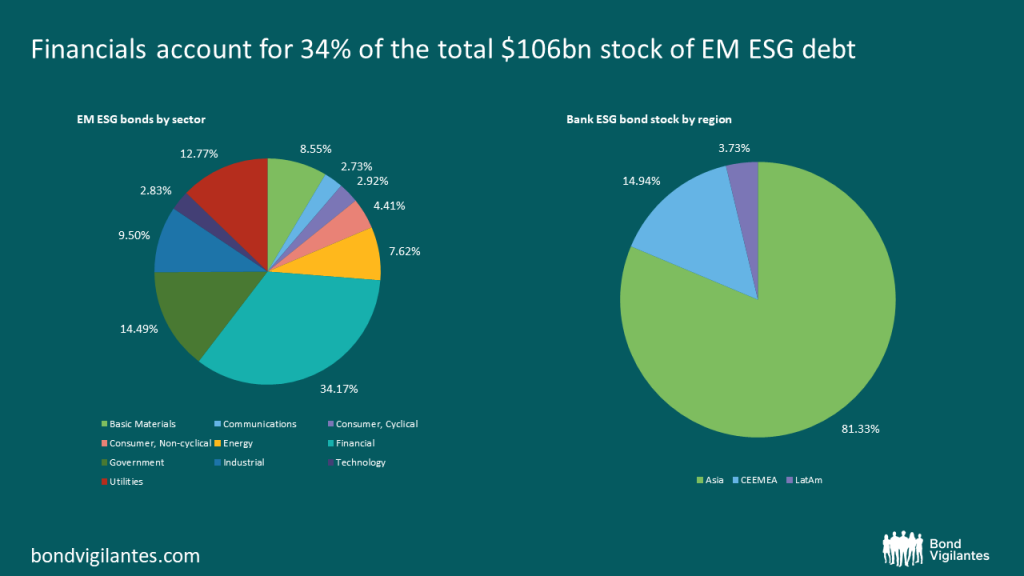

Financials account for 34% of the total $106bn stock of EM ESG debt. However, banks make up just 20% ($21bn), with the rest of the Financial bucket comprising Real Estate (9%, mainly Chinese) and Diversified Financial Services (4%). Asia is even more dominant for banks than it is for the broader market, accounting for 81% of issues. There is hardly any issuance from Latam.

Source: M&G, Bloomberg (20 July 2021)

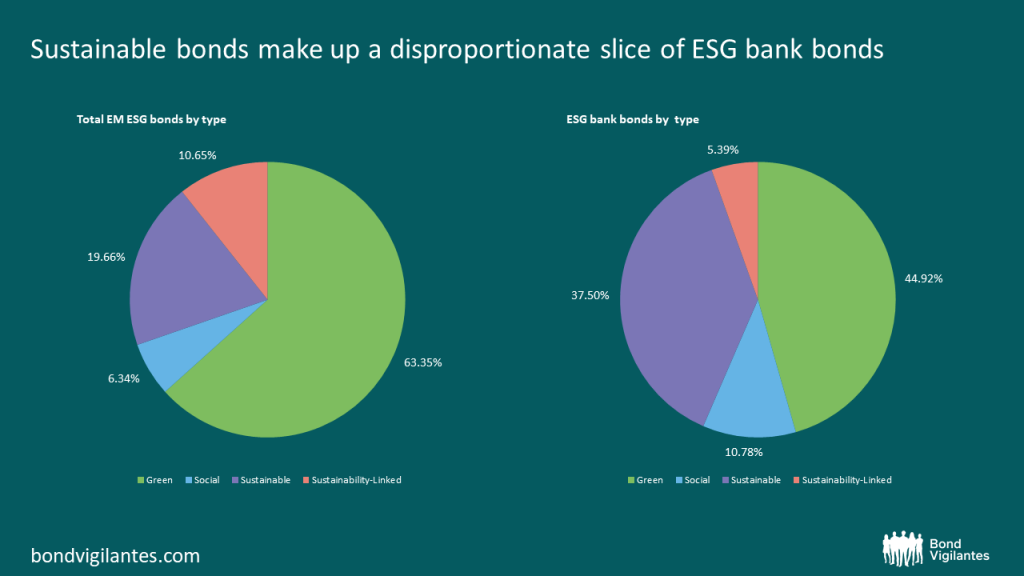

Like the broader market, outstanding ESG bank debt in EM has grown hugely over the past two years, with 2020 issuance accounting for 37% of the current stock of bonds and 1H21 issuance making up 35% ($7.5bn). But what is really interesting is the difference in weighting between different types of ESG bonds. The charts below show that Green bonds make up 63% of the total EM ESG market, with Sustainable bonds at 20%. For banks, however, Sustainable bonds are a much larger slice of the pie (39%), with Green bonds not far ahead at 45%. Indeed, Sustainable bonds could be the largest portion of the EM banks ESG pie by the end of 2021. 69% of all Sustainable bank bonds have been issued since March 2020, while in 1H21 46% of all bank ESG bonds issued were Sustainable, with Green bonds making up just 35% of the total. What is driving this major shift?

Source: M&G, Bloomberg (20 July 2021)

It is the COVID-19 pandemic itself that has resulted in the surge of interest in Sustainable bank bonds. Aside from public health, the major focus has been on the financial impact of the crisis, particularly unemployment and poverty. Furlough schemes have been commonly used where countries can afford them. On the banking side, minimum capital ratios have been temporarily eased and loan deferral schemes introduced to maintain the flow of credit to individuals and SMEs and to prevent a wave of personal and corporate bankruptcies. Sustainable bonds provide another tool for fighting the pandemic. Their use of proceeds is generally split between Environmental and Social lending, with the Social side generally consisting of lending that boosts employment, access to essential services and affordable housing, which are all areas that the pandemic has brought under pressure. In fact, Ziraat, the largest bank in Turkey which issued a Sustainable bond in January 2021, specifically identifies “number of loans to companies and SMEs facing natural and/or pandemic disasters” as one of its Sustainability reporting items, alongside the projects it has identified for greener lending such as financing electric tractors and Europe’s largest solar panel factory. It is no coincidence that spring 2020 marked the start of a surge of issuance of these bonds as banks tapped into the demand for ESG products to help their local economies.

Sustainable bonds issued by banks are a product that neatly meet the needs of both economies and markets in the context of the pandemic. However, that is not to say that they are a perfect product. We on M&G’s EM Debt team do not tend to invest solely on bond labelling. Sustainable bonds often contain look-back clauses, allowing money to be put to work refinancing projects that began several years ago. Additionally, funds raised to support employment could be used to support almost any business. We would urge investors to check that the Use of Proceeds is sufficiently clearly defined to minimise the risks money flowing to unintended areas. Our team also considers the ESG policy at corporate level to ensure that banks’ lending policies are sound rather than simply relying on bond labels. For instance, while Banco do Brasil has not issued a labelled bond, it has a very well developed sustainable credit policy (available here), stipulating for instance that companies seeking funding for hydroelectric facilities must first “carry out an independent socio-environmental assessment and action plan to mitigate the identified risks and impacts”. More and more banks are currently in the process of developing or refining their ESG policies. The ESG market is still in its youth and will change as it develops. What is clear, though, is that the demand from investors for ESG products is only going to grow. This means that, hopefully unlike the pandemic, EM banks’ focus on Sustainable bonds is here to stay.

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox