Inflation outlook: this time is (not) different

Summary: For a generation of policymakers, investors and workers, inflation seems a distant memory. The mainstream central bank narrative is that the inflationary pressures in the economy today are transitory and so do not justify imminent interest rate hikes. In this longer-form review, I consider how the Covid policy response set the inflationary scene in 2020, how monetary authorities have responded since and why they could be dangerously behind the curve.

Within and without the investment industry, few can have failed to be at least a little concerned by near-daily headlines of rising price pressures. Supply-driven factors, driven to a large extent by Brexit border delays, meteoric natural gas prices and a HGV driver shortage take much of the focus here in the UK, along with the explosion in demand of a population released from lockdown. The rising cost of natural gas, to some degree a result of the UK’s laudable move towards greener energy, has been compounded by a mix of long-falling domestic production, a lack of storage facilities and increasing industrial demand as economies reopened. Meanwhile, a lack of fuel tanker and lorry drivers has led to petrol and other goods shortages. Long queues to petrol forecourts fast became a familiar sight, while energy suppliers covering millions of the population have announced bankruptcy as winter approaches and they have been unable to pass on rising energy prices to consumers. Headlines of rising prices are by no means the preserve of the UK: in most developed economies, even the famously low-inflation Eurozone, investors and the public are increasingly concerned by the prospect of inflation.

Many market commentators, including central bankers, dismiss these inflationary pressures as transitory. After all, most developed nations have not seen significant inflation for many decades. No major central bank has expressed significant concern about inflation or effected meaningful immediate policy action. For a global economy not used to seeing inflation, the question of the moment is: “what should make this time any different?”. But, as we will see, there is an argument that the question should be reframed: “were the past four low-inflation decades the exception, not the rule?”. This blog is the story of how the Covid policy response set the inflationary scene, how monetary authorities have responded and five reasons that, taken together, I believe could lead to higher inflation than most of us have become used to.

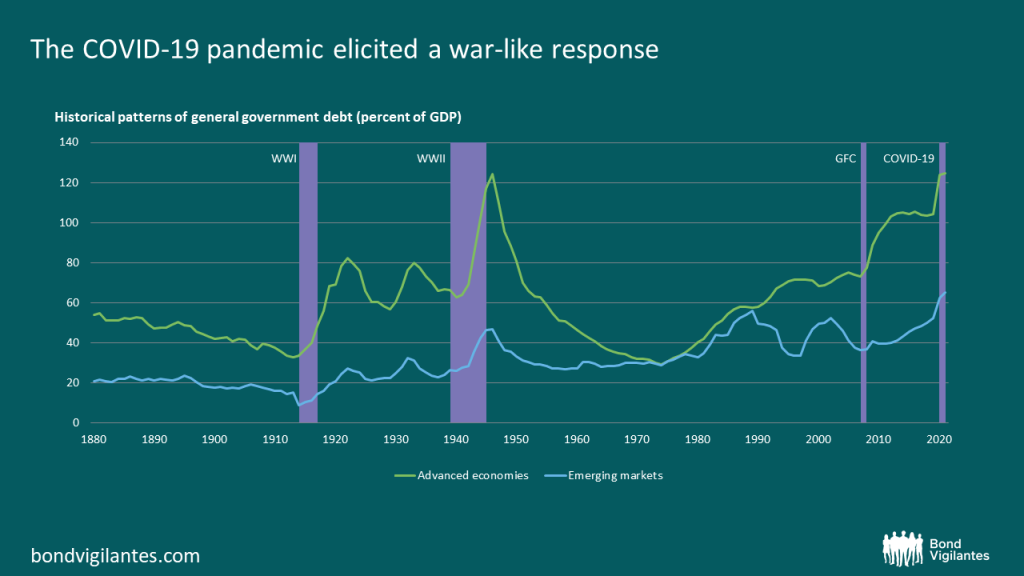

Building up the fire: a war-like policy response and a peace deal

I would not be the first to suggest that, in considering the likely effects of the Covid policy response, we might look to the way in which we have dealt with previous national efforts – namely wars – in recent history and their aftereffects. If Covid was the enemy in this war, vaccines are the peace deal promising a return to normality and prosperity.

The prospect of inflation first arose in popular concern as we entered this year. High on the dual announcement of the Pfizer vaccine and President Biden’s election, 2021 promised (for those economies fortunate enough to have access to early vaccinations) a heady combination of pent up demand released and fiscal growth in the world’s largest economy. This was against a backdrop of monetary and fiscal support of a scale already unprecedented in peacetime: in their policy response, governments declared a war on Covid, issuing a vast quantity of debt to support businesses and families and bridge the Covid crevice.

Sources: IMF [October 2020 Fiscal Monitor “Policies for the Recovery“], Historical Public Debt Database; IMF, World Economic Outlook database; Maddison Database Project; and IMF staff calculations. Note: The aggregate public-debt-to-GDP series for advanced economies and emerging market economies is based on a constant sample of 25 and 27 countries, respectively, weighted by GDP in purchasing power parity terms.

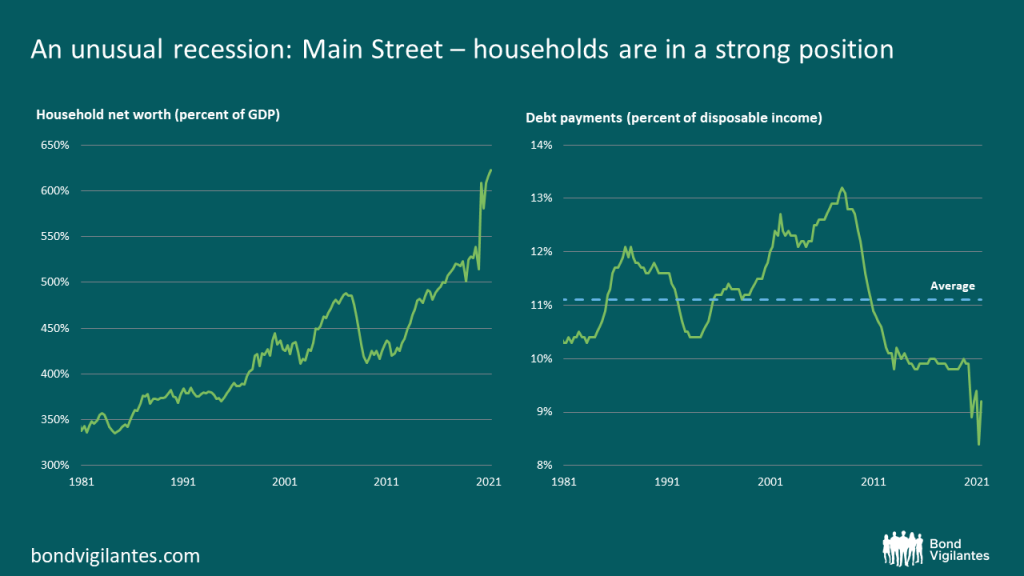

This policy response led to a highly unusual recession, both for Main Street (industry, services and the public) and Wall Street (investors). In the case of the former, for surely the first time in history this deep recession led not to a loss of income and wealth but rather an increase. For as governments sought understandably to assuage the unemployment, earnings loss and financial stress of a global economy brought into standstill almost overnight, households in developed economies found themselves in an apparently better position than they had been (at least in the short term), with furlough and other income-support schemes plugging income gaps. At the same time, household expenditures fell with little outlet for disposable income and moratoria on (some) rents, evictions and debt payments. Other policies, notably the stamp duty break in the UK, were designed to support domestic property markets. The US government even turned to helicopter money, mailing out stimulus payments to households across the country.

Source: M&G, Bloomberg (June 2021 – latest data available).

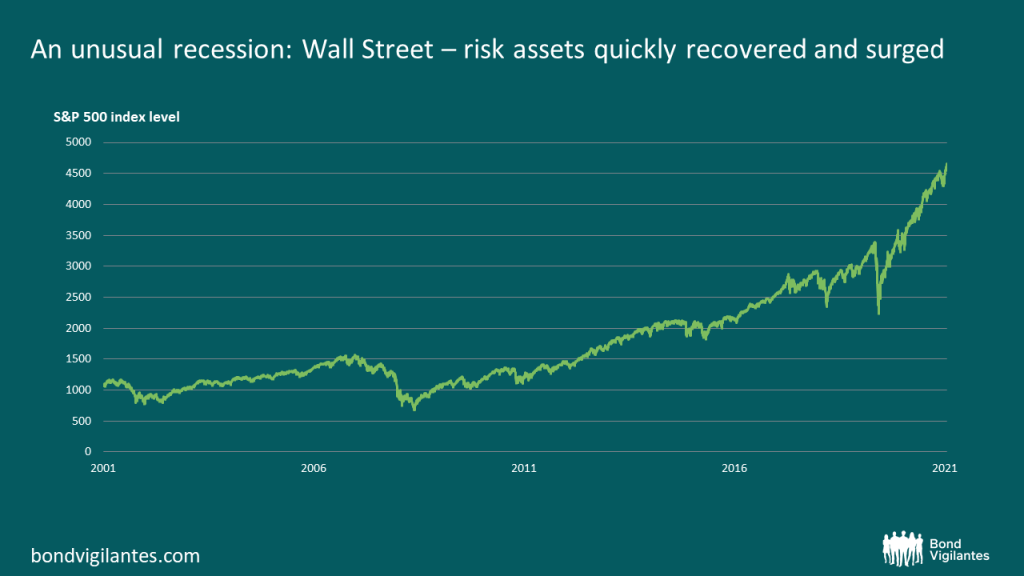

Central banks not only enabled major governments to pursue this policy by turning their money printing presses to overdrive (in reality purchasing government-issued debt using their infinite reserve currency to keep government financing costs affordable). They also intervened heavily in financial markets, delving into the economic machine by buying company-issued debt and purchasing the shares of junk bond ETFs – in essence, buying assets to support their prices (and liquidity). In pursuing their goal of financial stability they have been, so far, enormously successful. It would be remiss not to say that these policies, while supporting the overall economy, acted as an accelerant to already-rising inequality in wealth and outcomes in society. It is a strange recession indeed that led to the creation of over five million new millionaires, and nine new billionaires (the latter with combined wealth in excess of the cost of vaccinating the world’s poorest countries). [1]

Source: M&G, Bloomberg (3 November 2021).

This mix of buoyed household savings and investments, massive pent up demand released as economies reopened and a highly accommodative policy backdrop set the scene for the inflationary pressures we saw in early 2021.

The monetary policy response: every little thing is gonna be all right

If the word of 2020 was “unprecedented”, a good contender for 2021 would be “transitory”. Many (notably including the world’s central bankers) have dismissed these price pressures as being down to “transitory” effects. “From long experience we expect the inflation effects of these increases to be transitory” [2] said Federal Reserve Chair Powell as recently as August. “Inflation is elevated, largely reflecting factors that are expected to be transitory” [3] read the Fed’s press release following its latest November FOMC meeting. At a September panel of central bankers, Powell labelled the irritating persistence of higher inflationary pressures “frustrating”. [4] The one central bank that seems to be taking inflation more seriously is the Bank of England, albeit taking the market by surprise in deciding against hiking interest rates in its November meeting.

It is true that some of these effects are transitory in nature. Most obviously were base effects: having come from a starting point of negative oil prices in 2020, some return to normality will clearly result in higher inflation prints mathematically. After 18 months of financial data extreme in magnitude in both directions, caution is warranted in interpreting percentage changes. Pent up demand and buoyed household incomes are also temporary, not structural, forces particularly as furlough schemes, income support and eviction moratoria come to an end. A common argument among inflation sceptics is that while we can expect higher prices this year, inflation is a year-on-year rate. “I can understand prices going up this year with pent up demand and supply pressures – but what is there to suggest that prices will rise by 5% every year?”.

Others have pointed to idiosyncrasies that are muddying the waters. Used car prices surged over the past year. But surely that was just because people couldn’t buy cars during the pandemic, and in any case want them even more now to avoid taking public transport. ECB President Lagarde spoke recently of the need “to ensure that we do not overreact to transitory supply shocks that have no bearing on the medium term”, adding that there are “no signs that this increase in inflation is becoming broad-based across the economy”. [5] The claim that the inflation we are seeing is noise, down to idiosyncratic anomalies and not “broad-based”, is not without precedent.

When oil prices surged following the Arab-Israeli war of October 1973, then-Federal Reserve Chair Arthur Burns removed oil and energy-related products (total index weight 11%) from the Consumer Price Index (CPI) arguing they were not important for monetary policy. When food prices (index weight 25%) surged, this was attributed to unusual weather and promptly removed too. Thus was created the now-ubiquitous “Core CPI” figure, free of the supposed idiosyncrasies of volatile food and energy prices. Inflation (and Burns’ culling of the inflation basket) didn’t stop there: by the time other “idiosyncratic” effects (mobile homes, used cars, children’s toys, women’s jewellery) had been removed over the coming months, only 35% of the CPI basket remained. [6]

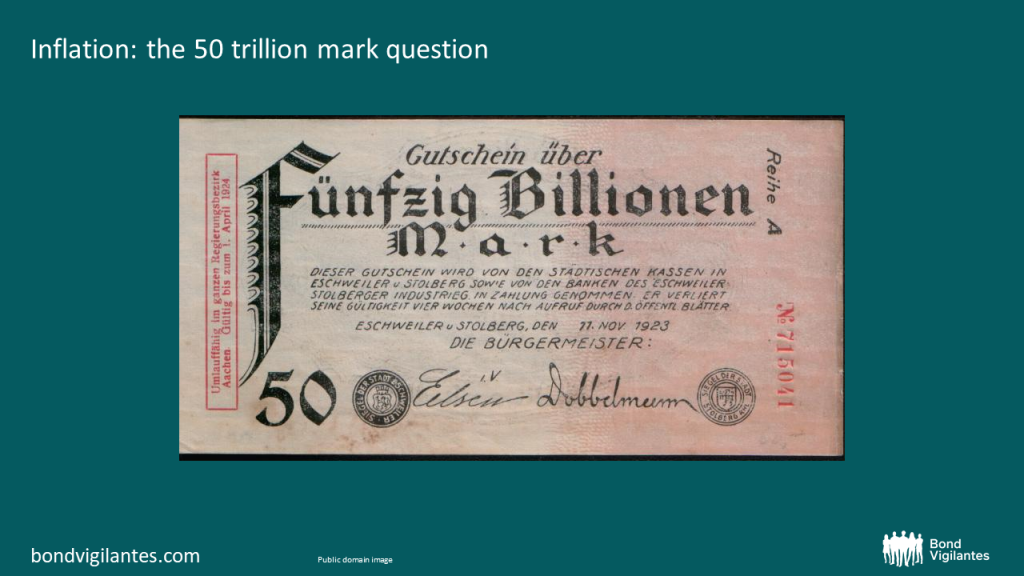

Current claims that inflation prints are simply mathematical effects, not reflective of reality, or idiosyncratic anomalies are eerily reminiscent of previous inflationary periods then. So are suggestions that inflation is a one off, “just this year” effect. These calls to reason and notions of idiosyncratic forces are appealing. But I suggest these arguments miss the point. Explaining away the reasons for price rises (even though the reasoning may be correct) seems to me to misremember what inflation really is, and how it comes about. Periods of high inflation cannot be convincingly explained by traditional economics without an understanding of the quirks of human behaviour. Reasoning about inflation and whether it makes sense or not gets us only so far. For consider: what reason was there in prices doubling every few days in the Weimar Republic? Or in a monthly inflation rate of 40,000,000,000,000,000% in 1940s Hungary? [7]

I don’t suggest we should fear double-digit-percent inflation or higher. Today’s economy is different in many ways from those of the early-to-mid twentieth century. But recent history, from the hyperinflation of the Weimar Republic to Arthur Burns’ CPI-meddling in 1970s America, teaches us to be wary of applying merely cold reasoning and rational logic when thinking about inflation. The very concept of transitory inflation is a dangerous one.

Inflation today: the abominable snowman

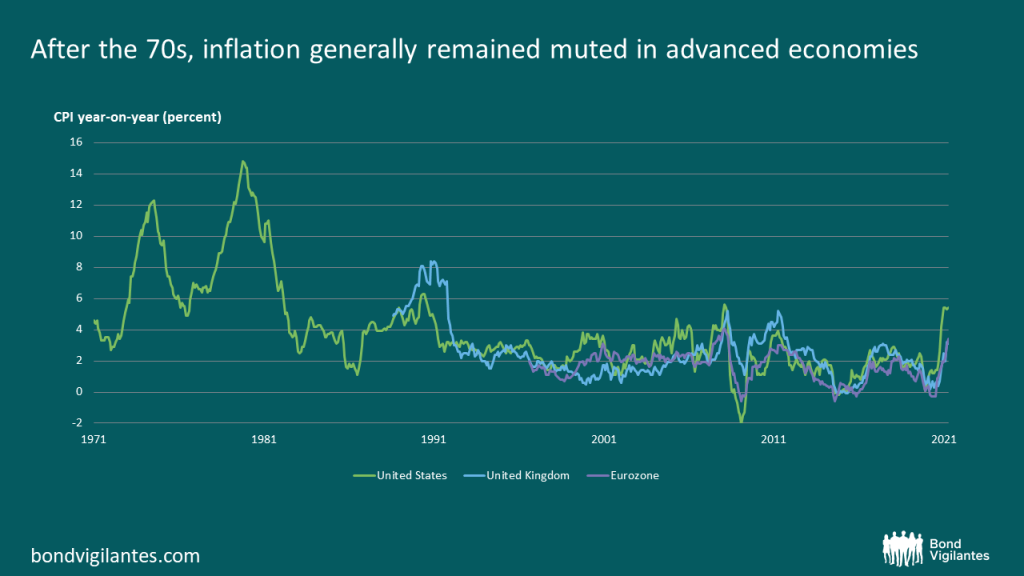

Most of us, in major developed markets at least, haven’t really experienced prolonged inflation. For a long time, it has been not been a significant concern for the population at large. With the relatively short-lived exception of the 1990s, the past three to four decades have seen inflation limited for the most part to 2-3% a year.

Source: M&G, Bloomberg (30 September 2021).

There are good and generally well-accepted reasons for this. Most significant among them are three structural deflationary factors that have been in place over the previous few decades: globalization, demographics and technology. We have written about these factors before which, among others, have all helped keep inflation in check for some time. By way of reminder:

The big three

Globalization: the past four decades have seen rapid globalization, with cheaper labour and goods flowing to the West.

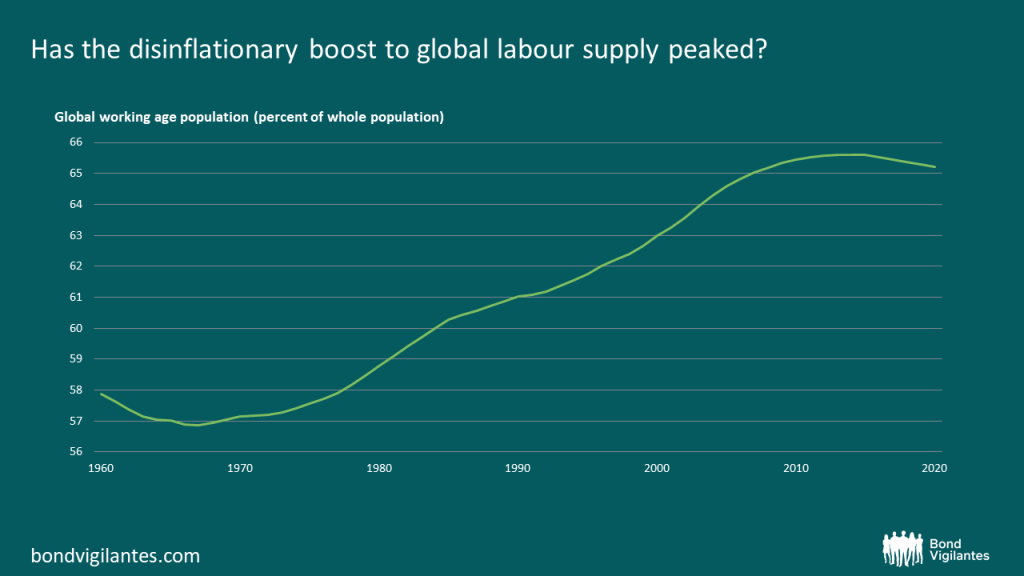

Demographics: often referred to as a basketball working its way down a snake, the huge post World War baby boomer generation came to dominate the workforce in the late 1970s, driving down wage competition while trade union membership declined. As the boomers reached peak earnings, demand for safe, income-producing assets in which to invest their savings increased, driving down bond yields.

Technology: online shopping has afforded consumers price discovery on a different plane to that several decades ago; with the ability instantly to see prices available from hundreds of retailers, companies have lost a great deal of pricing power, driving down goods prices. At the same time, increasing automation in certain industries has slowed wage increases.

Along with these structural effects, central banks have played a significant role in keeping inflation under control. Since then-Federal Reserve Chair Paul Volcker set interest rates as high as 20% in June 1981 to control rampant US inflation (which peaked above 14% in 1980), central banks have made it their mission to control inflation.

Since then, we have become used to low, 2-3% inflation. I think this time could be different. But perhaps it would be truer to say that this time will be no different. Perhaps the past four decades of persistently low inflation in developed economies have been the exception, not the rule.

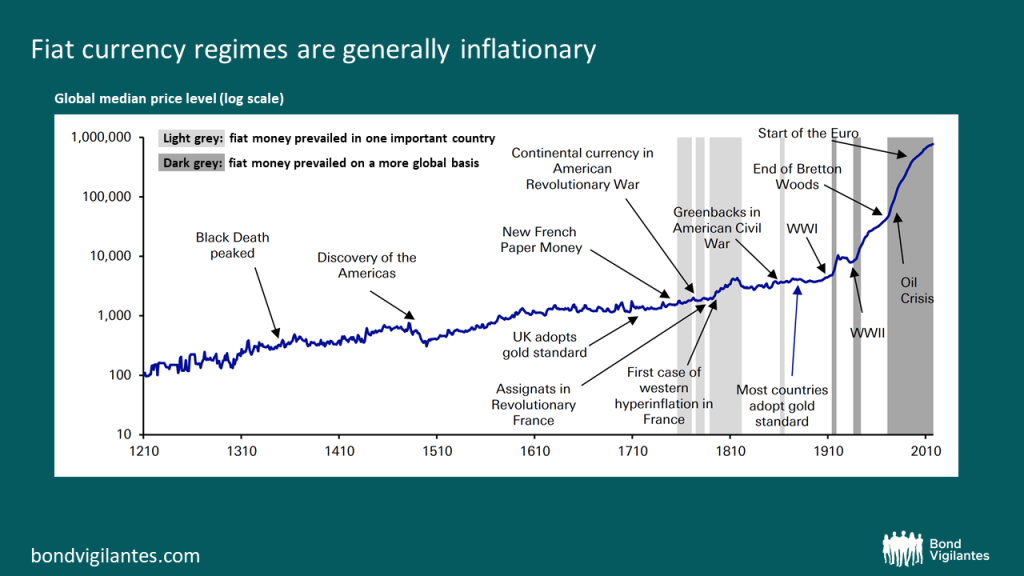

I wrote above that the policy response to the Covid recession was reminiscent of a wartime response. I pointed out that I would not be the first to suggest that, in considering the likely effects of this colossal intervention, we might do better to examine post-war economic history than more recent peacetime. Wartime spending in the past has generally led to periods of higher inflation. This is particularly true under fiat currency regimes, in which currencies are not pegged to a store of value like gold but float freely. Seen in this light, perhaps we ought to reframe the question from “why should this time be any different from the past four decades” to “why should this time continue to be any different”. Like in wartime, governments have injected significant amounts of money into the economy. It is true that not all money in the economy is equal in its inflationary impact. As we might expect, those on lower incomes spend a greater percentage of their disposable income (they have a higher marginal propensity to consume). This means that, pound for pound, an increase to disposable income will have a greater inflationary impact for lower income households. Nonetheless, an increase in money supply leads to inflation a priori.

Source: GFD, Deutsche Bank (Jim Reid et al., “Long-Term Asset Return Study: Fiat, Fifty and Frail”, September 2021). Note: This series compiles the median price level for around 100 countries over time. At first, only the UK has available data, but Sweden then joins in 1290 and others progressively follow.

I believe something has changed and that investors are right to be concerned about inflation for perhaps the first time in decades. What makes this debate notable is that, for even the most experienced of us working in and participating in financial markets, low-to-moderate inflation is virtually all we have seen. Perhaps the real exception has been the past four decades, spent in a fiat currency regime but with inflation remaining generally well behaved.

What makes this time (not) different: the formidable five

- Cutting the balloon strings: the big reversal

Let us begin with that which has been keeping things different these past four decades. As we have seen, globalization, technology and demographics have a lot to answer for in having kept inflation at bay for some time. But should we believe that these big three will remain as powerful as they have been?

Globalization, demographics and technology still exert a powerful effect on the global economy. But there is reason to believe that their deflationary impact could begin to decline. Take globalization. The past few years have seen rising nationalism, protectionism and the reassertion of borders, exemplified in 2016 by the UK’s vote to leave the European Union and the election of President Trump. These events brought into stark relief sections of society that had been severely failed by the free markets, “what you earn is what you learn” globalization project of the past four decades. Rising inequality in the face of a rhetoric of plentiful opportunities for rising in the new global economy sowed fertile ground for populist leaders to harness the anger of those who have not benefitted from the globalization project. [8] With cracks already showing in the late 2010s with trade wars, Trump and Brexit, the pandemic will surely only add to a possible deceleration in globalization as economies recognize the value in domestic supply chains.

Nor should we underestimate the impact that demographic trends have on the global economy. As the demographic might of the baby boomers eventually passes over the coming decades, working age populations will once again decrease. It seems reasonable to expect then that the deflationary trend this generation brought about could begin to reverse.

Source: OECD (2021), Working age population (indicator). doi: 10.1787/d339918b-en (Accessed 4 November 2021). Note: The working age population is defined as those aged 15 to 64. This indicator measures the share of the working age population in total population.

Technology remains a powerful force and will probably remain a deflationary one. But even here, there is an argument that we are beginning to see some pushback against the role that technology plays in society, from growing antitrust legislation to calls for increasing regulation to control the impact of tech giants on the world.

These three trends won’t go away any time soon. But on balance, there is an argument that these forces could begin to lose some of their power over the coming years and decades.

2. Shifting sands: a changing electorate

A recent paper from the University of Cambridge’s Centre for the Future of Democracy makes troubling reading. “Globally, youth satisfaction with democracy is declining – not only in absolute terms, but also relative to how older generations felt at the same stages in life. There are notable declines in […] the “Anglo-Saxon” democracies, including the United Kingdom, Australia, and the United States.” [9]

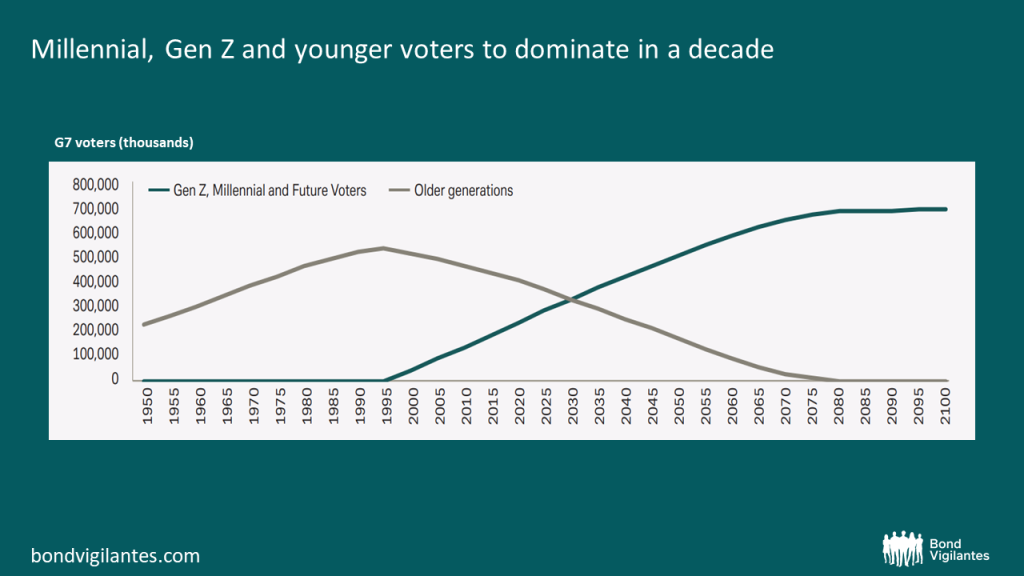

What are we to make of this dissatisfaction? The report’s authors find that “a major contributor to youth discontent is economic exclusion”. [10] In the US, for example, despite making up around a quarter of the population, millennials hold only 3% of the wealth – in contrast to the baby boomer generation, which held 21% at the same age. This has a direct impact on life opportunities, from higher rent costs early in life and greater debt burdens to difficulty owning a home and starting a family. [11]

With voting-age millennial and younger cohorts set to outnumber older generations in G7 countries within around a decade, there is a risk we could soon see blunt policies aimed at redistributing wealth. Given the higher marginal propensity to consume of younger and less wealthy consumers, this would have an inflationary effect.

Source: United Nations, Haver, Deutsche Bank (Jim Reid et al., “What we must do to rebuild”, November 2020). Note: midpoint of 15-20 age range is used to proxy voting age.

This is part of a wider trend over the past four decades, in which returns from GDP growth have gone disproportionately to owners of capital over labour. Taken with the failure of government and economic policy to address inequality over the past four decades, we should expect at best a rise in wealth-distributive policy; the danger is that, acting too late, governments leave resentment to brew further and open the door to more authoritarian leaders pursuing more extreme policies.

3. The fuel: economic policy

As we have seen, the pandemic elicited a war-like fiscal policy response from most governments. At the same time, the focus of central banks was firmly on ensuring financial market stability rather than controlling inflation. The Federal Reserve, for example, announced last year that it would move its 2% inflation target to one of “flexible average inflation targeting”, seeking “inflation that averages 2% over a time frame that is not formally defined”. [12] While overall economic stability is an important part of central banks’ mandate, monetary authorities expanded this remit to a new level in 2020, in effect directly financing central government borrowing.

With the worst of the pandemic I trust behind us, fiscal policy remains highly accommodative, seeking now to stimulate economies to grow into their debt burdens. To those who point to the massive stimulus following the Great Financial Crisis but lack of inflation that followed, here is the main difference. Those years saw expansionary monetary policies but fiscal tightening and austerity. This time, governments and central banks are working in concert to keep financial conditions loose.

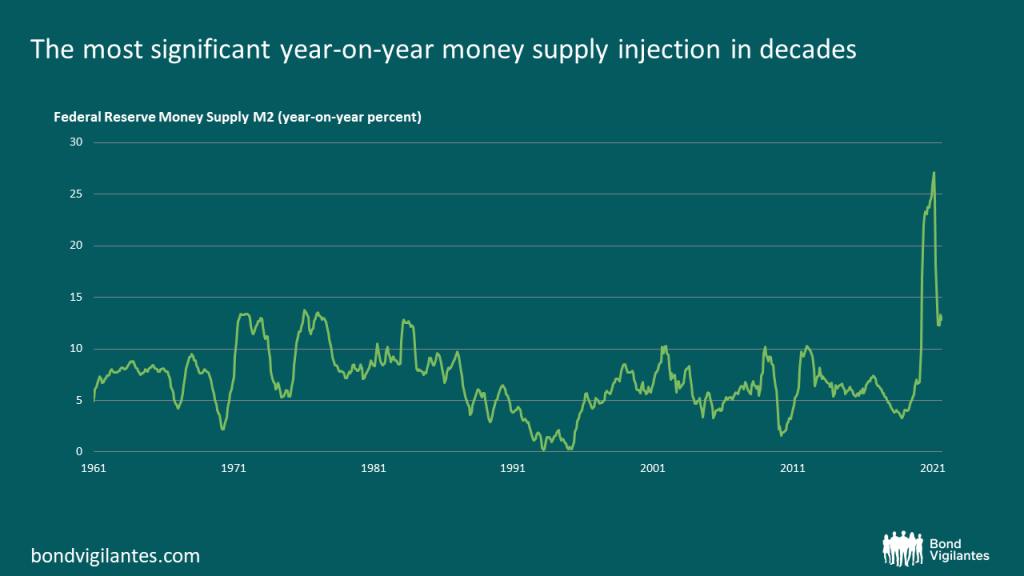

Much is rightly made of supply-side constraints by those warning of inflationary pressures. The simple chart below paints a simpler but just as powerful picture of the demand side. Last year saw a rapid increase in money supply. While it is true that much of this money finds its way quickly to the wealthy, with a lower marginal propensity to spend it, remember that we are in a highly unusual post-recession position. Even after adjusting for income, households are in a strong position, have money to spend and want to spend it.

Source: M&G, Bloomberg (30 September 2021).

A further effect of the huge government spending brought about by the pandemic is that, with public debt levels at wartime levels, central banks have a strong disincentive to hike rates and increase the cost of borrowing. Comparing UK government spending with the Bank of England’s additional quantitative easing (bond buying) gives a good idea of central banks’ de facto (lack of) independence right now.

4. Unintended consequences: the sustainable economy

With central banks’ focus already drifting away from controlling inflation, many seem too to be repositioning their mandate as one of sustainability and inclusive economics. This is laudable. Such a mandate seems, however, more antagonistic than complementary to one of controlling inflation.

In late 2020, Fed Governor Brainard gave a speech on the central bank’s commitment to a “broad-based and inclusive recovery”. [13] This would presumably mark a departure from the automatic hiking of rates into an overheating labour market. Given the persistent disparity in unemployment in different groups (between Black and headline unemployment, for example), such a policy adjustment could help address this inequality. Raising the bar to tightening monetary conditions in the face of labour market pressure is, however, an inflationary policy.

The move to a sustainable economy is surely inflationary too. Broadly speaking, this must be the case: sustainable things are more expensive (to the individual end consumer at the point of sale[i]). If this were not true, and sustainable options were already cheaper than unsustainable ones, then we would surely already have a sustainable green economy. Encouraging consumers to move towards sustainable – more expensive – alternatives, is inflationary. So too is government funding of sustainable infrastructure and the subsidy of green alternatives. These are all good things, and none of this is to say we should not do them – but they are inflationary.

5. The spark: energy, wages and rents

There is plenty of inflationary fuel then in the global economy. The spark that risks igniting persistently higher inflation lies in a number of key pressures we see in the market today.

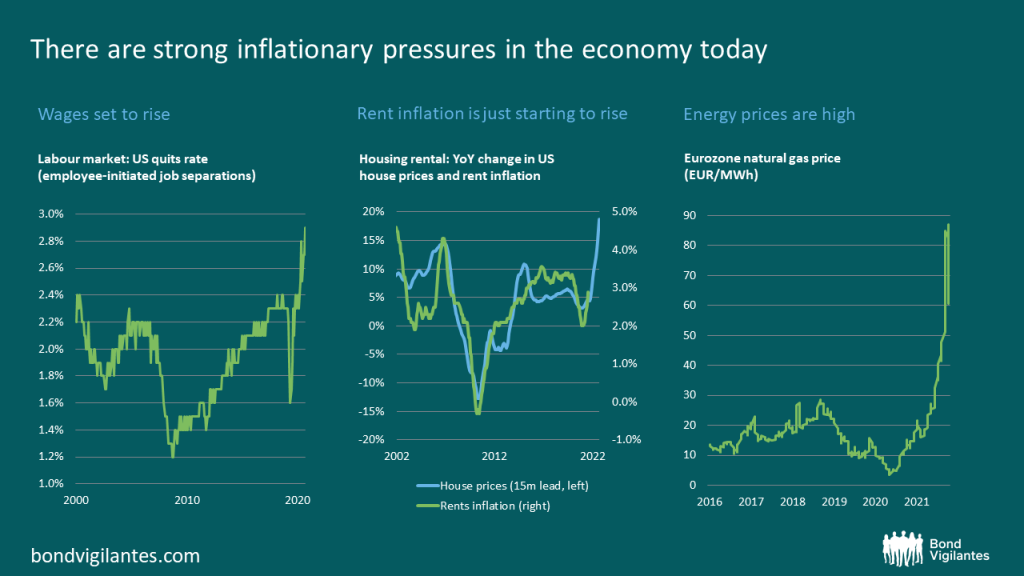

One of the most newsworthy price pressures at the moment is the rise in energy costs. This is part of a broader evolution in the composition of the components leading to higher inflation in the CPI. While at the beginning of the year, CPI increases were driven largely by reopening factors (like used cars, airfares and food away from home), prints over recent months reveal a move towards more structural ones (like energy).

The labour market is the second source of pressure. With household savings running high and many workers reconsidering their employment options (retiring early or re-entering education for example), there are currently more job openings in the US than unemployed people. The job quits rate in the US reveals more and more workers choosing to leave or change their jobs, a key leading indicator of wages. After a period of downward pressure, it is not surprising therefore to see annual wage growth figures around 10% in the US and UK.

Finally, a key component of spending is on the rise. Rent costs, comprising 40% of core CPI, have remained relatively subdued so far. But rent inflation has just started to make its way up. These factors will continue to work their way into inflation numbers in the coming months.

Source: M&G, Bloomberg (30 September 2021).

Conclusion

For a generation of policymakers, investors and workers, inflation seems a distant memory. Surely this time won’t be any different to the past few decades: a few periods of slightly elevated inflation, but nothing to worry much about. Four decades of structurally deflationary forces and an ever-growing toolkit of inflation-curbing measures available to central banks has lulled us into a sense of a permanently benign status quo.

The deflationary forces of the turn of the century may be losing some of their power. And, for the first time in many years, there exist in the economy not just one but numerous inflationary forces acting in concert. Let us remember the lessons of history, from Arthur Burns’ CPI-meddling to periods of hyperinflation, and beware regarding inflation as a rational phenomenon to be explained away. Let us examine carefully too the environments that followed previous periods of emergency economic policy. Generally they were ones of high inflation under fiat currency regimes.

The question “will this time be different” should be reframed. The past four decades have been the exception and this time may in reality be no different at all.

Notes:

[1] https://www.theguardian.com/news/2021/jun/22/world-has-gained-52m-new-millionaires-in-covid-crisis-report; https://www.ft.com/content/86b99144-ba71-441d-b297-ddcdc94ea7f2

[2] https://www.federalreserve.gov/newsevents/speech/powell20210827a.htm

[3] https://www.federalreserve.gov/newsevents/pressreleases/monetary20211103a.html

[5] https://www.ecb.europa.eu/press/key/date/2021/html/ecb.sp210928~4cc57f558d.en.html#footnote.14

[6] See an excellent summary by Stephen Roach of Yale University here: https://www.marketwatch.com/story/the-ghost-of-arthur-burns-haunts-a-complacent-federal-reserve-thats-pouring-fuel-on-the-fires-of-inflation-11621971073

[7] https://www.investopedia.com/articles/personal-finance/122915/worst-hyperinflations-history.asp

[8] See Sandel, M. [2020] “Tyranny of Merit” for an enlightening discussion

[9] Foa, R.S., Klassen, A., Wenger, D., Rand, A. and M. Slade [2020] “Youth and Satisfaction with Democracy: Reversing the Democratic Disconnect?” Cambridge, United Kingdom: Centre for the Future of Democracy

[10] Ibid.

[11] Ibid., p.17

[12] https://www.stlouisfed.org/on-the-economy/2021/july/inflation-expectations-fed-new-monetary-framework [original italicization]

[13] https://www.federalreserve.gov/newsevents/speech/brainard20201021a.htm

The value of investments will fluctuate, which will cause prices to fall as well as rise and you may not get back the original amount you invested. Past performance is not a guide to future performance.

18 years of comment

Discover historical blogs from our extensive archive with our Blast from the past feature. View the most popular blogs posted this month - 5, 10 or 15 years ago!

Bond Vigilantes

Get Bond Vigilantes updates straight to your inbox